Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and James Comtois debate the investment case for and against blockchain stocks, in the wake of several crypto company crashes.

Karrie Gordon, staff writer, VettaFi: Okay, James, I’ve come fully outfitted in my fencing gear (it took me a bit to have it custom-made to bull size) because I know this is one you’re all too happy to try to slice to ribbons around me.

I know there are a lot — and I mean a lot — of reasons to be reticent about crypto right now, given FTX’s collapse and the domino effect that’s had on the crypto ecosystem of exchanges and lenders. It’s easy to point fingers at FTX and Alameda Research, but their potentially fraudulent actions aren’t unique to crypto (see also: Enron, WorldCom, and Lehman Brothers) or indicative of failings of crypto specifically.

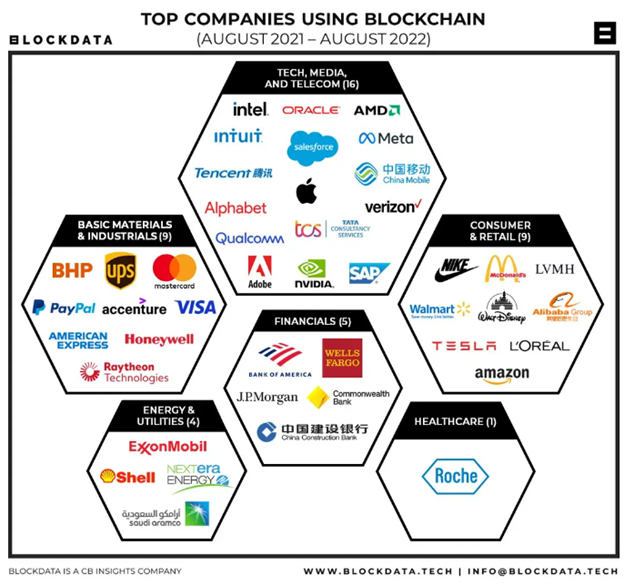

While I’m not here to argue the case for cryptocurrencies, I still believe there are many reasons to be bullish on blockchain technology itself and the companies developing it. And I’m in good company: Major financial industry players have been using it for years.

All the way back in 2016, JPMorgan, headed by renowned crypto skeptic Jamie Dimon, developed Quorum, a permissioned blockchain that’s used for business applications; the company continues to make huge strides in blockchain today. They’re just one of many financial industry giants committing to blockchain, but I feel it’s notable given Dimon’s public disdain of crypto tokens but belief in the potential of the underlying blockchain technology.

James Comtois, staff writer, VettaFi: Karrie, when you invited me to the VettaFi Parry Club, I was worried we’d be fencing, because this little bear has been terrible at the sport all his life. Maybe because of these giant bear claws? Fortunately, given that I do indeed have these big bear claws, I feel like I can hold my own in a fight over blockchain.

Being bearish over crypto these days seems like catching fish in a barrel (which, as you know, bears love), but you’re right in that blockchain technology offers the glimmer of a silver lining in the crypto cloud. I agree that blockchain has potential. Its positives are immutability, transparency, convenience, and the ability to leave an irreversible audit trail.

Except that the technology is nowhere near ready for prime time. Not only is it nearly impossible to fix a mistake on the blockchain once inputted, but it’s also still very easy to hack, with often no recourse for the victim. I know I wouldn’t want my entire medical history on that thing! So, while there could be potential, there are still too many uncertainties in blockchain to make it a worthy investment, in my not-so-humble bear opinion.

Gordon: While it’s not impossible to fix a mistake or roll back a substantial hack on decentralized blockchains, it doesn’t happen often. Also, public blockchains are constantly evolving, building better security and functions all the time.

I’ll agree that the biggest challenge right now for blockchain is its nascence, but that’s also its biggest opportunity. As we’ve seen in the tech space historically, with rapid growth comes rapid evolution: Northeastern University professor Ravi Sarathy anticipated that large enterprise blockchain (companies with 1,000+ employees using blockchain in their business) will be commonplace by 2030. The latest market share estimates for the global blockchain technology market are forecasting growth up to $69 billion by 2030, at a CAGR of 68% between 2022 and 2030. That’s up from an estimated $4.8 billion in 2021.

It shouldn’t be a large surprise, given that the 2021 annual Global Blockchain Survey conducted by Deloitte reported 81% of 1,280 financial executives worldwide believed blockchain was scalable and had reached mainstream adoption potential. Even more telling, 73% said that not adopting blockchain would put them at a competitive disadvantage. Corporations recognize this disruption potential, with 44 of the top 100 public companies by market cap already using blockchain technology, according to BlockData.

I firmly believe that blockchain will have a foundational role to play in the digital world that’s developing and will be as large a disruptor in how we account for and track things, verify transactions, and transfer ownership as the internet was in distributing information. That’s enormous disruption potential, and something that you want to be sure your portfolio is on the right side of.

