The consumer price index increased 6.2% in October, the highest it has been since December 1990, and core inflation, minus food and energy prices, surged 4.6% in its most rapid gain since 1991, reports CNBC.

Prices across all sectors are soaring, with fuel oil prices growing 12.3%, adding up to a 59.1% increase for the entire year. Energy sector prices were up 4.8% and have grown 30% in the last year. Used cars gained 2.5% for the month and 26.4% year-to-date, while new car prices rose 1.4% for the month and 9.8% for the year.

The collective price raises have meant that wages are even further behind now, with the Labor Department calculating real wages post-inflation to be down 0.5% in October from the previous month, taking into account a 0.4% increase in hourly earnings averages.

A final nail in the inflation coffin of last month was the cost of shelter, which makes up a third of what is used to calculate the entire consumer price index, rising 0.5% for the month. It brings the year growth to 3.5% over last year and could be an indicator that inflation is more than just transitory.

“Inflation is clearly getting worse before it gets better, while the significant rise in shelter prices is adding to concerning evidence of a broadening in inflation pressures,” said Seema Shah, chief strategist at Principal Global Investors.

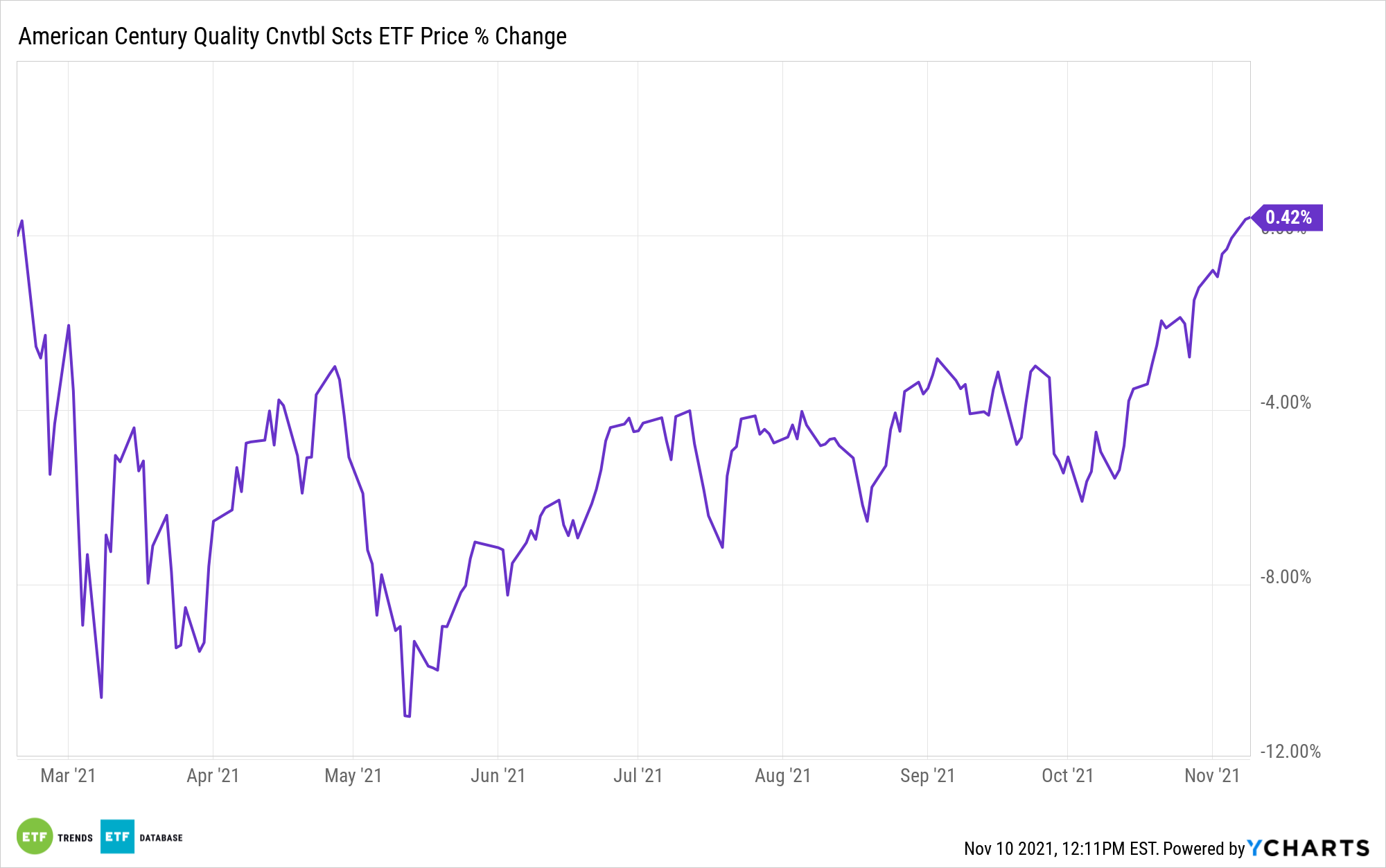

Convertible Bond Funds Perform Well as Inflation Hedges

The American Century Quality Convertible Securities ETF (QCON) is an actively managed convertible bond ETF that uses industry diversification with balanced beta exposure to offer the best risk/return potential for investors.

The fund invests in convertible securities that contain characteristics that are similar to bonds and stocks, and are generally made up of debt securities and preferred stocks that are convertible to common stock or other equity securities, either from the same issuer or a different one, at a specific price and within a certain timeframe.

The portfolio managers use a quantitative and fundamental investment process to select securities based on metrics such as earnings growth, sales, profitability, leverage, price momentum compared to peers, valuation, and yield compared to other convertible securities.

The fund is weighted in a way that balances risk and returns. Convertible securities tend to perform more like stocks when the underlying stock price is high compared to the conversion price, and more like a bond when the underlying stock price is low compared to the conversion price.

QCON has an expense ratio of 0.32%.

For more news, information, and strategy, visit the Core Strategies Channel.