Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon debate the hottest topic in 2024 investing thus far: spot bitcoin ETFs.

Elle Caruso, staff writer, VettaFi: Hey, Karrie! I’m looking forward to discussing the investment case for spot bitcoin ETFs. Investors had been long awaiting the approval of these funds, which have the potential to be genuinely transformative for the ETF and broader investing industries.

The iShares Bitcoin Trust (IBIT), the Fidelity Wise Origin Bitcoin Fund (FBTC), the Bitwise Bitcoin ETF Trust (BITB), the ProShares Bitcoin Strategy ETF (BITO), and the Invesco Galaxy Bitcoin ETF (BTCO) have taken in a combined $3.1 billion year to date as investors flock to the space.

In a recent conversation with VettaFi, Invesco’s Kathy Kriskey said the ideal allocation to crypto is just 1% of the overall portfolio. This is such a small amount in a well-diversified portfolio that it’s hard to see any downside. The crypto exposure sits alongside other alternative investments and helps provide a diversified source of returns and significant growth potential.

The alternatives bucket in a portfolio, according to Kriskey, ideally holds commodities and crypto. Maybe a small amount of real estate, too, if you’re into that. Commodities will comprise the largest portion of this group, with investors ideally allocating 5-8% of their assets. Any more than 5-8% in commodities and 1% in crypto is unnecessarily risky.

Spot bitcoin ETFs make it easy to get this exposure. Looking at it from a high level, I don’t see what’s not to like about these funds.

‘That’s Likely All We Get for Awhile’

Karrie Gordon, staff writer, VettaFi: I won’t lie; I’ve been enjoying watching the celebrations around the launch of the spot bitcoin ETFs. While it’s easy to get caught up in the hype, I think it’s important to mind the big picture. We need to step back and recognize the extremely significant hurdles digital assets still face.

Blockchain technology, which powers cryptocurrencies like bitcoin, carries enormous potential to revolutionize segments of our increasingly digital world. However, it is also a nascent technology and, despite the hype and promise, may never gain broad adoption. You need to look no further than the disappointment of augmented reality to see one potential path for blockchain uptake.

Unless you’ve intentionally avoided all crypto-related new in the last five years, you’ve likely seen the naysayers and fear-mongering around crypto and blockchain. For a not-insignificant percentage of the population, cryptocurrencies and blockchain technology have become synonymous with bad actors and criminal activity.

Without serious regulatory guardrails and oversight — something I might add that is antithetical to the entire premise of decentralization — digital assets are likely to remain a niche asset class. In the U.S., I wouldn’t hold your breath for any regulatory framework anytime soon. Our own Todd Rosenbluth, head of research here at VettaFi, agrees.

“That’s likely all we get for a while,” he said, speaking of the recent approval of spot bitcoin ETFs in the New York Times. “The government remains uncertain about cryptocurrency in general.”

It makes for a muddied and muted outlook for the potential of bitcoin to remain anything other than speculative for investors.

Without Spot Bitcoin ETFs, Investors Will Invest in Physical Bitcoin

Caruso: You bring up great points, Karrie. However, I think investors who want exposure to bitcoin will find it one way or another. With the recent SEC approval of spot bitcoin ETFs, investors can now compare the different products on the market and make prudent, smarter choices. The various spot bitcoin ETFs have different liquidity profiles and tracking errors, but they all provide safer access to bitcoin via a highly liquid, regulated product. This is something that should give investors and the larger community comfort.

This is also advantageous for financial advisors. Previously, advisors may not have had access to the funds that their clients were allocating to crypto. Clients wanted crypto exposure, and ultimately, advisors were losing clients due to their inability to deliver that desired exposure.

However, spot bitcoin ETFs allow advisors to expose clients to bitcoin in a wrapper that advisors are comfortable with. The products enable direct ownership of bitcoin. But, as I mentioned above, they also offer the benefits associated with the ETF structure.

It’s Risk All the Way Down

Gordon: The SEC maintains its obstructive stance toward crypto in the U.S. in its ongoing refusal to create regulations for this new asset class. So where does that leave blockchain and bitcoin? A purely speculative venture based on a technology that has yet to prove its real-world mettle and worth. And as we all know, speculative investments carry inherently elevated risks.

