Growth stocks and related exchange traded funds strengthened on Wednesday after weaker-than-anticipated private payrolls data helped add to hopes that the Federal Reserve would maintain its easy money policy.

Following ahead of the U.S. government’s more comprehensive employment report on Friday, ADP’s jobs report revealed that private employers hired fewer workers than expected in August, Reuters reports.

“Information on inflation with regard to jobs and wages is something that will be an important factor affecting Fed decisions rather than demand and supply side issues, which is why the Friday jobs data will set the stage for the Fed’s September meeting,” Tom Martin, senior portfolio manager at Global Investments, told Reuters.

Meanwhile, updated data on Wednesday also showed that U.S. manufacturing activity unexpectedly rose over August on strong order growth, but a measure of factory employment dipped to a nine-month low, which may be partially attributed to a lack of workers.

While U.S. markets just notched another month of gains, with the S&P 500 on its seventh consecutive monthly winning streak, some have cautioned that markets could become more volatile in the fall season.

“September can be quite a challenging month for risk assets,” Suzanne Hutchins, head of real return investments at Newton Investment Management, told the Wall Street Journal. “Markets are pretty high across the board, valuations are pretty rich.”

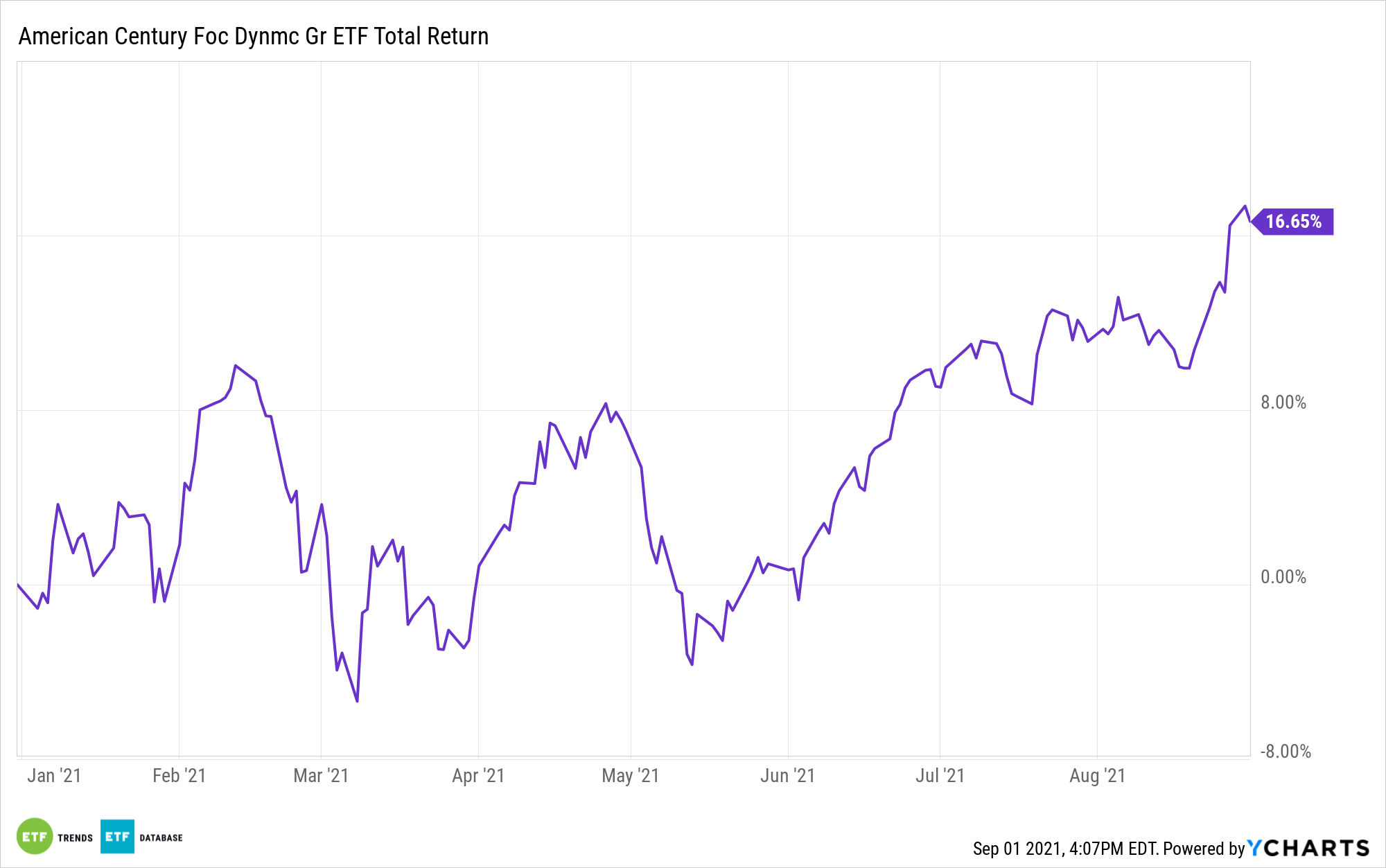

Investors interested in the growth style can turn to targeted strategies like the American Century Focused Dynamic Growth ETF (FDG). FDG is a high-conviction strategy designed to invest in early-stage, rapid-growth companies with a competitive advantage and high profitability, growth, and scalability.

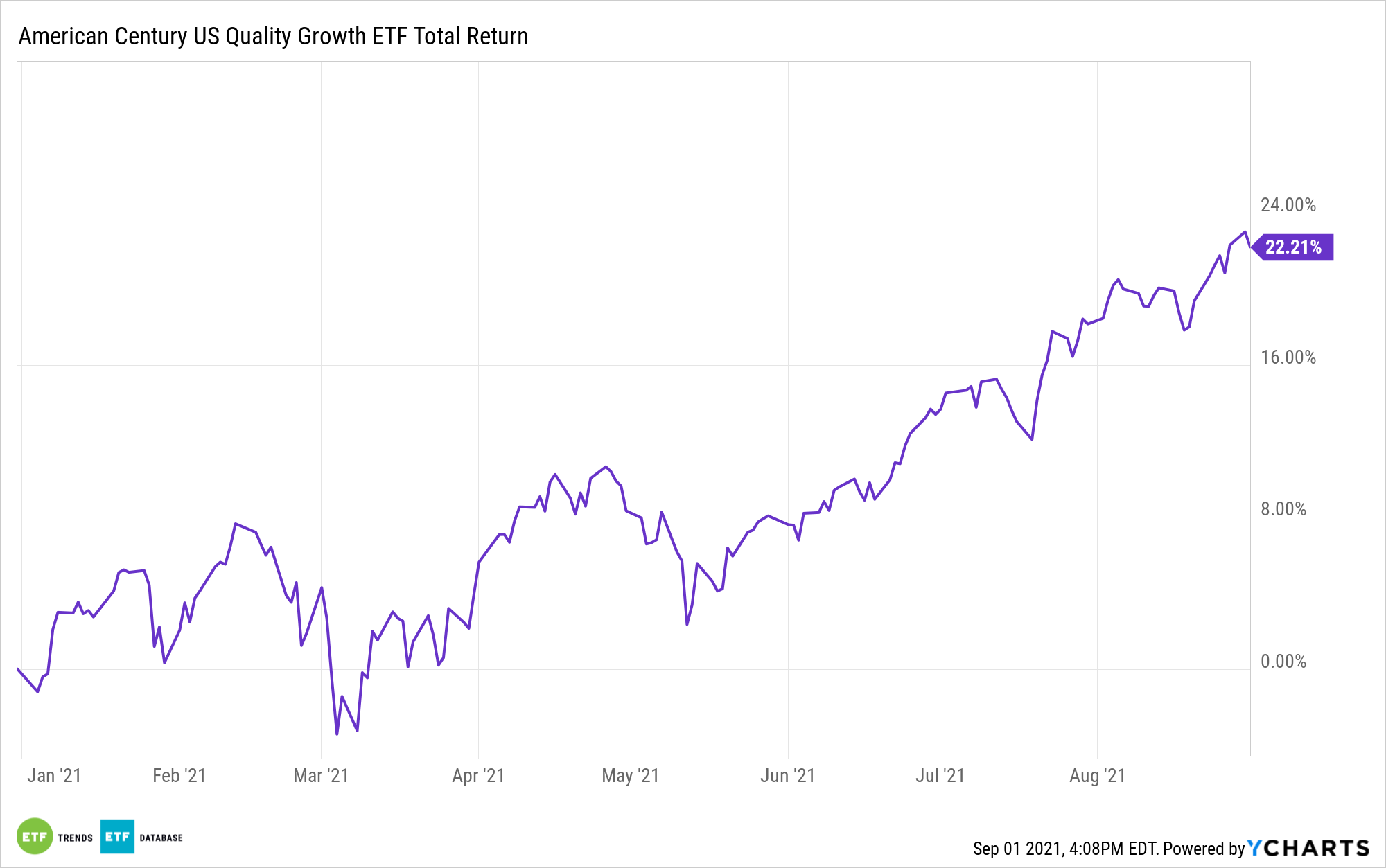

Additionally, investors can look to the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.