Investment managers in crypto ended 2021 with $62.5 billion in assets under management, with bitcoin and bitcoin-related funds the largest draw for investors, reports CoinTelegraph. The latest data from CoinShares shows crypto investment product inflows growing from $6.8 billion in 2020 to $9.3 billion in 2021, reflecting increasing interest from both individual and institutional investors.

Bitcoin-related funds brought in the biggest piece of the inflows pie at $6.3 billion for the year, while ether-related products attracted $1.4 billion. Funds that contain a variety of crypto assets carved out $775 million of inflows for 2021 as the entire space grew.

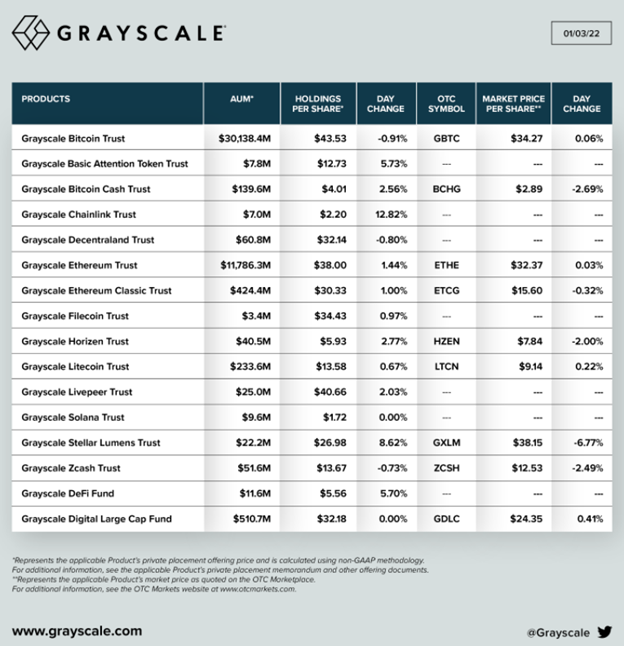

Grayscale continues to be the largest crypto asset manager, with a total of $43.5 billion in AUM as of January 3, according to its Twitter. The Grayscale Bitcoin Trust (GBTC) remains their largest fund with a little over $30 billion in AUM, followed by the Grayscale Ethereum Trust (ETCG) at nearly $11.8 billion in AUM.

Image source: Grayscale’s Twitter

2021 saw the launch of 37 new investment funds within crypto, compared to 24 the year before, as appetites increased for crypto products from investors. Last year also saw crypto hitting the multi trillion-dollar mark as an asset class, drawing the attention of advisors and investors.

The launch of bitcoin futures funds in the U.S. later in the year also brought increased attention and opportunity to bitcoin and the crypto space overall, and the addition of more investible crypto assets equated to further growth.

Investing in Bitcoin With Grayscale

For investors who are looking for a way to gain exposure to the largest cryptocurrency globally, Grayscale offers the Grayscale Bitcoin Trust (GBTC). The fund is benchmarked to the CoinDesk Bitcoin Price Index and seeks to reflect the value of bitcoin (BTC) held by the trust with the value of the shares.

The fund allows investors to gain exposure to bitcoin through a secure structure. By gaining exposure in the form of a security, investors don’t have to buy, store, and safekeep bitcoin (BTC) themselves. Bitcoin via the fund is stored in cold storage with Coinbase as the custodian.

GBTC allows investors to have shares that are titled to their name, auditable, easy for financial and tax advisors to account for, and easy to transfer to beneficiaries. The trust is an SEC-reporting company registered pursuant to Section 12(g) of the Securities Exchange Act of 1934.

The fund has an annual fee of 2.0% and currently has $30 billion in assets under management.

For more news, information, and strategy, visit the Crypto Channel.