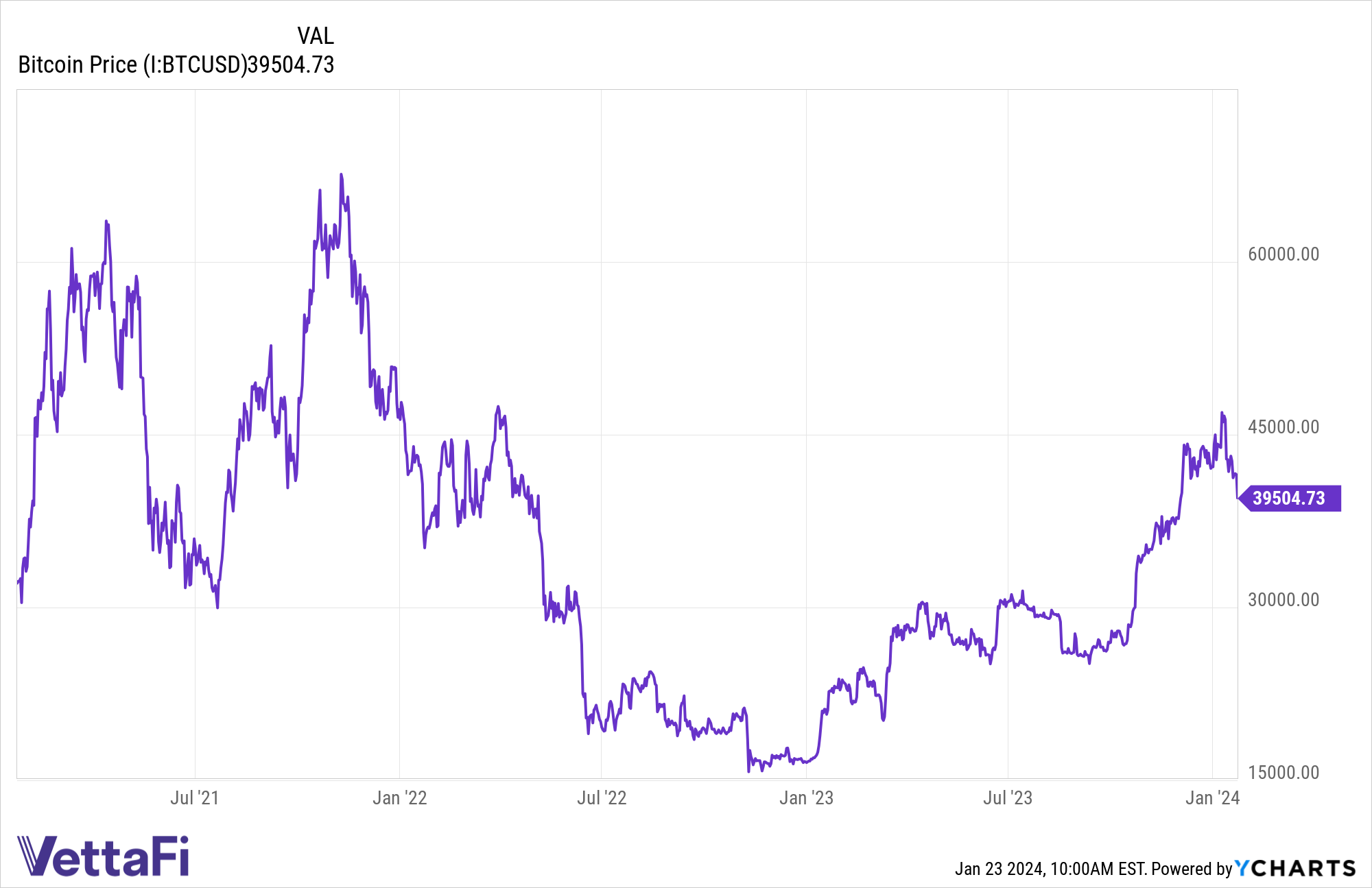

Bitcoin prices reached all-time highs on November 9, 2021, peaking at $67,617. Prices were buoyed by the enthusiasm and optimism of approving the first bitcoin futures ETFs. One year later, prices had plummeted to $15,742 as of November 10, 2022.

