The first U.S. ETF with “crypto” in its name was the Bitwise Crypto Industry Innovators ETF (BITQ), which was launched on May 21, 2021. Prior to that, there were very few public crypto equities. The most well-known IPO was Coinbase Global (COIN) which did not occur until April 14, 2021. Coinbase’s IPO coincided with the growth of the crypto industry which peaked in 2021 when Bitcoin hovered around the ~$60,000 range. In the ETF world, this was followed by several ETF launches not just from crypto-focused companies like Bitwise, but also traditional players like Invesco, Schwab, and Fidelity. Its launch as a public company also brought investors and analysts with a key advantage—public SEC filings with insight into both industry and company data. Currently, Coinbase is one of the largest constituents (4.3% index weight) of the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index, which is the underlying index for the Invesco Alerian Galaxy Crypto Economy ETF (SATO). The following are takeaways from Coinbase’s most recent 10-K published on February 21, 2023, including industry insights and updates from the 2021 to the 2022 10-K.

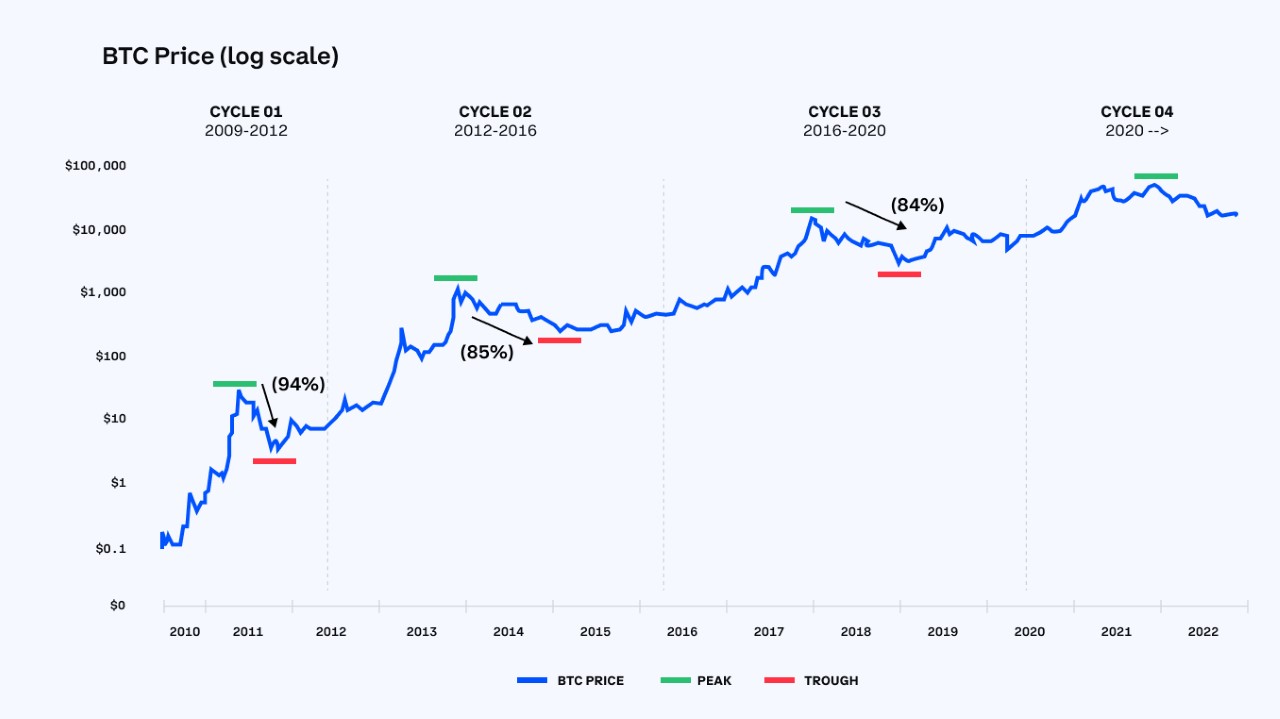

Coinbase is adapting is business model through crypto asset cycles. In the business overview section of the 2022 10-K, Coinbase added a section discussing asset price volatility and crypto cycles. The company points out four major crypto asset price cycles that occurred since 2010 with each cycle lasting approximately two to four years (illustrated in the chart below which was also newly included in this year’s 10-K). Because of limited ability to forecast the crypto cycle and predict revenue, the company has implemented cost-cutting measures including workforce reductions in order to maintain profitability throughout downturns. The company reduced its headcount by 18% in June 2022, followed by another 21% workforce reduction in January 2023. Coinbase believes that the latest workforce reduction will reduce technology, sales and marketing, and general and administrative expenses by 30% y/y in 1Q23. Coinbase has also stated that they will take a more “rigorous approach” to investment in new products and also added language that shifts away from their historically acquisitive business. In 2022, the company recorded $101.4 million in gross impairment charges due to strategic investments and acquisitions that performed more poorly than expected due to economic conditions.

Source: Coinbase Global 2022 10-K

Increased focus on subscription revenue including interest income from USDC. Transaction revenue accounted for 91.4% of the company’s net revenue in 4Q21, but only 53.2% of net revenue in 4Q22. This was mostly due to lower asset prices and lower trading volumes, but also due to an increase in subscription revenue which was mostly derived from USDC (a stablecoin backed by the US dollar). The higher interest rate environment contributed to both higher interest income from USDC and interest earned from customer fiat balances held on the platform. The company states, however, that if interest rates were to significantly decline from 2022 levels that subscription revenues could also significantly decline.

