International stock exchange traded funds strengthened on Monday after European markets ended higher, breaking a five-day losing streak.

The pan-European STOXX 600 index was higher after dipping to a three-week low last week, Reuters reports.

Meanwhile, Asian stocks weakened further, following news of another round of regulatory crackdowns on Chinese firms.

Global markets have been under pressure after enjoying months-long gains. Traders are now worried about inflation, COVID-19 restrictions in Asian economies, China’s regulatory uncertainty, and bets that central banks could begin rolling back accommodative pandemic-era stimulus.

Nevertheless, European investors were assuaged after the European Central Bank last week upwardly revised its growth and inflation outlook for the year and beyond, pointing to the faster-than-expected Eurozone economic recovery.

“While we are used to seeing US markets lead the way, there is a feeling that we could see greater catch-up for Europe as high vaccination levels keep deaths relatively stable,” Joshua Mahony, senior market analyst at IG, told Reuters.

Markets will be watching for U.S. consumer prices data on Tuesday to gauge the inflation outlook after rising producer prices last week fueled doubts about the U.S. Federal Reserve’s transitory inflation spike.

“Some central bankers will have you believe they are happy to hold back on tightening for now, we are seeing very clear signs that this spike in inflation is far from fleeting,” Mahony added.

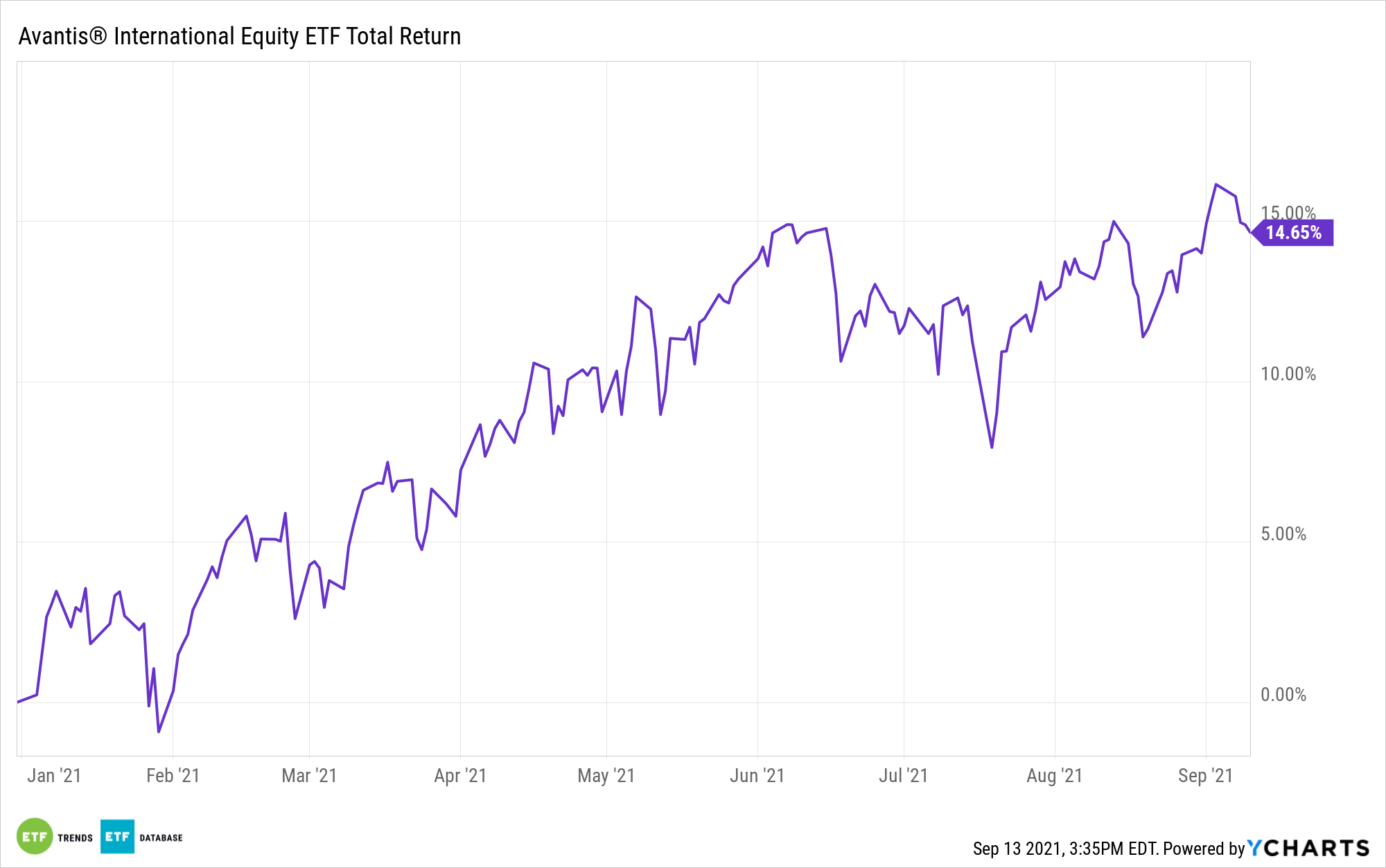

Investors interested in international markets can consider ETF strategies for foreign exposure. For example, the Avantis International Equity ETF (AVDE) is built upon an academically-supported, market-tested framework to identify securities with expected high returns based on market prices and other company information. Relying on trading and portfolio management processes, the Avantis team analyzes whether the perceived benefits of a trade overcome its associated costs and risks. AVDE primarily invests in a diverse group of companies of all market capitalizations across non-U.S. developed market countries, sectors, and industries, emphasizing investment in companies believed to have higher expected returns.

