BlackRock brought the crypto ETF industry back into the spotlight. And many investors and advisors are wondering whether a spot Bitcoin ETF will be approved, what this means for Bitcoin, and what the crypto ETF industry will look like in the future. This note provides a high-level overview of recent news and looks at the future of spot Bitcoin ETFs, blockchain ETFs, and more.

BlackRock, Grayscale, and Spot ETFs

It seemed like many investors had forgotten about Bitcoin. Then BlackRock — the world’s largest asset manager — filed for a spot Bitcoin ETF on June 15. The BlackRock filing was followed by filings from other major players like Wisdomtree and Invesco. WisdomTree, Invesco, and several others previously filed for a spot Bitcoin ETF in 2022. All were denied. This has all happened amidst the SEC’s current legal battle with Grayscale over its request to convert its Grayscale Bitcoin Trust (GBTC) to a spot Bitcoin ETF.

So why now for BlackRock? Many believed that BlackRock “knew something” that would suggest that the SEC would be willing to approve a spot Bitcoin ETF. Other theories floated around, but none had any proof. But filing for a spot Bitcoin ETF means that BlackRock sees value in launching a spot Bitcoin ETF. And because of its size, reputation, and knowledge of the regulatory environment, there could eventually be a chance of approval. Although, there is no easy way to predict when that would happen. Approval for BlackRock would also increase the likelihood of approval for Grayscale and other similar spot Bitcoin ETFs. But up to this point, the SEC hasn’t seemed to change its stance on spot Bitcoin ETFs.

Why Is This Important for ETFs?

The SEC has so far been resistant to a spot Bitcoin ETF. Why? Because of the possibility of fraud and manipulation due to a lack of regulation. Right now, the SEC has only approved futures-based ETFs since the CFTC regulates futures. If a spot Bitcoin ETF were to be approved, it could be extremely impactful for the crypto ETF industry. According to the Bitwise VettaFi 2023 Benchmark Survey, 32% of advisors surveyed said they would be more comfortable allocating to crypto assets in the future if there was a spot-based ETF. And 68% said that their preferred way to invest in crypto would be an ETF. This would also catch the crypto ETF industry in the U.S. up to other countries, including Canada, which currently offer spot Bitcoin ETFs.

Bitcoin Prices Come Back to Life Along With Some Positive Regulatory Signals

Since news of the BlackRock filing, the price of Bitcoin has increased 20% to $30,700. Before this, Bitcoin had briefly touched $30,000 in April. But it has hovered mostly between $20,000 to $30,000 since mid-2022 when interest in crypto ETFs and Bitcoin was waning. There have also been several regulatory shifts over the past few weeks that may now suggest that the SEC has become more accepting of crypto. On June 20, EDX Markets launched — a digital asset market backed by Fidelity, Charles Schwab, and Citadel.

