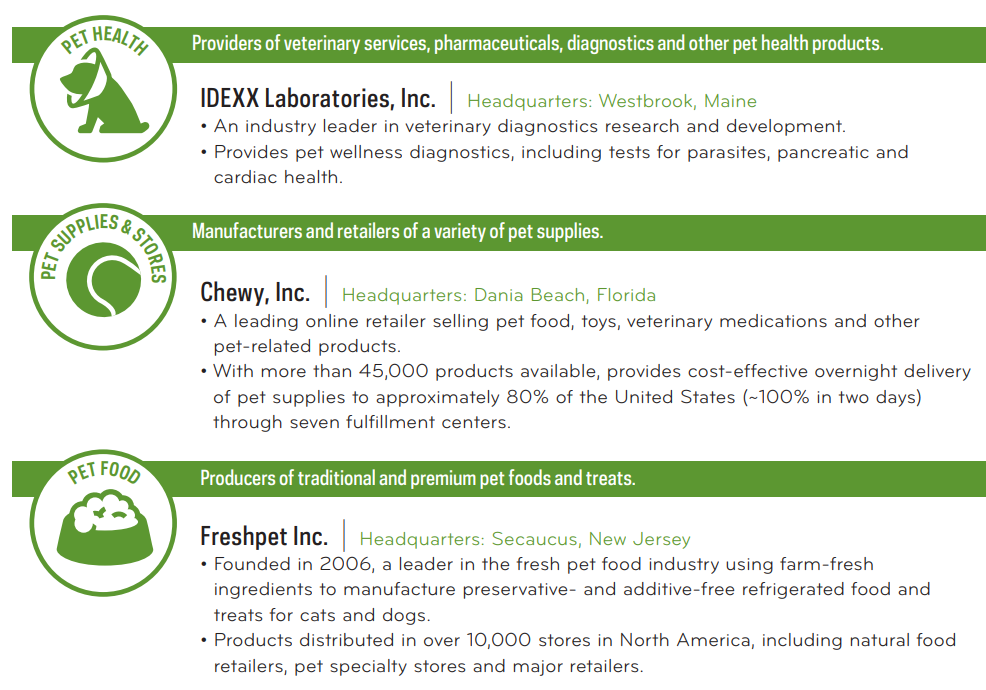

Pets today are more than companions—they are part of the family. And caring for them is big business. Global pet care industry sales are expected to grow to over $200 billion annually by 2025. The companies driving this extraordinary growth typically fall into one of several broad categories: pet health, pet supplies and stores, or pet food. Who are some of these companies and what kind of services do they provide? Let’s take a look.

About PAWZ and the FactSet Pet Care Index

The ProShares Pet Care ETF (PAWZ) is the first ETF focused on the pet care industry. It invests in companies that potentially stand to benefit from the proliferation of pet ownership and the emerging trends affecting how we care for our pets.

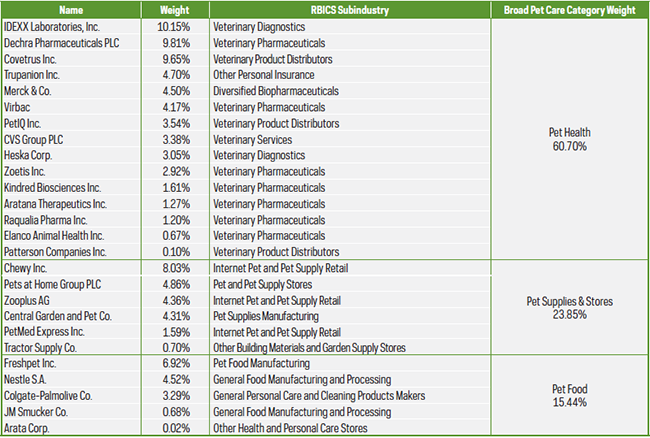

PAWZ follows the FactSet Pet Care Index™. The index consists of U.S. and international companies whose principal revenue comes from one of eight FactSet Revere Business Industry Classification subindustries (“RBICS”), or companies who generate at least $1 billion in annual revenue from an RBICS subindustry, or who are identified by FactSet as pet care related businesses.

FactSet Pet Care Index Holdings

The FactSet Pet Care Index gives investors the opportunity to gain broad exposure to public companies in the global pet care industry.

Index constituents as of 6/30/2019. Subject to change. PAWZ intends to hold securities in approximately the same proportion as the index, but there is no guarantee it will. View the complete list of PAWZ’s daily holdings.

Fetch more information about PAWZ. Learn more about the pet care industry.

Disclosure:

Data: American Pet Products Association 2017-2018 National Pet Ownership Survey (68% of U.S. households have pets, spending since 2001, GDP); Grand View Research ($200 billion market); “Fewer Babies, More Pets? Parenthood, Marriage, and Pet Ownership in America” (55 million in five years); Deal Hound Pet Report Q2:2018 (M&A activity); American Pet Products Association 2017-2018 Survey and ProShares (GDP). Company information sources: zoetis.com; todaysveterinarybusiness.com; thebalance.com; cnbc.com; investors.freshpet.com; zooplus.com; seekingalpha.com.

Any forward-looking statements herein are based on expectations of ProShares at this time. Whether or not actual results and developments will conform to ProShares’ expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions, changes in laws or regulations or other actions made by governmental authorities or regulatory bodies, and other world economic and political developments. ProShares undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing involves risk, including the possible loss of principal. This ProShares ETF is non-diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Investments in smaller companies typically exhibit higher volatility. Smaller company stocks also may trade at greater spreads or lower trading volumes, and may be less liquid than stocks of larger companies. The fund is subject to the risks faced by companies in the pet care industry. Although the pet care industry has historically seen steady growth and has been resilient to economic downturns, these trends may not continue or may reverse. Please see the summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing. Obtain them from your financial advisor or broker-dealer representative or visit ProShares.com.

The “FactSet Pet Care Index” and “FactSet” are trademarks of FactSet Research Systems Inc. and have been licensed for use by ProShares. ProShares have not been passed on by these entities or their affiliates as to their legality or suitability. ProShares based on the FactSet Pet Care Index are not sponsored, endorsed, sold, or promoted by FactSet Research Systems Inc., and it makes no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES. FactSet Research Systems Inc. does not guarantee the accuracy and/or the completeness of the FactSet Pet Care Index or any data included therein, and FactSet Research Systems Inc. shall have no liability for any errors, omissions, or interruptions therein.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.