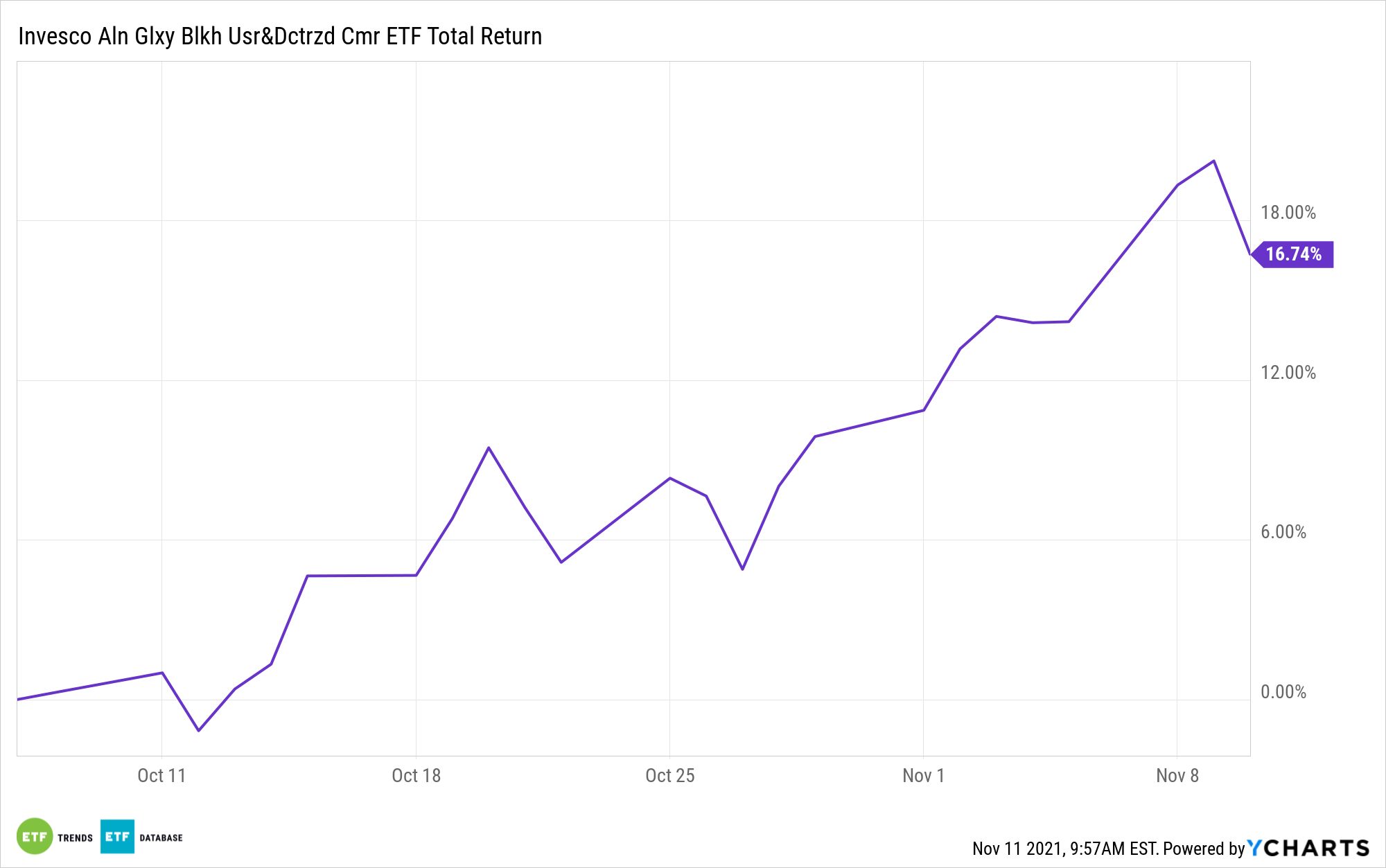

The digital asset space can offer potential investors a myriad of opportunities, which makes an all-encompassing ETF like the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC) a perfect option for broad exposure.

Per its fund description, BLKC will aim to track the Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index. BLKC’s index is comprised of stocks of companies that are materially engaged in the development of blockchain technology, cryptocurrency mining, cryptocurrency buying, or enabling technologies, exchange traded products (ETPs), and private investment trusts traded over-the-counter that are linked to cryptocurrencies.

“Cryptocurrencies themselves, however, represent just one portion of the potential economic value created by digital assets,” Invesco notes on their website. “Investors can also invest in companies that provide technology or tools related to digital assets, as well as companies that could benefit, either directly or indirectly, from blockchain or the shift to decentralized finance. Decentralized finance (also known as DeFi) describes a system in which financial transactions are made directly between buyers and sellers without the need for banks or other centralized financial institutions.”

Looking under the hood, 15% of its allocation goes to the Grayscale Bitcoin Trust, giving investors indirect exposure to the leading cryptocurrency, bitcoin. This indirect exposure can be of benefit when it comes to risk-averse investors who are still hesitant to invest directly in digital currencies.

Digital Assets Causing a Labor Shortage?

Cryptocurrency millionaires could be the reason why there’s a labor shortage, causing employers to make their offers more attractive in order to hire talent. Research firm CivicScience surveyed thousands of respondents during a bullish October for crypto gains.

“The gains from cryptocurrency trading may be fueling the persistent labor shortage in the US as Americans across the income spectrum gave up full-time jobs to take their chances on risky digital assets, a new study shows,” a Business Insider article noted.

It only highlights the potential of the cryptocurrency space and the larger decentralized finance ecosystem.

“One finding showed that around 11% said they or someone they know have resigned from their jobs due to the financial freedom afforded by digital asset trading,” the article added. “The survey comes as the total market cap for digital assets just hit $3 trillion for the first time on record, roughly the size of the entire UK economy.”

For more news, information, and strategy, visit the Crypto Channel.