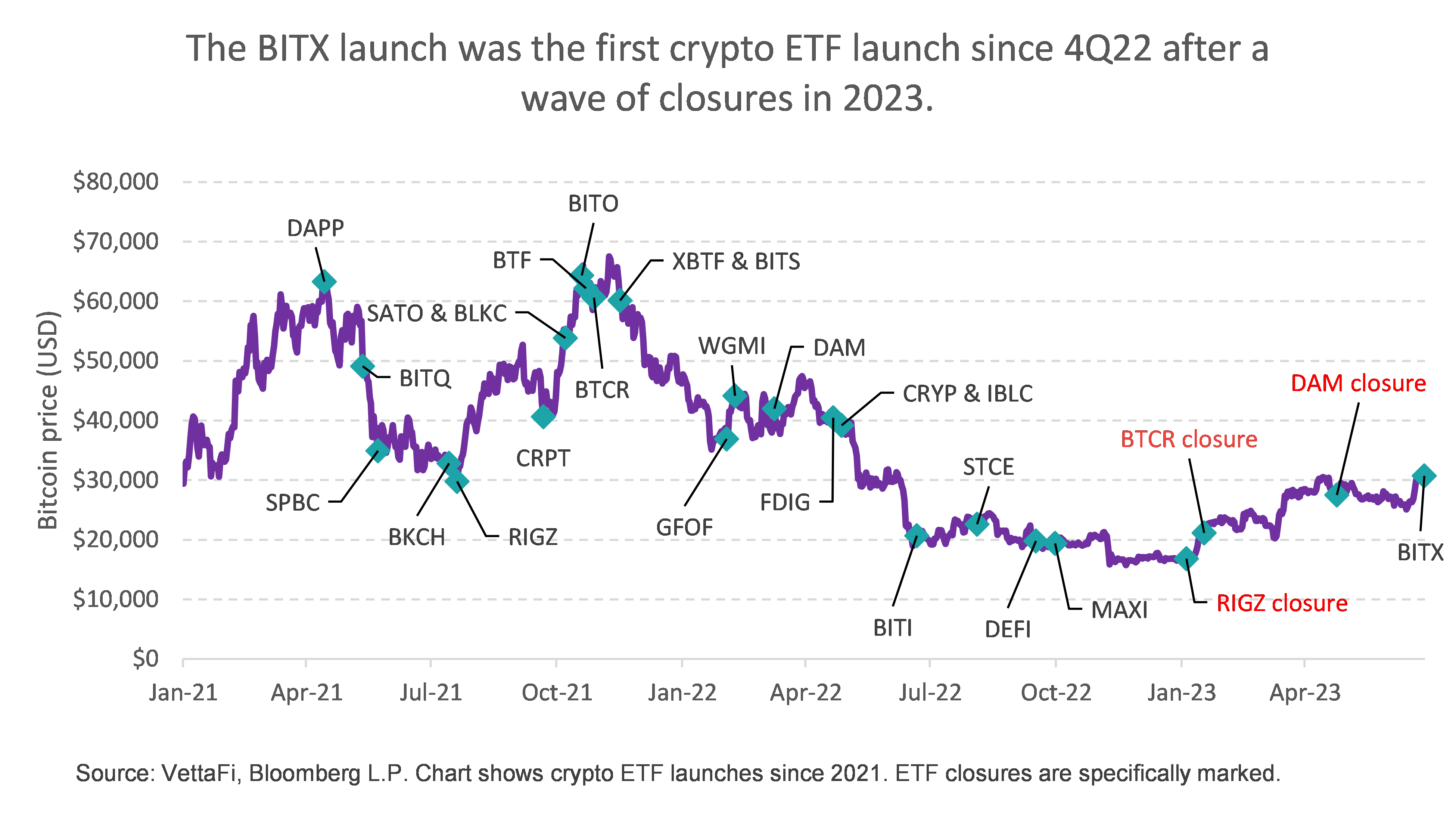

In contrast to other crypto exchanges, investors will be able to trade through financial intermediaries instead of relying on an exchange to maintain custody (like with FTX). On June 27, the first leveraged Bitcoin ETF started trading—the Volatility Shares 2x Bitcoin Strategy ETF (BITX). Last year, the SEC also approved the first inverse Bitcoin ETF — the ProShares Short Bitcoin Strategy ETF (BITI). Both BITX and BITI use futures to track the price of Bitcoin. However, it’s still been surprising to many in the industry that the SEC would approve a leveraged product and an inverse product before a spot ETF. These events may be a positive signal for the SEC’s attitude toward crypto. But there’s still a notable difference between the way the SEC feels about futures-based Bitcoin ETFs versus spot-based ones. This means approval of a spot-based ETF may still be far away.

Blockchain ETFs Are Still Losing Investor Interest

It may also be the case that a spot Bitcoin ETF product would take shares from futures-based Bitcoin ETFs like BITO and not receive as much new investor interest. At this point, it seems that many investors are not as interested in Bitcoin as they were when it became a mainstream product. This has been well-illustrated by blockchain and crypto equity ETFs which are a large portion of the current crypto ETF market. These ETFs are industry and/or thematic ETFs. They hold stocks of companies within the crypto ecosystem but are still highly correlated with the price of Bitcoin.

After weak performance in 2022 exacerbated by several large events (Celsius, FTX, etc.), these ETFs have been significantly outperforming other ETFs YTD. The Valkyrie Bitcoin Miners ETF (WGMI), for instance, is up 189% YTD and is the best-performing equity ETF yet has received very little inflows. Typically, higher performance would attract more inflows. But it seems like many investors may have been burned by crypto in the past and are no longer interested.

From a thematic perspective, blockchain was the future of technology. And while it’s still a valid theme, investors seem to be more interested in artificial intelligence this year. More conservative investors may only have interest in allocating to one “future tech” theme. And artificial intelligence is a more tangible idea (with so many different apps and websites you can easily play with). AI is also more closely linked to some well-known large-cap names like NVIDIA (NVDA) and Microsoft (MSFT), which may give investors more peace of mind relative to Bitcoin, which has been historically volatile.

Bottom Line:

A lot is happening in the crypto ETF industry. But it’s still uncertain if and when a spot Bitcoin ETF will be approved. A spot Bitcoin ETF will likely be a net positive for crypto ETFs and the overall crypto industry. But blockchain and crypto equity ETFs might be left behind. That’s because investors are looking at other themes and industries like artificial intelligence and semiconductors.

For more news, information, and analysis, visit the Crypto Channel.