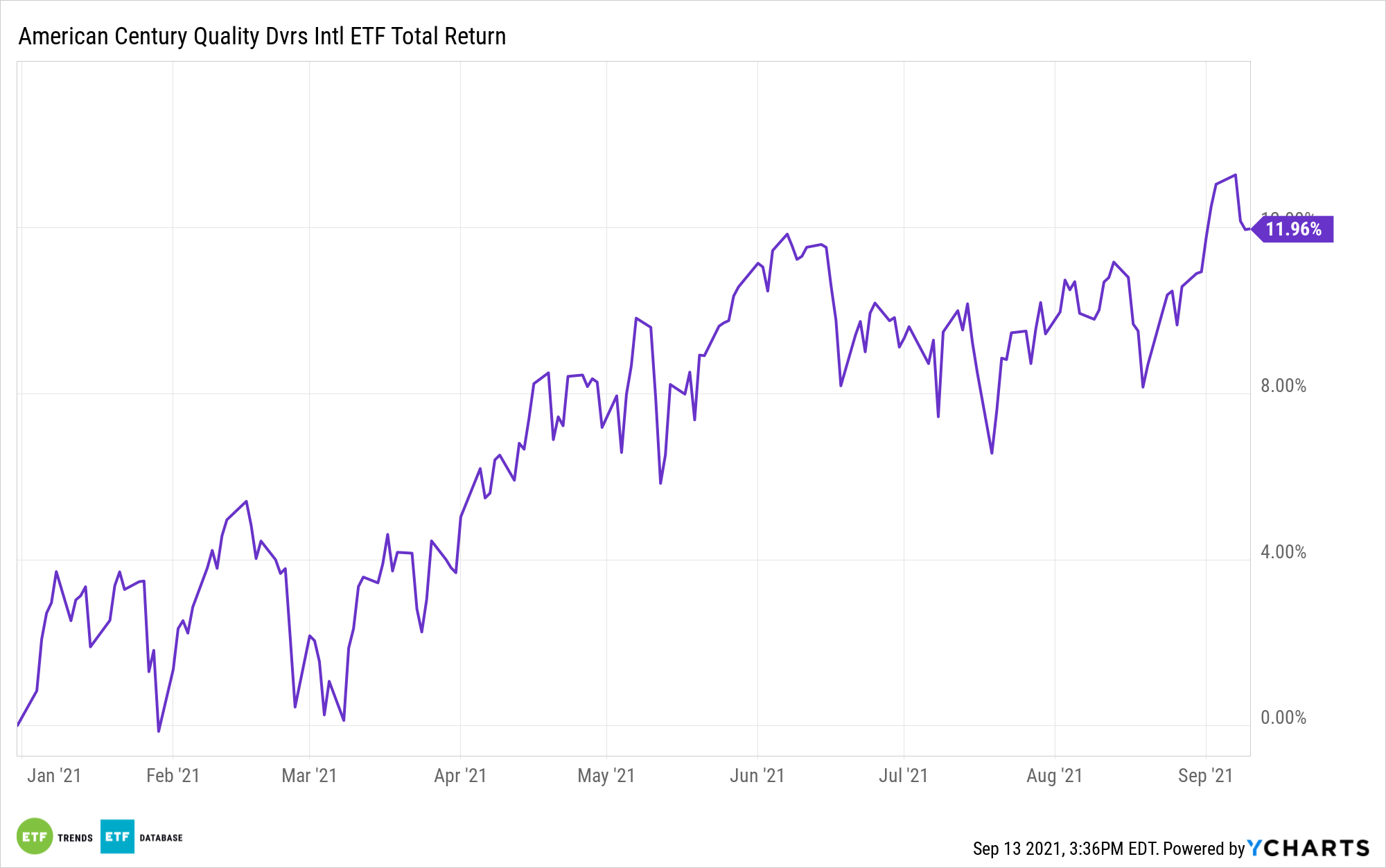

Additionally, the American Century Quality Diversified International ETF (NYSEArca: QINT) utilizes the American Century Investments Intelligent Beta methodology, which systematizes many of the same attributes that fundamental research and security selection seek to identify in a rules-based, indexed approach. QINT is a large foreign blend fund that seeks to enhance core international exposure. Its rules-based approach analyzes each stock’s quality, growth, and value characteristics to select individual securities. It also dynamically adjusts exposures to take advantage of prevailing market conditions.

For more news, information, and strategy, visit the Core Strategies Channel.