Growth stocks and related exchange traded funds rallied on Monday, with the technology sector leading the S&P 500 and Nasdaq to record highs, after the Federal Reserve assuaged fears of a sudden rollback in accommodative measures.

High-growth technology companies typically benefit from expectations of steady economic expansion and a lower-rate environment since their value rests heavily on future earnings.

“On the one hand, the Fed said that it will taper but it will not raise interest rates, which is good for the growth stocks,” Irene Tunkel, chief U.S. equity strategist at BCA Research, told the Wall Street Journal. “On the other hand, people are really worried about Delta.”

Meanwhile, U.S. benchmarks are pushing toward their longest consecutive monthly winning streak since 2018 as the ongoing easy monetary policy outlook helped offset concerns over a slowing economic recovery due to the surge in COVID-19 infections.

Fed Chair Jerome Powell said on Friday that the central bank would maintain its cautious approach to tapering its massive pandemic-era stimulus measures and reaffirmed a steady economic recovery, Reuters reports.

“The market was wholly prepared for a taper timeline last week and the Fed not really commenting has helped give markets an added push on hopes that easy policies will help offset some risks around rising infection cases,” Ross Mayfield, investment strategist at Baird, told Reuters. “Although, if the Fed continues to be so dovish in its policy meetings going ahead, markets might think that there are some problems brewing in the economic recovery process.”