Coinbase addresses custody and the failure of FTX, Celsius Networks, Voyager, and Three Arrow Capital. While Coinbase claims to have no material direct impact, it addresses that these 2022 events did cause changes in crypto market prices, crypto market volatility, and customer sentiment. Specifically, that includes loss of confidence in the broader crypto economy, reputational harm to crypto platforms like Coinbase, negative publicity, and increased scrutiny by regulators and lawmakers. They also reiterated holding assets 1:1 and not lending or rehypothecating client assets. In June 2022, the company updated its Retail User Agreement to grant legal protection to custodied crypto assets in the event of a bankruptcy. Coinbase caveats, however, that due to the novelty of crypto assets, courts have not yet considered this type of treatment for custodied crypto assets.

Regulatory and legal classifications like commodities vs. securities are still highly debated. Based by language by both the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), certain crypto assets may be classified as commodities and certain ones may be classified as securities. But there is not a clear or consistent classification framework. Coinbase added language to its filing referring to itself as “asset-agnostic” and seeking to access to every asset where it is safe and legal to do so. But despite this language change, customers have returned focus back to the basics—Bitcoin and Ethereum. In 4Q21, Bitcoin and Ethereum each contributed 16% to trading volume, with the remaining 68% going to other crypto assets. But in 4Q22, Bitcoin held 35% of Coinbase’s trading volume, Ethereum held 33% of trading volume, and other crypto assets were only 33%.

The company will no longer disclose verified users. For the year ending 2022, the company reports a 24% increase in verified users which includes all consumers, institutions, and developers that have a registered account on the platform. The company formerly used this metric as an indication of scale; however, they no longer believe that this metric provides meaningful insight into its business performance so this metric will be discontinued in the next 1Q23 earnings report. While a change in metrics can be viewed as a negative, this change seems rational since verified users tracks registration and not necessarily activities that lead to revenue generation.

Bottom Line:

While the crypto economy remains volatile, large crypto companies like Coinbase are able to adapt their business to changing market conditions. Because the crypto economy is still in its early stages, it is extremely difficult to time the market and pick stocks within this sector—even with the added clarity provided by public SEC filings. With crypto ETFs holding 9 out of the top 10 spots for highest performing equity ETFs YTD, investor interest has been returning to crypto. Rules-based index-linked products like ETFs may provide an investor with exposure to the crypto economy, while diversifying away some of the aforementioned single-stock risk.

For more news, information, and analysis, visit the Crypto Channel.

The Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index (CRYPTO) is the underlying index for the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

VettaFi LLC (“VettaFi”) is the index provider for SATO, for which it receives an index licensing fee. However, SATO is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of SATO.