The Siren Nasdaq NexGen Economy ETF (BLCN) appeals to me right now given the price opportunities. This ETF puts more emphasis on the companies actually using and developing blockchain — so it has a portfolio of largely familiar financial entities and the like, with minimal exposure to the crypto miners and exchanges that tend to show up in higher weights in other crypto ETFs. Given crypto’s collapse, I think it’s a smarter play right now (even though the fund is still down 44% YTD, that’s still more buoyant than other crypto funds).

Comtois: I don’t doubt that blockchain will play a significant role in our lives in the future. But it’s a question of when that change takes hold, and what growing pains the tech has to go through to get there.

Blockchain being unregulated and decentralized is ultimately a net negative, I think, and one of the reasons why the massive amounts of fraud we’re seeing represent a feature of the system, not a bug. The anonymous nature of decentralized blockchains can make them the ideal tech for fraudsters and criminals (see the “Silk Road” digital black market scandal). Plus, the lack of a universal standard makes interoperability between blockchains a real challenge.

If brave (or rather, foolhardy) investors want to put any money into the ‘chain, then I think they at least should wait until there’s some sort of regulation (which appears to be much easier said than done) so they’re protected from bad actors.

A lot of it comes down to whether you see a fund like BLCN that’s down 44% YTD (while, by comparison, the S&P 500 is down only 15%) as a good opportunity, or as a sign that it’s investing in a quickly sinking ship. I’m pretty firmly in the latter camp.

Maybe I’m just being overly pessimistic about the potential of blockchain’s future. But then again, I am just a bear with a barrel here.

Gordon: Okay, let me stop you for a minute to clarify a common misconception. Blockchain is a distributed ledger, but it isn’t inherently decentralized. The kinds of blockchains that the private sector uses are actually centralized versions most of the time, meaning that the company or an individual has control over them.

So for example, Vanguard uses blockchain technology to retrieve index data from providers, because it’s faster and more efficient than traditional methods. FedEx (FDX) uses it to manage its supply chain. Another great example closer to our stomping grounds: WisdomTree (WT) is leaning into blockchain as the way of the future in a big way with a multitude of blockchain-enabled funds and their own pending blockchain-native financial app. (In fact, I recently chatted with Jarrett Lilien about it: WisdomTree President Discusses Brand Evolution And The Digital Future.)

As far as regulations in the U.S. go, I know firsthand what an arduous process it’s been to get anything substantive from the various U.S. regulatory bodies — it’s a nerdy thing I tend to keep up on and write about on occasion. (See also: Commissioner Hester Peirce Wants Meaningful Crypto Action.) Despite FTX’s spectacular implosion, I do think taking the time to get crypto regulation right is the correct approach by the SEC, lest we entirely drive that innovation potential out of the U.S.

Comtois: While it’s a good sign for blockchain that established financial firms like Vanguard and WisdomTree are leveraging the technology, I see just as many institutions abandoning their efforts to use blockchain, including the Australian Stock Exchange, IBM, and Amazon. Like crypto, the blockchain in its current state feels very much like a mirage that vanishes the closer you get to it.

You’re also seeing contagion spread in several companies connected to crypto and blockchain tech (and as it stands now, blockchain and cryptocurrencies are still inextricably linked) that aren’t connected to FTX. Crypto lenders BlockFi, Three Arrows Capital, Voyager Digital, and Celsius Network have all filed for bankruptcy.

Investors bearish on this tech could express that view via short bitcoin exposure, which they could find in the ProShares Short Bitcoin Strategy ETF (BITI). Plus, Direxion has filed to launch the Direxion Bitcoin Strategy Bear ETF, which will provide managed short exposure to CME bitcoin futures contracts.

Gordon: I would disagree that they are inextricably linked, but that’s a long-winded argument for another time. It’s important to note that despite the crypto winter of this year that’s taken a heavy toll on cryptocurrencies and tokens, the emerging technology subsectors that had the most private investment in the third quarter via venture capital firms were Web3 (the proposed, decentralized evolution of the internet) and DeFi, both built on blockchain technology, bringing in $879 million in investments and beating out fintech and biotech, according to PitchBook.

Investing is alive and well in blockchain, a disruptive and fundamental building block of the future for many core industries of the U.S. economy, including financial services, healthcare, government, infrastructure, energy, and more. If you want a purer play on the crypto economy, then I strongly suggest you consider actively managed funds, given the volatile nature of investing in a nascent industry. For investors interested in companies that have this more direct exposure to the crypto economy while still focusing on blockchain development and growth, the actively managed Amplify Transformational Data Sharing ETF (BLOK) could be worth a look.

Now, if you’ll excuse me, I’m going to figure out how to return this clearly unnecessary barrel of fish and also contemplate why I ever thought fencing with hooves was a good idea.

Comtois: Here, let me help you with that barrel. As always, it was a pleasure, Karrie. You’ve been a delightfully upbeat bull. I eagerly await the next time we spar. Until then, I feel like I should remind everyone that cryptocurrency is a scam and call it a day.

For more news, information, and analysis, visit the Crypto Channel.