Markets have lost the upward momentum they made on Monday, falling once again yesterday on Omicron fears and Federal Reserve Chairman Jerome Powell’s announcement that the central bank would be considering more rapid tapering at the December meeting, reports CNBC.

The Dow Jones Industrial dropped over 600 points so far, with the S&P 500 losing 1.6% and the Nasdaq falling 1.7% after Powell’s announcement.

The plans to taper faster come amidst new fears from the Omicron COVID variant and travel bans that could further exacerbate supply chain issues. It’s an indicator that the Fed has further shifted its focus from the pandemic to combatting the historic inflation.

“At this point, the economy is very strong and inflationary pressures are higher, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases … perhaps a few months sooner,” Powell said. “I expect that we will discuss that at our upcoming meeting.”

Stocks have been on a rollercoaster ride, with the introduction of Omicron to the world stage causing a panic sell-off on Friday in markets that were then assuaged on Monday by South African doctors reporting that thus far the variant seems fairly mild. Now they have fallen once more with the double hits of Moderna’s CEO sharing that the drop in effectiveness of current vaccines could be significant and that new, targeted vaccines are still months away, as well as Powell’s announcement.

The CBOE volatility index, commonly referred to as VIX and a good gauge of Wall Street’s fear was up once again.

“With the VIX volatility index surging to its highest level in months, it appears investors may be facing several days of outsized market gyrations,” said Jim Paulsen, chief investment strategist for Leuthold Group.

Finding Volatility Protections With Actively Managed LVOL

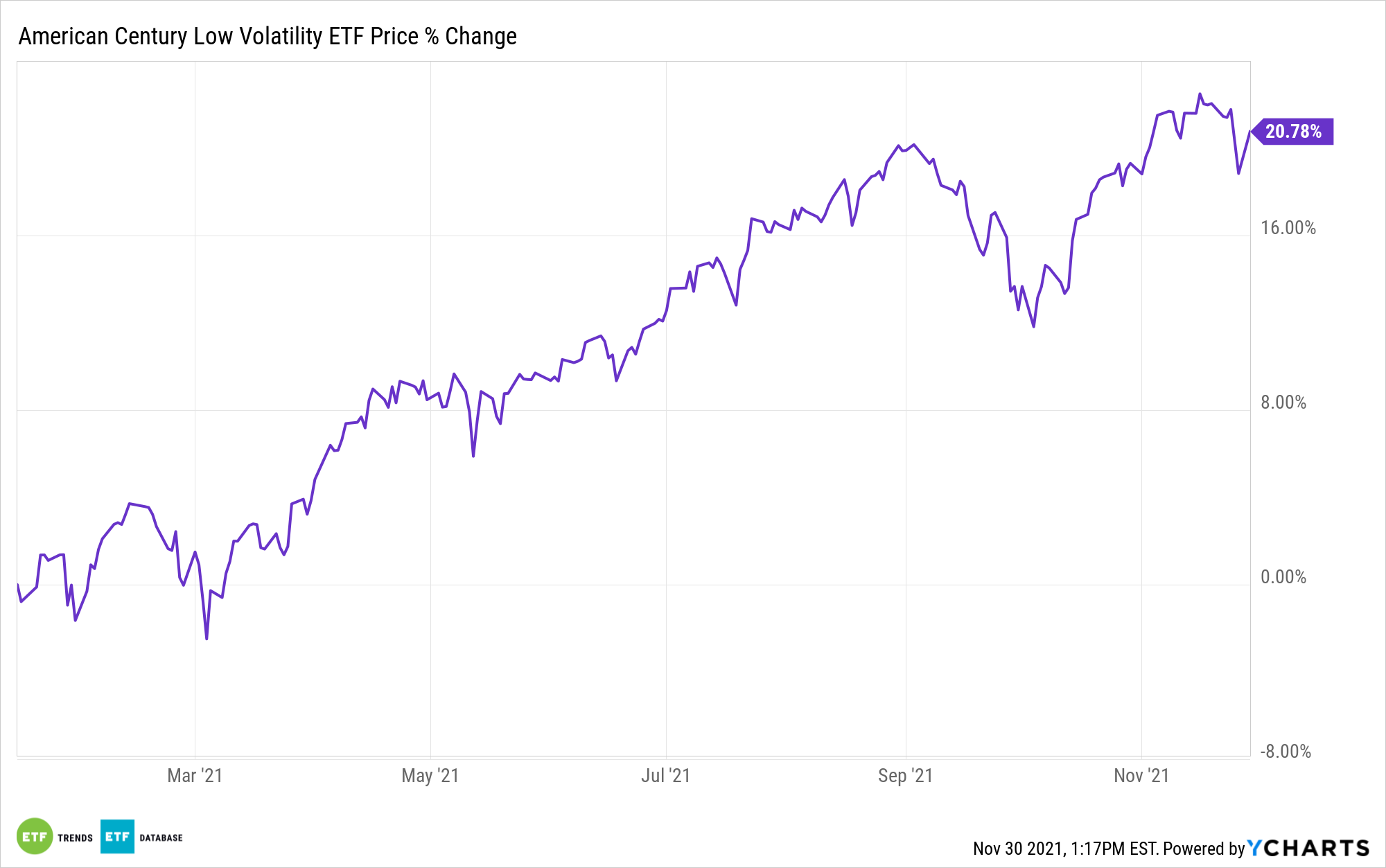

For investors that are fearing volatility and drawbacks, the American Century Low Volatility ETF (LVOL) might be a solution to consider, as it looks to track the market long-term while also offering less volatility, especially in downturns.

LVOL is an actively managed fund that uses the S&P 500 as its benchmark. The fund seeks to offer lower volatility than the overall market by screening for asymmetric, or downside, volatility as well as investing in companies with strong, steady growth.

It not only looks to reduce volatility at the portfolio level, but also in its individual securities. The portfolio managers seek to balance returns with risk management by evaluating the individual securities and their place and performance within their sector and overall.

Securities are sold when they become less viable compared to other opportunities, when the risk becomes greater than the return potential, or when other events that might change their prospects occur. By balancing risks and responding to changing market conditions as they happen, American Century works to capitalize on market liquidity.

LVOL has an expense ratio of 0.29%.

For more news, information, and strategy, visit the Core Strategies Channel.