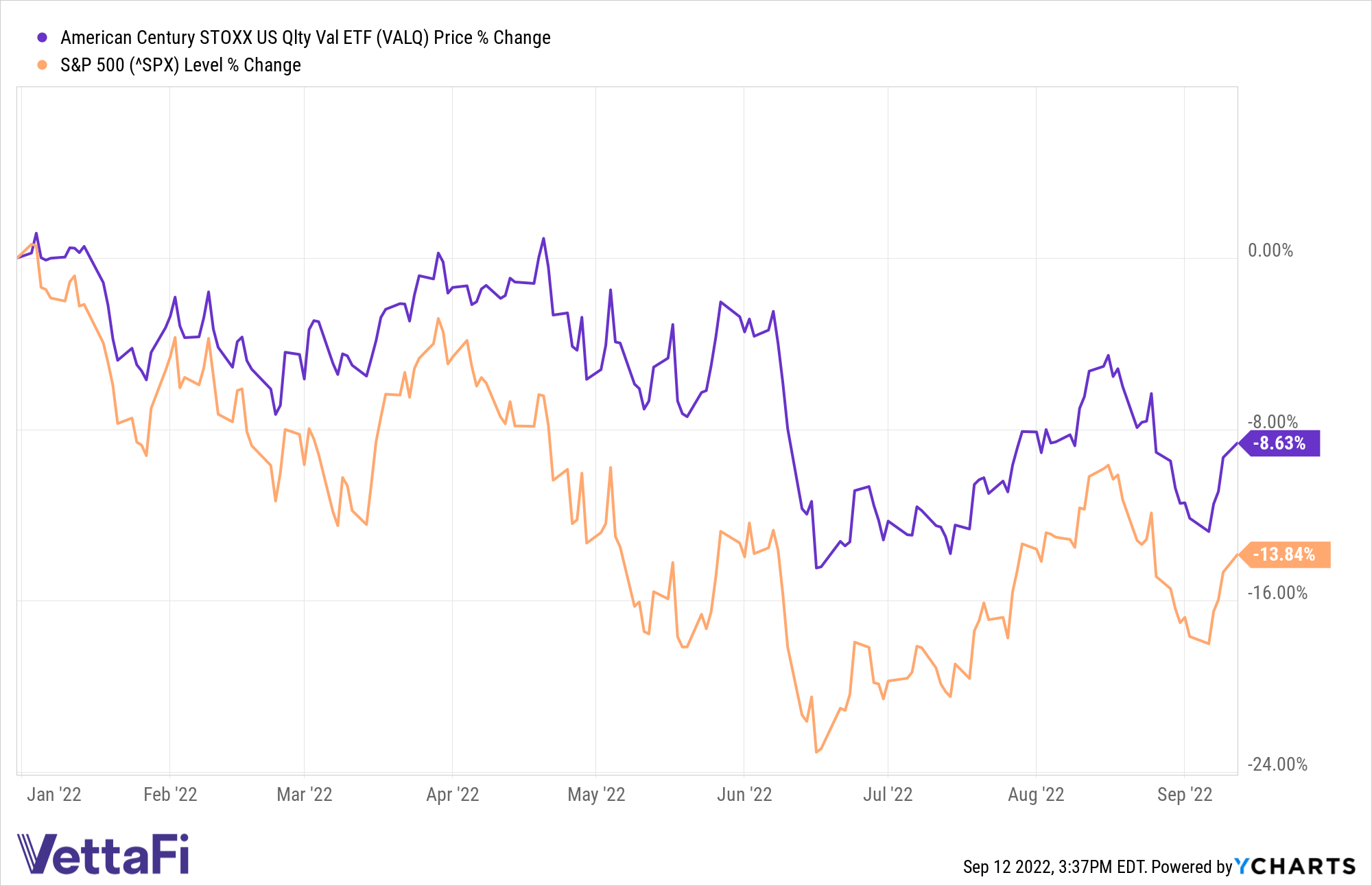

Rising inflation and the Fed’s aggressive plan to raise interest rates have taken a lot of the shine off growth stocks this year. Plus, volatility continues to reign supreme. While the S&P 500 closed up 1% on Monday, the index is down 14.31% year-to-date.

As a result, investors have been turning from growth towards value. This makes perfect sense. After all, in times of high inflation and low returns, cheaper is always more appealing. Plus, value stocks have historically outperformed the market over the long-term.

“Investors bracing for further pain in stocks might want to turn to the cheaper corners of the market that have suffered less, but not all value funds are created the same,” reported Evie Liu for Barron’s. “Generally speaking, large-cap value stocks have held up better than their small-cap brethren this year, as investors bet that larger firms will have more financial resources to better survive a potential recession.”

However, it can be difficult for a novice investor to select the right value stocks. So, investors seeking a targeted approach to value stocks may want to consider the American Century STOXX U.S. Quality Value ETF (NYSE Arca: VALQ).

VALQ tracks the iSTOXX® American Century® USA Quality Value Index, which tries to identify undervalued large-cap companies that have stronger financial fundamentals relative to rivals. The index screens stocks based on value, quality, and income.

VALQ is outpacing the S&P 500 by more than 500 basis points year-to-date.

The fund aims to have 30% to 80% of its portfolio in value stocks, and 20% to 65% in stocks that exhibit sustainable income. With an expense ratio of 0.29%, VALQ is reasonably priced for a multi-factor index fund, though it’s more expensive than ultra-low-cost plain-vanilla index ETFs.

“We have been overweight to value over growth in recent months,” said vice president of ETF product and strategy for American Century Investments. “Value securities had been more attractively valued, tend to offer higher dividend yields (which helps contribute to their shorter duration profile than growth stocks where most of the return is due to price appreciation) and have recently experienced stronger momentum vs. growth.”

For more news, information, and strategy, visit the Core Strategies Channel.