U.S. markets and stock exchange traded funds plunged Wednesday, giving up the gains in the previous session, as fears of an economic recession mount.

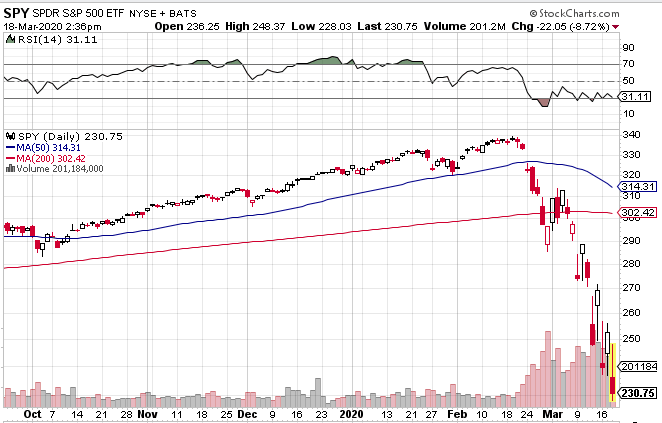

On Wednesday, the Invesco QQQ Trust (NASDAQ: QQQ) decreased 7.5%, SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA) fell 10.4%, and SPDR S&P 500 ETF (NYSEArca: SPY) dropped 8.7%.

A broad selloff in both stocks and bonds Wednesday pointed to growing demand among investors for cash to cope with the potential economic weakness in face of the coronavirus pandemic, the Wall Street Journal reports.

“We’re going to have massive disruption and dislocation in our economy,” Keith Bliss, managing partner at iQ Capital, told Reuters. “People are conflating what’s going on with the coronavirus with what happened in the global financial crisis.”

The selling has even affected the once safe-haven U.S. Treasuries market, with one-month U.S. bills briefly turning negative for the first time since 2015. Peter Boockvar, chief investment officer at Bleakley Advisory Group, argued that the selling in government debt reflects a changing market mentality.

“Now that they’ve gotten around to U.S. Treasurys, that tells you that legitimately nothing is safe,” Boockvar told the WSJ. “There’s no place to hide other than cash.”

The number of coronavirus or COVID-19 infections globally crossed 200,000, or more than doubling in two weeks. Governments around the world are asking citizens abroad to come home and those already at home to stay there in a bid to contain the contagion.

“It’s happening so fast, it’s almost too much to grasp at this point,” Frank Cappelleri, the executive director at Instinet, told the WSJ. “It’s at the point where if you check the futures at nighttime and you’re not limit down, it’s a relief.”

SPDR S&P 500 ETF

For more information on the markets, visit our current affairs category.