The shift to value continues, as the Dow Jones Industrial Average hit a record high on Monday while the technology-heavy Nasdaq slipped. Investors can play the ongoing value shift through targeted exchange traded funds.

The materials sector rose to a record high after miners and makers of steel products rallied on the record-setting run in gold, copper, and aluminum, Reuters reports.

Meanwhile, energy stocks advanced to their highest in over a year after a ransomware cyber attack on the top U.S. pipeline operator, Colonial Pipeline, halted a fuel network that transfers almost half of the East Coast’s energy supply.

Meanwhile, economic data showed that the U.S. economy is not recovering at the rapid clip that was previously projected. Inflation numbers and retail sales data this week could guide the next leg in the U.S. equity rally.

“Inflation data is pretty important from a market leadership perspective,” Keith Parker, head of U.S. and global equity strategy at UBS, told Reuters. “The number should come in strong, and probably contribute to another leg in the reflation value rotation.”

After the strong rally, some money managers are concerned that stock valuations are elevated.

“Markets have come quite a long way and gone up a lot in a relativity straight line,” Mike Bell, global market strategist at J.P. Morgan Asset Management, told the Wall Street Journal. “So the hurdle for further gains becomes higher.”

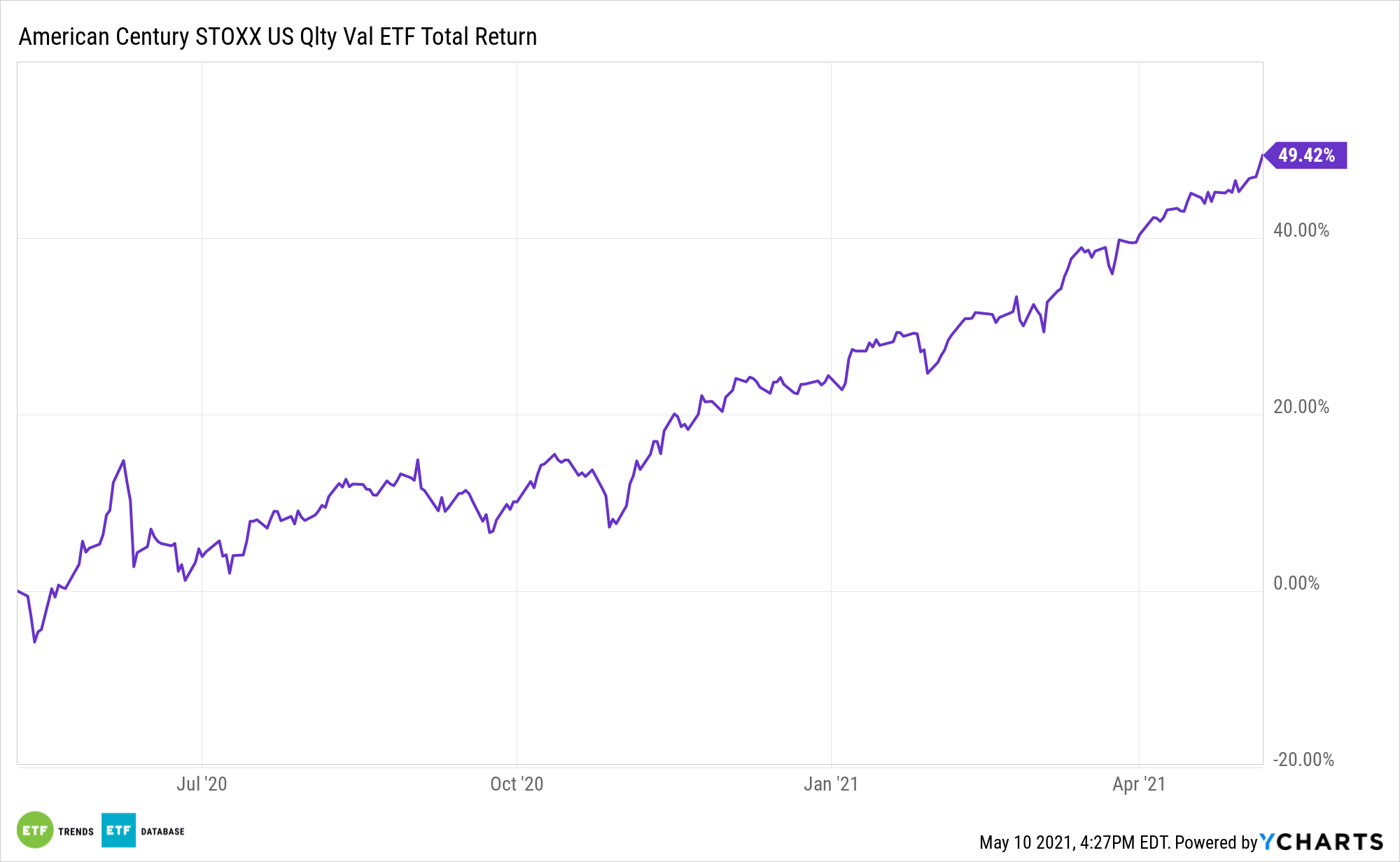

Investors who are interested in a targeted approach to the value segment can look to the American Century STOXX U.S. Quality Value ETF (NYSEArca: VALQ). VALQ’s stock selection process includes a value score based on value, earnings yield, and cash flow yield, along with a sustainable income score based on dividend yield, dividend growth, and dividend coverage.

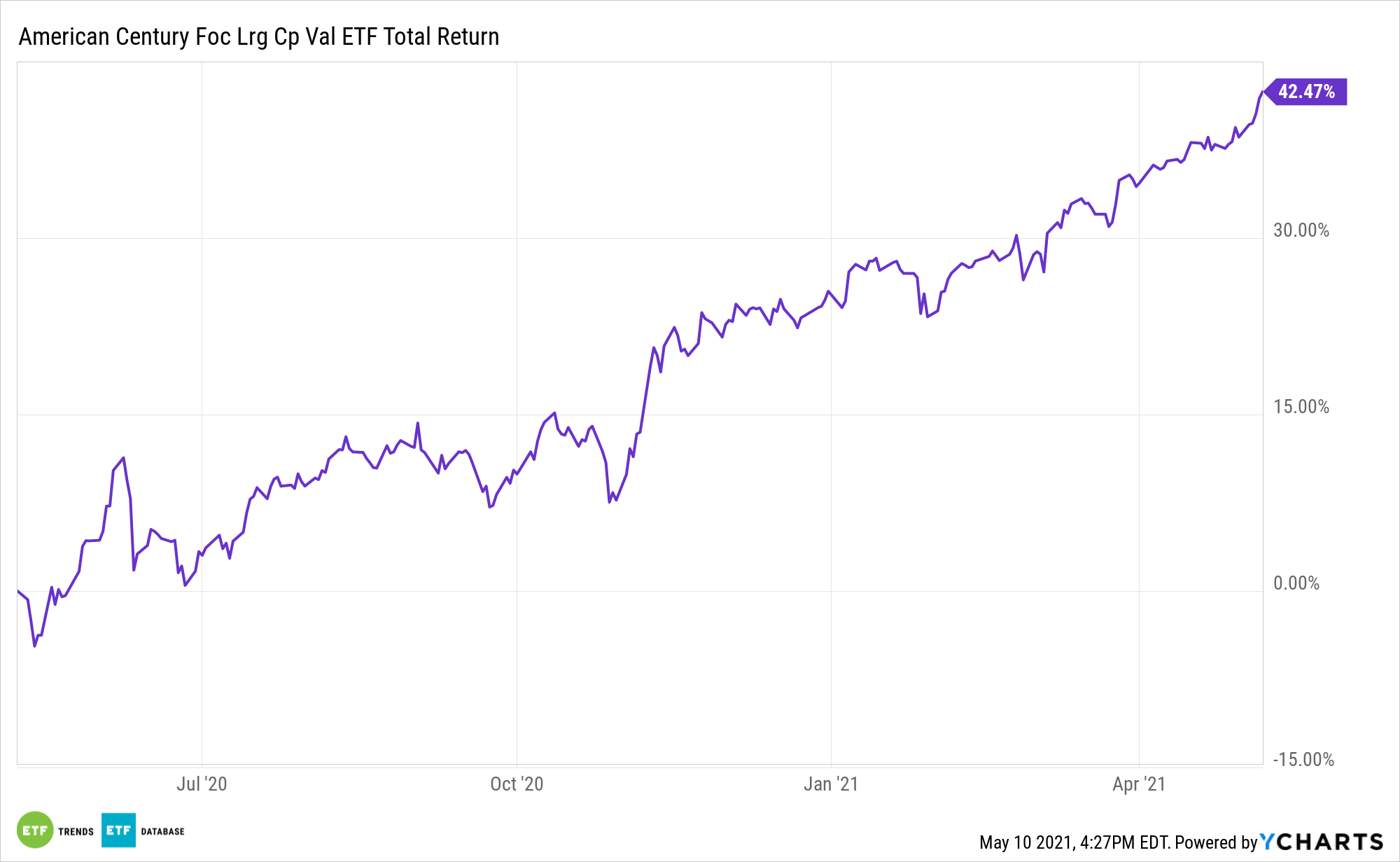

The American Century Focused Large Cap Value ETF (FLV) tries to achieve long-term returns through an investment process that seeks to identify value and minimize volatility. FLV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets.