Fast-forward to now. Bitcoin ETFs launched on January 11, with bitcoin prices spiking at $49,000. As of Tuesday morning, January 23, bitcoin traded at $38,711. All the investors who piled into spot bitcoin ETFs have lost 21% in less than two weeks.

What’s more, there is genuine concern that because bitcoin is speculative (not directly linked to any real-world assets), an influx of investors into the space will only exacerbate the already significant volatility.

Is Volatility in Spot Bitcoin ETFs Overplayed?

Caruso: It’s true that bitcoin prices can be highly volatile. However, during the one-year period trailing January 11, there were 202 ETFs that had higher one-year volatility than bitcoin, according to Dave LaValle, Grayscale’s global head of ETFs.

There’s volatility in crypto, and the ETF wrapper won’t mitigate that volatility; however, it may be overplayed or misunderstood. This makes it imperative for investors to know what they own.

I mentioned tracking error earlier, and I think that’s important to drill down on. Many investors are focused on the fees. However, a few basis points difference in fees has a smaller impact than a substantial difference in tracking error.

In the first week that the new spot bitcoin ETFs were trading, Fidelity and Invesco’s funds (FBTC and BTCO, respectively) were leagues ahead of the rest regarding minimizing tracking error. Although the data is still fresh, this is worth considering for investors looking to add exposure to the space.

Bitcoin Exacerbates the Climate Crisis

Gordon: It’s true that many bitcoin ETFs are tracking with minimal errors, which is extremely important for such a volatile asset class. I need to step past the trading mechanisms and look at bitcoin itself, however, for my last point. More accurately, I need to talk about how bitcoins are created.

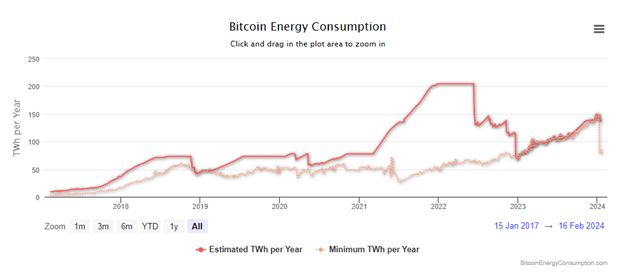

Bitcoin mining has been in the public eye for a few years now for the intense energy drain that mining bitcoins requires. New bitcoins are minted using a proof-of-work model, which requires computers and massive server banks. The Digiconomist estimates that bitcoin uses 137.68 TWh of electricity annually, more than Colombia and Portugal’s 2022 energy use combined.

Image source: Digiconomist

The vast majority of miners still rely on fossil fuels for energy sources. While increased awareness and efforts are needed to transition bitcoin miners to green energies, progress remains slow. What’s more, the bitcoin blockchain is consuming exponentially more water each year. The blockchain consumed 591.2 gigaliters (GL) in 2020, 1,576.7 GL in 2021, and estimates for 2023 are around 2,237 GL, according to recent research published in Cell Reports Sustainability. In a world of increasing water scarcity and climate crisis, the bitcoin token creation model only serves to tip the scales in the wrong direction.

For investors with an eye for climate, alternative assets, and opportunity, carbon offsets are an asset class to consider. Carbon credit markets offer similar nascence as crypto. For investors comfortable with a riskier volatility profile akin to that of bitcoin and cryptocurrencies, carbon credits are worth a look. Investors can gain exposure through funds like the Carbon Credits Strategy ETF (NTRL) and the KraneShares Global Carbon Offset Strategy ETF (KSET).

In a year rife with risk, investing in spot bitcoin ETFs seems counterintuitive to the security most investors seek. For those investors seeking more protections but alternatives to stocks and bonds, the regulated carbon cap-and-trade markets are an asset class to consider. Funds include the KraneShares Global Carbon Strategy ETF (KRBN) and the Carbon Strategy ETF (KARB).

For more news, information, and analysis, visit the Crypto Channel.