By Caleb Sevian

Thought to ponder…

“Your outer world reflects the state of your inner world. By controlling the thoughts that you think and the way you respond to the events of your life, you begin to control your destiny.”

Robin Sharma

The Monk Who Sold His Ferrari, Special 15th Anniversary Edition

The View from 30,000 feet

Going into last week market expectations were that Nvidia’s earrings report and Powell’s speech at Jackson Hole would catalyze a definitive move higher or lower in the U.S. markets. Although both events offered good entertainment value (especially for strategist geeks), neither offered much in terms of groundbreaking news. As expected Nvidia blew out numbers (again), and Powell channeled his inner Volcker (again). In the end, the market action was defined by the troubling upside breakout in global yields which skyrocketed through key technical levels and reenforced consensus views, which rolled over the markets like a dense fog blanketing participants in a veil of acceptance that rates will move higher than expected and stay there for longer than hoped for. The cocktail of rate worries is mixing with increasing de-synchronized global economies, adding to woes. The U.S. and Japan are showings signs of vigor despite rates drifting higher, while Europe and China are each flirting with recessions and looming idiosyncratic deflationary forces.

- Nvidia earnings and the Powell speech at Jackson Hole don’t live up to the hype

- Housing stats that will make you queasy

- The unintended consequences to policy – farewell to innovation

- The most Frequently Asked Question from clients this week: What risks keep you up at night (the labor market, geopolitical turmoil, the U.S. election)?

Nvidia earnings and the Powell speech at Jackson Hole don’t live up to the hype

Nvidia

- Blew away expectations with revenue growing 101% year-over-year, on $13.5b of revenue versus previous company guidance of $11b.

- The beat was driven by data center sales, which were up 171% year over year to $10.3b.

- Nvidia paired the beat with an upgrade of current quarter revenue to $16b.

- The initial reaction of Nvidia’s stock price was a continuation of AI euphoria with the stock jumping 6% in after hours trading, sending Wall Street analyst scrambling raise their price targets, but in the following days the stock drifted lower, eventually closing lower than before the record earnings report.

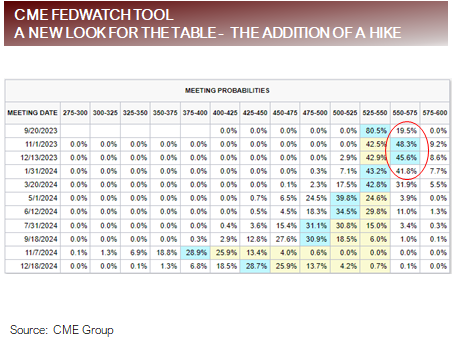

Jackson Hole (Powell remarks that stood out)

- “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

- “…the process still has a long way to go, even with the more favorable recent readings”

- “…food and energy prices are influenced by global factors that remain volatile and can provide a misleading signal of where inflation is headed.”

- “…two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.”

- “Sustained progress is needed, and restrictive monetary policy is called for…”

- “…non-housing services, accounts for over half of the core PCE index…this sector has moved sideways since liftoff… Given the size of this sector, some further progress here will be essential to restoring price stability.”

Bottom Line

- Nvidia briefly lived up to the buildup but faded, and ultimately the stock yielded to being guided by the direction of the broader markets.

- Powell’s speech leaned towards the hawkish side, but in fairness, he said nothing new. His speech was simply the reiteration of points he’s been making over the last 18 months. Occasionally the market listens.

Rising interest rate expectations overshadowed AI frenzy nullify the Nvidia effect

Housing stats that will make you queasy

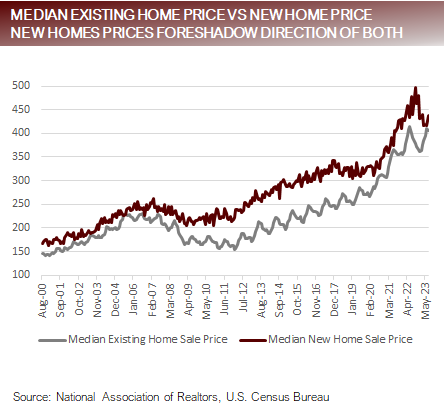

- The median selling price for new home sales and existing home sales are within striking distance of crossing, as existing home prices have held steady and new home prices have collapsed, demonstrating the relative flexibility of builders to adjust price to demand price points. This begs the question of when existing home prices will do the same?