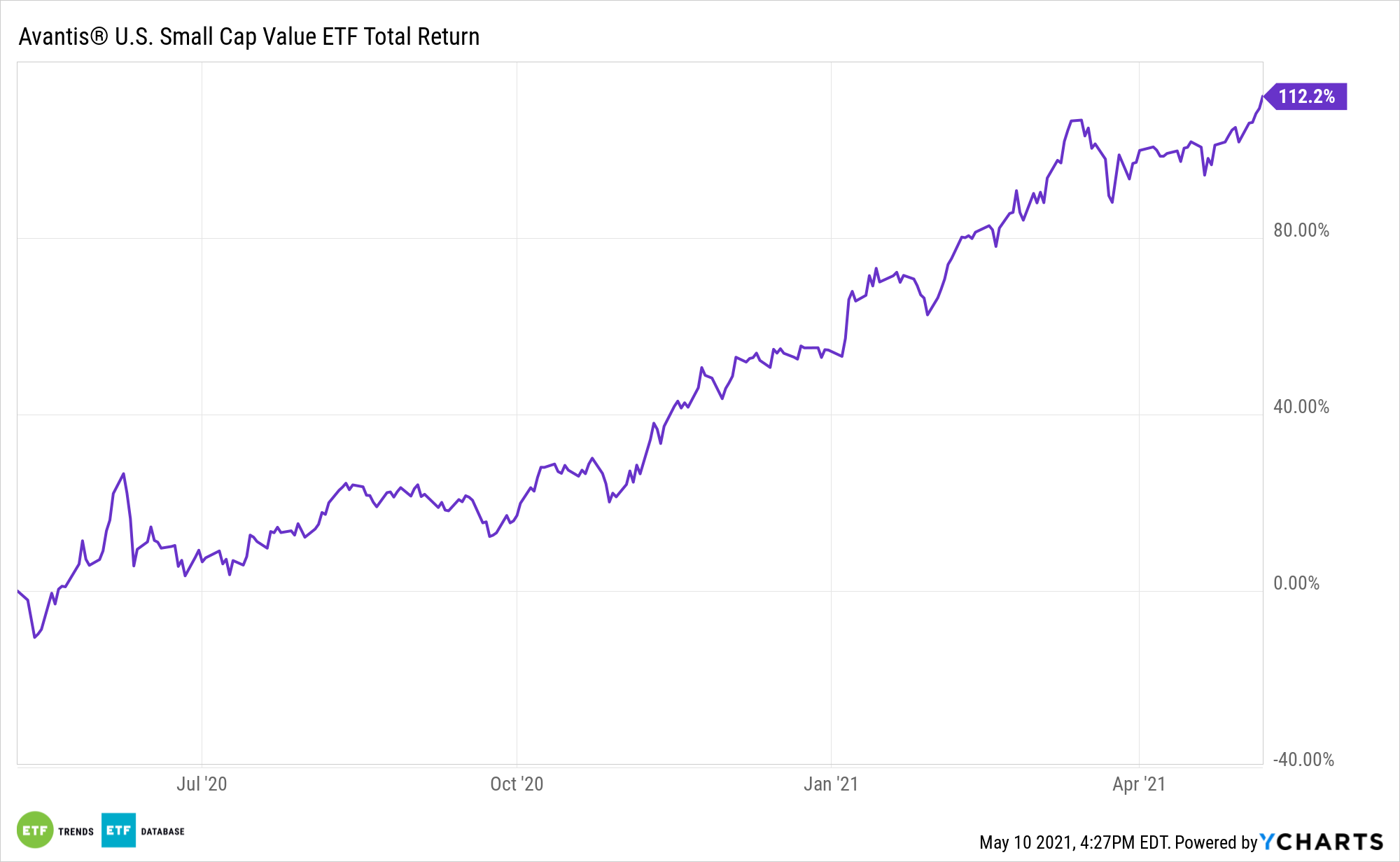

Additionally, the Avantis U.S. Small Cap Value ETF (AVUV), an actively managed ETF, seeks long-term capital appreciation. The fund invests primarily in U.S. small cap companies and is designed to increase expected returns by focusing on firms trading at what are believed to be low valuations with higher profitability ratios.

For more news, information, and strategy, visit the Core Strategies Channel.