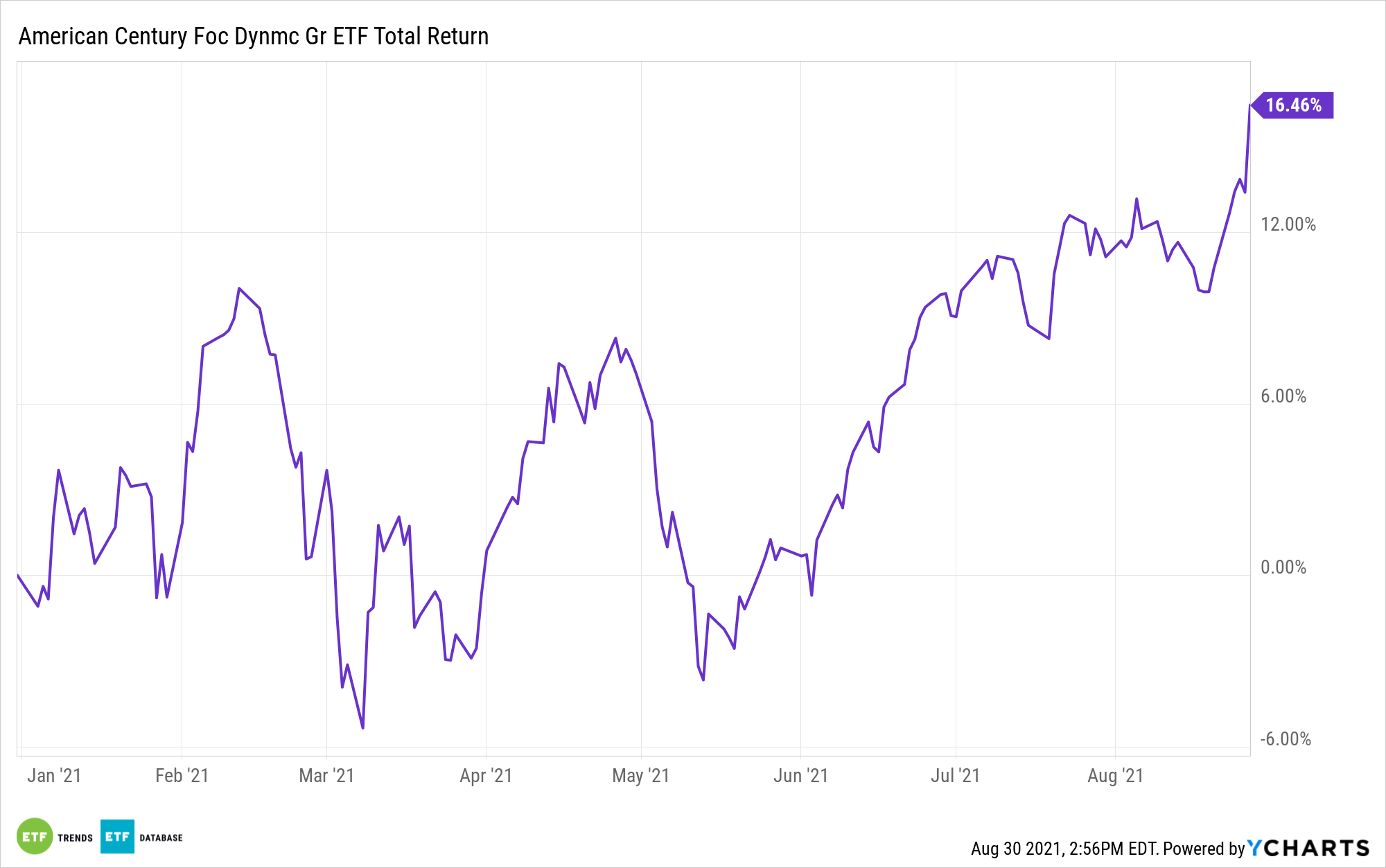

Investors interested in the growth style can turn to targeted strategies like the American Century Focused Dynamic Growth ETF (FDG). FDG is a high-conviction strategy designed to invest in early-stage, rapid-growth companies with a competitive advantage and high profitability, growth, and scalability.

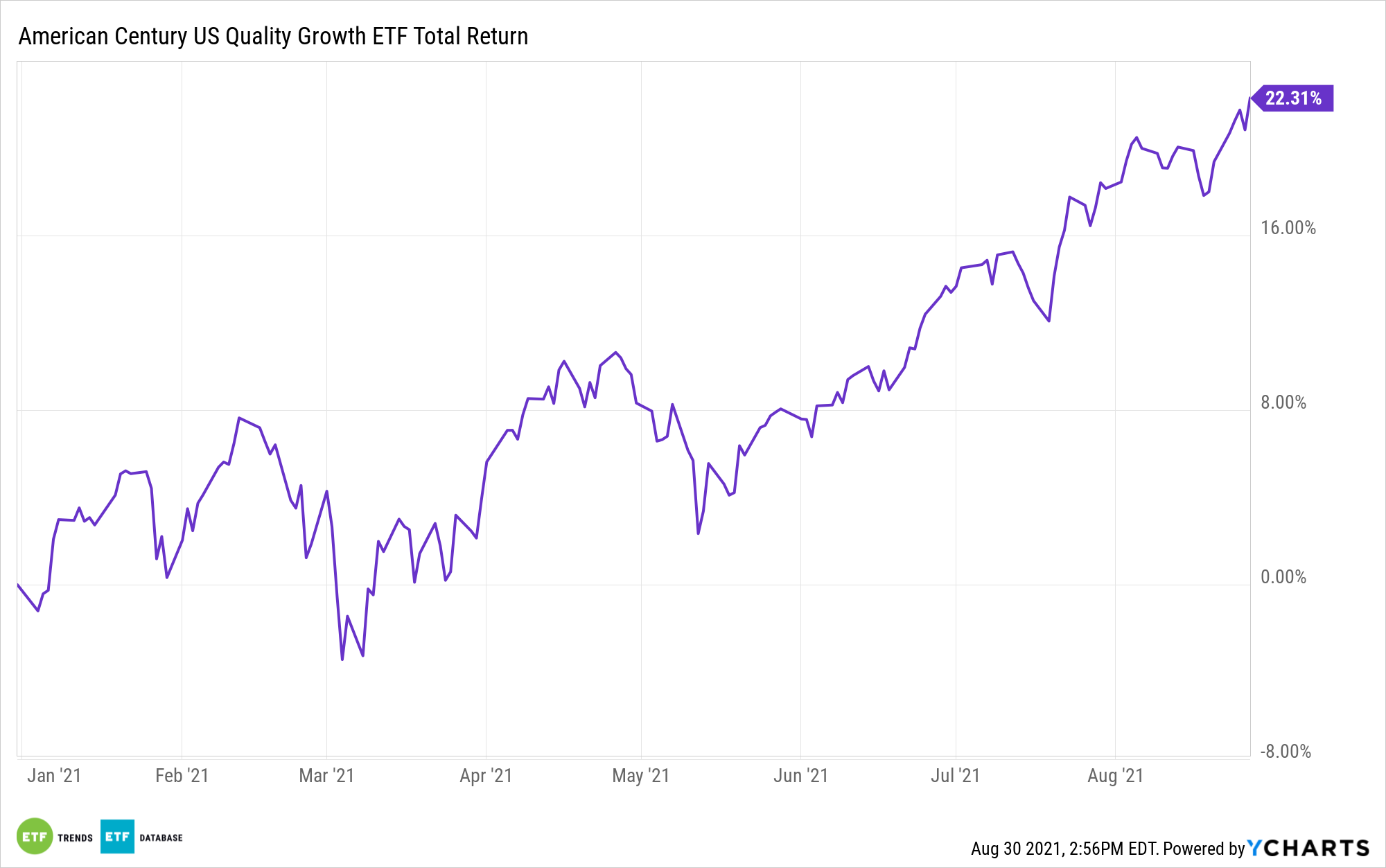

Additionally, investors can look to the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.