- The average 30-year mortgage hit a new high last week of 7.31%, the highest rates since 2000, but that doesn’t both most people, given that 91% of people have a 30-rate locked in below 5%.

- S. Mortgage Brokers Association reported home purchase applications just dropped to the lowest level since 1995.

- S. July existing home sales fell 2.2% m/m or 16.6% year-over-year to 4.07m units, which on a seasonally adjusted basis, is the lowest since July 2010.

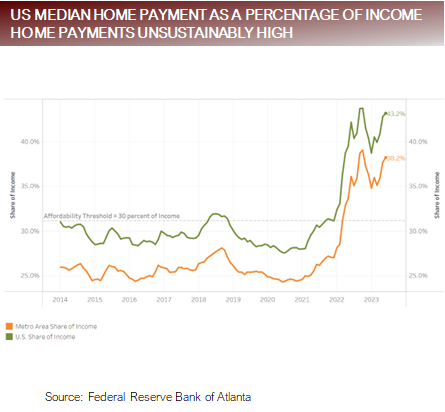

- The average American household would need to spend 43% of their income to afford the median priced home, surpassing the previous peak set in 2006 just before the GFC.

- Home prices have increased 7.6x faster than income since 1965 and 3.1x faster than income since 2008.

- Approximately 90% of major metros have a price to income ratio above the maximum recommended ratio of 2.6x.

Bottom Line

- Sharply higher interest rates have distorted the housing market creating a supply shock, where existing homeowners are unwilling to sell their houses because their 30-year mortgage is the most valuable asset they have. New home builders have stepped into fill the supply void, with pricings for new homes turning sharply lower. The same price weakness will likely need to be seen in the existing home market to clear inventory once it arrives, but since inventory doesn’t exist, the lack of liquidity is masking reliable price discovery.

Imbalances that seem to defy gravity eventually return to earth

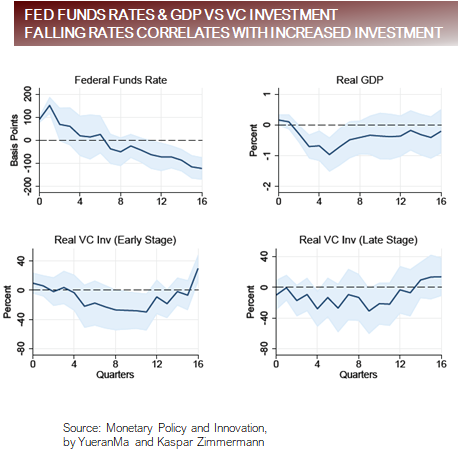

The unintended consequences to policy – farewell to innovation

- One of the foundations of our macro thought process is that policy determines long-term trends in the economy.

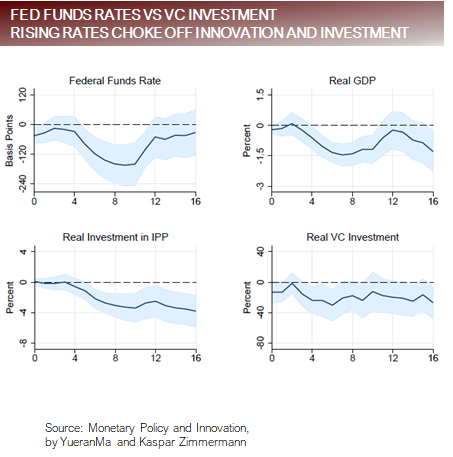

- At Jacksons Hole, a paper was presented titled Monetary Policy and Innovation, by YueranMa and Kaspar Zimmermann. Conclusions of the paper include (statements directly from paper):

- After a tightening shock of 100 basis points, research and development (R&D) spending declines by about 1 to 3 percent and venture capital (VC) investment declines by about 25 percent in the following 1 to 3 years.

- Patenting in important technologies, as well as a patent-based aggregate innovation index, declines by up to 9 percent in the following 2 to 4 years.

