Heading into the fifth day of gains, crude oil rocketed higher on Tuesday as optimism related ongoing production cuts and a recovery in demand related to the anticipated reopening of economies around the world drove investors and traders to buy black gold.

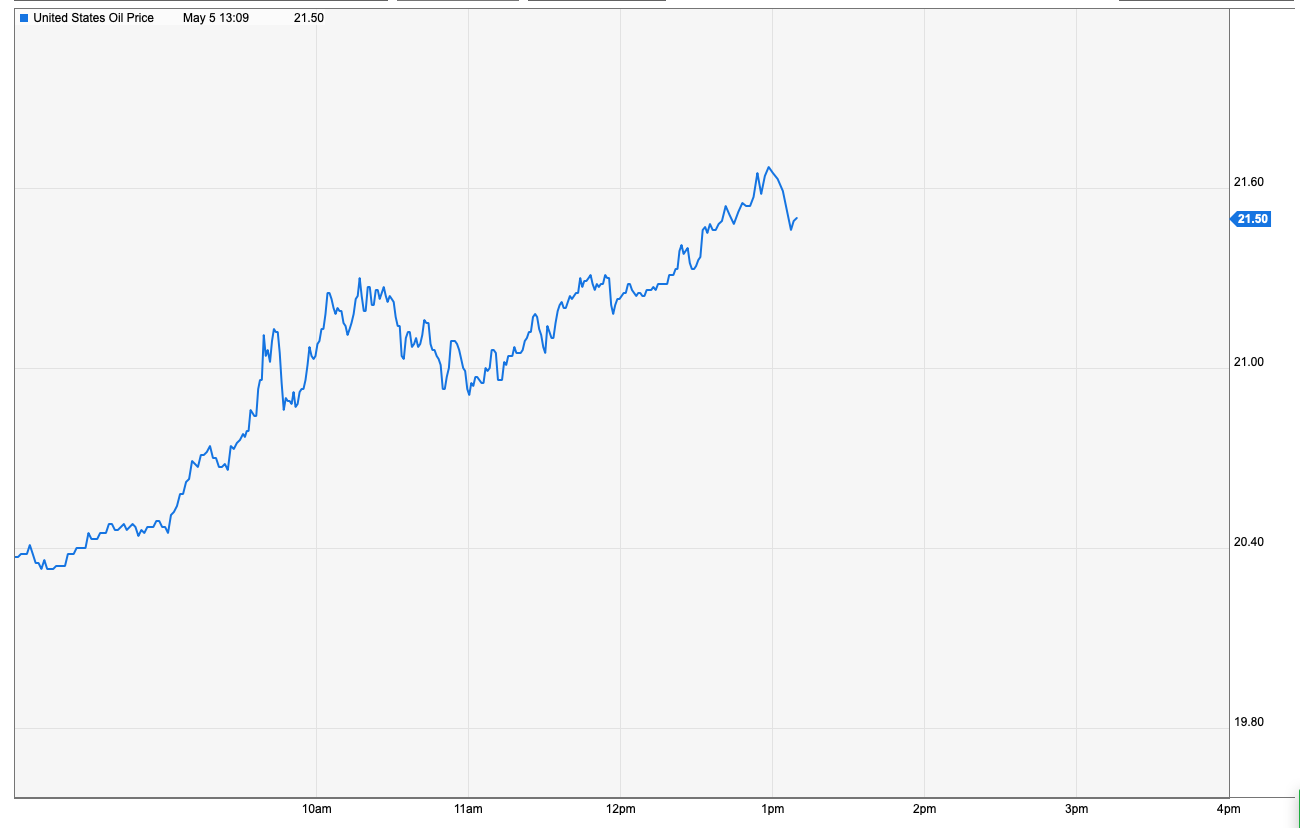

U.S. benchmark, West Texas Intermediate (WTI), exploded 20.6%, or $4.15, to trade at $24.78 per barrel, and is continuing to climb higher as of nearly 1 pm EST. The June contract rallied over 3% on Monday to close above $20 for the first time since mid-April, as it heads for its fifth-straight day of gains. Brent crude also made sizable gains, trading 12.4% higher at $30.57 per barrel, and is also targeting its fifth-consecutive positive session.

Analysts are elated by the move, heralding a bottom for demand, and looking for the oil market to continue to strengthen.

President Trump, who had claimed production cuts and an agreement between OPEC+ members would drive oil higher a short time before oil prices went negative for the first time in history, commented on the explosion in prices Tuesday, writing “Oil prices moving up nicely as demand begins again!” in a tweet.

Crude oil ETFs are beneficiaries of the move higher in the commodity also. The Invesco DB Oil Fund (DBO) is up over 4%, the United States Oil Fund LP (USO) has rallied more than 9.5%, while leveraged fund, ProShares Ultra Bloomberg Crude Oil (UCO) shot up 13% so far on Tuesday.

Damaged Demand

Consumers have been largely confined to their homes with shelter-in-place orders throughout much of the country in an attempt to stem the spread of the coronavirus pandemic, which has damaged demand for gasoline and oil. But with many states now exploring plans to reopen their territories, investors and analysts are enthusiastic that a recovery in oil will occur, as consumers move toward potential normalcy.

“The reopening of economies has injected a degree of cautious optimism back into an oil market that plunged to historic lows only weeks ago,” RBC analyst Michael Tran said in a note to clients Tuesday.

“There’s reason to believe the worst of the demand destruction is behind us. Commentary from multiple companies pointed to an improvement in US demand at the end of April, particularly for gasoline,” added Stacey Morris, director of research at Alerian.

For more market trends, visit ETF Trends.