Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), recently gave a speech outlining the growing interest in environmental, social, and governance (ESG) issues by investors, and the role the SEC will play in the phenomenon.

According to CNBC, the agency is looking to gather more information to determine what is important for investors, and to ensure companies are holding to their commitments.

Finding the Metrics that Define ESG for Investors

Chairman Gensler reported that the SEC has received over 400 unique letters regarding ESG and the fact that it is still very loosely defined.

In an attempt to find more measurable metrics, Gensler has instructed his staff to gather more information on metrics such as greenhouse emissions to ascertain which particular metrics are most important for investors.

“I’ve also asked staff to consider the ways that funds are marketing themselves to investors as sustainable, green, and ‘ESG’ and what factors undergird those claims,” Gensler said.

In addition to looking to begin giving more defined parameters to ESG, Gensler is also looking to follow up on companies that have made commitments to climate change practices.

“Further, I’ve asked staff to consider potential requirements for companies that have made forward-looking climate commitments, or that have significant operations in jurisdictions with national requirements to achieve specific, climate-related targets,” Gensler elaborated.

With respect to the social aspect of ESG, Gensler is looking for greater disclosure from companies in how they interact with and employ people. He is looking into metrics such as compensation, skills and development training, workforce turnover, benefits, workforce demographics like diversity, and more.

“Disclosure helps companies raise money. It helps the efficient allocation of capital across the market. And it helps investors place their money in the companies that fit their investing needs,” Gensler explained.

Capturing ESG with ESGA

With so much uncertainty around what ESG means, an actively managed approach can help separate signal from noise.

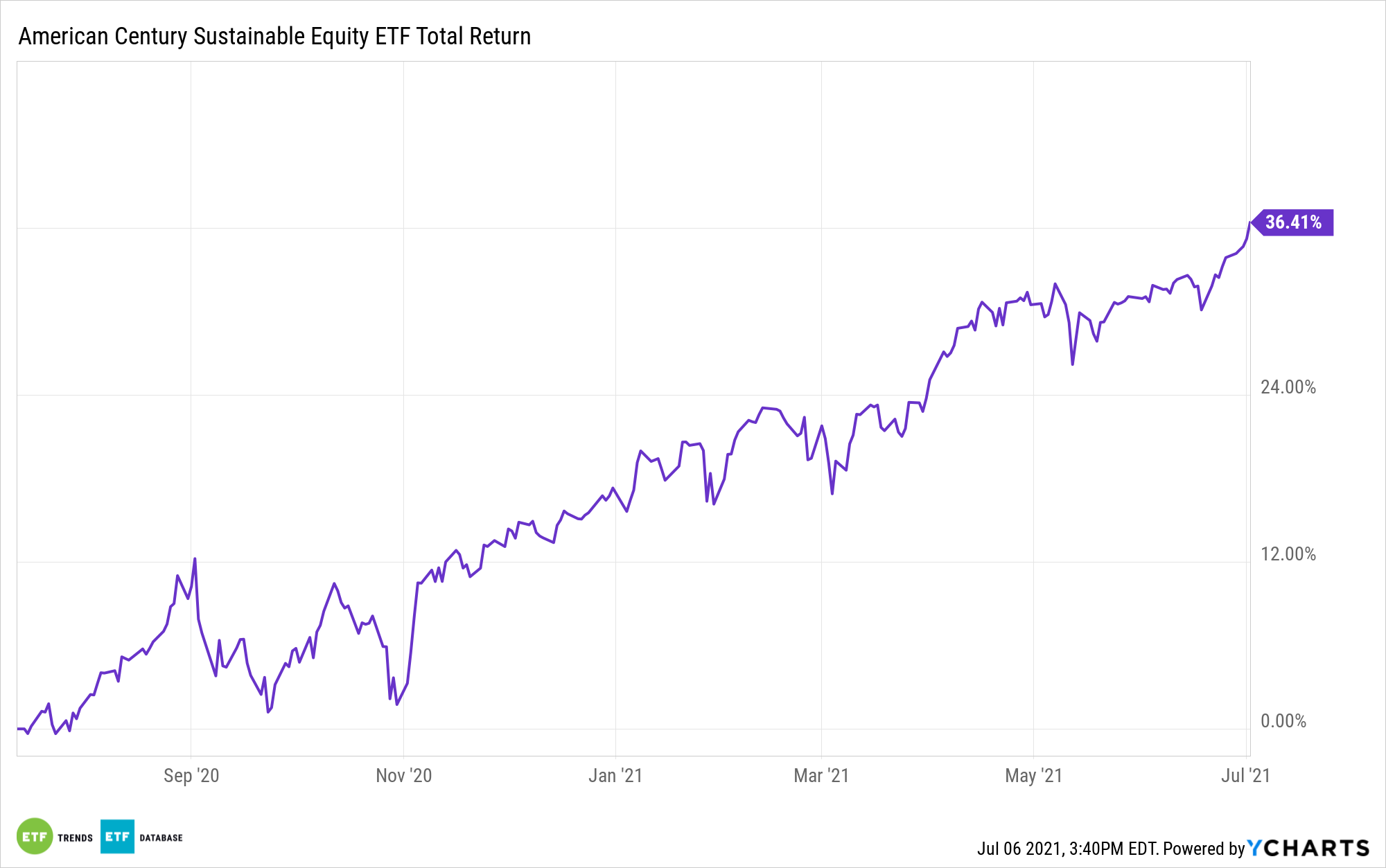

The American Century Sustainable Equity ETF (ESGA) invests in U.S. large cap companies with large growth and value potential that rank highly on ESG metrics.

ACI’s proprietary model assigns a score to each security for financial metrics and a separate score for ESG metrics, then combines them for an overall score.

The highest scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the S&P 500 Index.

The fund is a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last disclosure, ESGA held companies like Alphabet (GOOGL), Home Depot (HD), and Microsoft (MSFT).

ESGA has a total annual fund operating expense of 0.39% and total assets of $149 million.

For more news, information, and strategy, visit the Core Strategies Channel.