Source: New York Life Investments Multi-Asset Solutions team, Bloomberg, S&P, Bureau of Economic Analysis As of 10/15/19.

Unsurprisingly, small-cap earnings are fading. Reported profits are down nearly 9% on a trailing basis – the worst decline of this cycle. We expect declines to continue based on current economic fundamentals.

The Fed is lowering rates, won’t that help?

We are skeptical that lower interest rates will be able to further support equity valuations or spur a significant pickup in growth. This is in part because interest rates are already low, and because we don’t expect bond yields to fall significantly further without a catalyst. That means that any weakness in forward S&P 500 is likely to prompt a decline in the index’s price to earnings ratio.

Bottom line

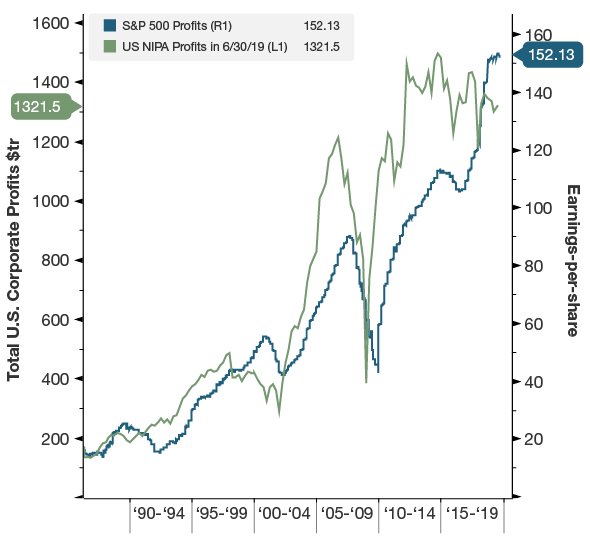

Investors’ continued optimism about corporate earnings for the S&P 500 doesn’t fit with our take on the weak global economic picture and the broader late cycle corporate profit trends. This is the key reason why we continue to think U.S. equities will face more trouble before the end of the year.

In our portfolios we have reduced equity exposure, favoring investments less exposed to wage pressures, global trade disruption, and manufacturing weakness. These investments tend to be in defensive (non- cyclical) sectors. They also tend to be higher in quality with strong balance sheets and stable earnings growth.

This material represents an assessment of the market environment as at a specific date; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

“New York Life Investments” is both a service mark, and the common trade name, of the investment advisors affiliated with New York Life Insurance Company.