- Based on previous estimates of the sensitivity of output to innovation activities, these magnitudes imply that output could be 1 percent lower after another 5 years.

- The economy and the markets are littered with intended, and unfortunately, unintended consequences of policy. The current bout of inflation can directly be traced to unprecedented fiscal and monetary programs during the pandemic (unintended). Drying up of the existing home sales market are a direct result of homeowners being able to lock in rock bottom mortgage rates during the post-pandemic era (unintended). These are obvious unintended consequences. Many unintended consequences are much sneaker and take years or even decades to become apparent. Innovation is an example of sneaky unintended consequence.

Follow the bouncing ball – interest rates have a direct relationship with innovation and investment

FAQ: What risks keep you up at night (the labor market, geopolitical turmoil, the U.S. election)?

Labor Market

- The soft-landing is predicated on controlled weakness developing in the labor markets. The problem with the labor markets is that they operate on feedback loops leading to paths of prosperity or financial turmoil.

- Confidence in employment & rising wags = increased consumer spending = increased demand for goods and services = rising asset prices = increased employment, confidence in employment & rising wages.

Conversely

- Uncertainty in employment & falling wages = decreased consumer spending = reduced demand for goods and services = falling asset prices = reduced employment, uncertainty in employment & falling wages.

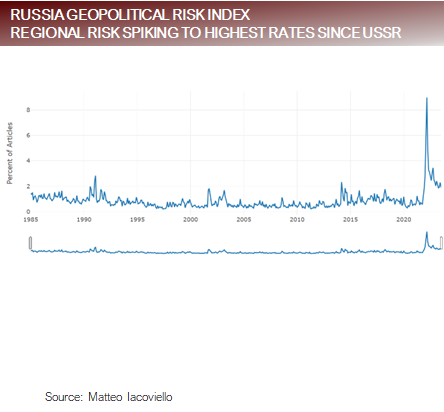

Geopolitical Turmoil

- The apparent assassination of Prigozhin by Putin and the recent increase of hostile rhetoric from the Biden Administration directed specifically at Xi Jinping (Xi was referred to by Biden in a speech as “bad folks” calling China a “ticking timebomb”) are signals of escalating hostilities that have the potential to erupt into geopolitical turmoil that could have dramatic economic consequences.

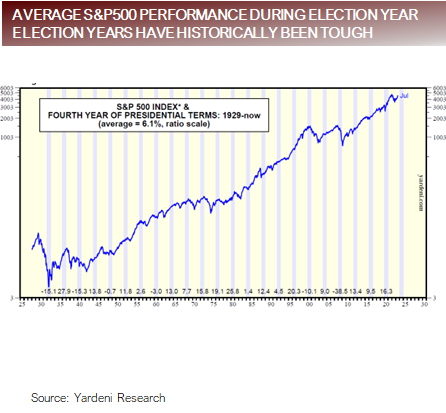

U.S. Election

- Next year is an election year. Historically, election years have been more challenging investment environments. With interest rates at restrictive levels and the average timeframe to a downturn placing the expected most difficult spot in the cycle next year the stars appear to be lining up for fireworks in 2024.

Investors should be opportunistic but not complacent, risks loom large

Putting it all together

- Last week promised to be a tug of war between set off be respective events that highlighted two major themes that have been driving 2023: AI vs Fed Policy. However, there were no fireworks, instead the markets settled into a slog, digesting interest rates that steadily marched higher.

- We are in a seasonally challenging period for the markets, with August through October, historically providing lower returns than average months. Add to this interest rates breaking technical levels to new cycle highs and over bought equity positions coming into the month and it’s no wonder each week this month has felt like a struggle.

- With the economy still accelerating driving earnings momentum, there is a plausible a glide path to stronger markets in the near-term once seasonal challenges and indigestion from higher rates passes.

- Investors should not be complacent. The Fed is basing decisions on data as it is reported, not forecasts of the impacts of higher rates. This means they are looking in the rearview mirror while driving forward. There is a real risk that at some point higher rates will catch like spinning wheels grabbing the pavement with sudden traction and the economy will lurch into a slowdown.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected]

Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or website are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied. FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.

For more news, information, and analysis, visit the Core Strategies Channel.