In times like these, investors can limit portfolio drawdowns by diversifying with fixed income exchange traded funds.

While the equity markets pulled back, investors turned to safe havens, purchasing bonds and pulling yields on Treasuries down.

Economic reports have reflected an economy that is recovering from the coronavirus pandemic, but traders have been betting on even more aggressive growth. However, Michael Gayed, a portfolio manager and author of the Lead-Lag Report newsletter, warned that the dynamic is starting to unravel, the Wall Street Journal reports.

“The market is going to start to wake up to the fact that the reflation narrative that’s been sold has probably been overbought,” Gayed told the WSJ. “It could be a nasty situation.”

Nadège Dufossé, head of cross-asset strategy at Candriam, warned that stocks are likely to be volatile and could experience a 10% correction.

Investors looking to strengthen their fixed income strategies can look to the Avantis Core Fixed Income ETF (AVIG), which invests in a broad set of debt obligations across sectors, maturities, and issuers. AVIG pursues the benefits associated with indexing, such as diversification and transparency of exposures. Yet the fund also has the ability to add value by making investment decisions using information embedded in current yields.

The Avantis Core Fixed Income ETF’s investment process uses an analytical framework, which includes an assessment of securities’ expected income and capital appreciation, to seek securities with high expected returns.

The Avantis Short-Term Fixed Income ETF (AVSF) also invests primarily in investment grade quality debt obligations from a diverse group of U.S. and non-U.S. issuers with a shorter maturity.

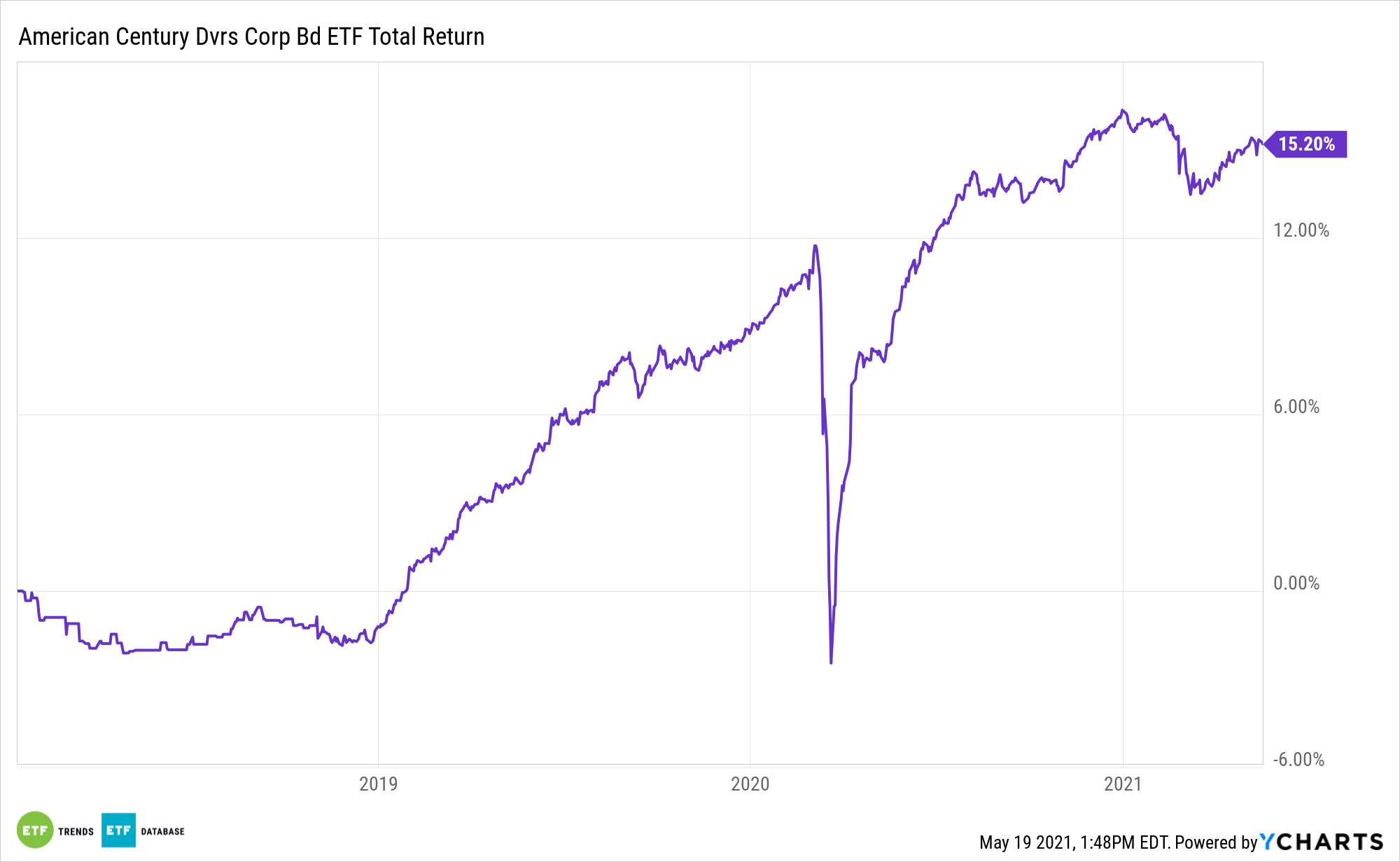

Finally, the actively managed American Century Diversified Corporate Bond ETF (NYSEArca: KORP) invests in U.S. dollar-denominated corporate debt securities issued by U.S. and foreign entities, but may also hold securities issued by supranational entities. Up to 35% of the fund’s net assets may be invested in high-yield securities or junk bonds. The fund may also invest in derivative instruments such as futures contracts and swap agreements. The weighted average duration of the fund’s portfolio is expected to be between three and seven years.

For more news, information, and strategy, visit the Core Strategies Channel.