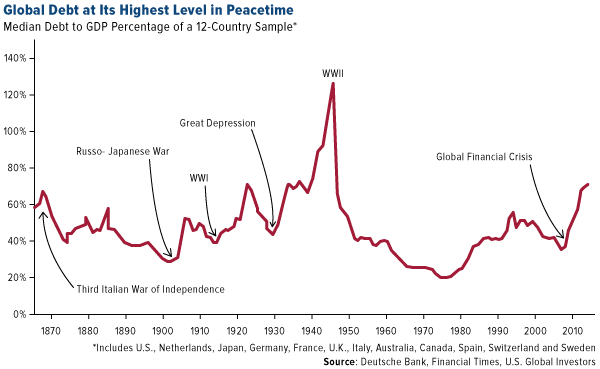

Jim Reid, the report’s lead author, warns that we may see central banks continue the sort of unconventional market interventions that have propelled record levels of borrowing in the first place.

“The multi-trillion dollar question is whether governments can successfully and consistently issue the holy grail of funding—zero-coupon perpetual bonds. If they can do that, spend the money, and central banks buy the bonds, then that is pure helicopter money,” Reid writes.

In its simplest terms, “helicopter money” refers to a rapid surge in money-printing, the hope being that it will spur economic output.

An inevitable consequence of this, of course, is runaway inflation. See: Weimar Germany, Zimbabwe and, more recently, Venezuela.

WGC: Gold Is Still Under-Represented

I see gold as a solution to many of the issues I’ve laid out, whether it’s recessionary spillover from Germany, high debt levels or helicopter money.

I’m not alone in thinking this. In a September report, the World Gold Council (WGC) calls the yellow metal “the most effective commodity investment,” adding that “allocations of 2 percent to 10 percent in a typical pension portfolio have provided better risk-adjusted returns than those with broad-based commodity allocations.”

However, the WGC says, gold is under-represented in most commodity indices, meaning investors are underexposed.

“Investors who access commodities via a broad-based index often assume they have an appropriate allocation to gold. In fact, most broad-based commodity indices have a very small allocation,” the WGC analysts write.

Consider the S&P GSCI, which tracks 24 commodities. West Texas Intermediate (WTI) oil and Brent oil make up nearly half of the index with a combined weighting of 45 percent. Gold, meanwhile, represents only 3.73 percent of the index.

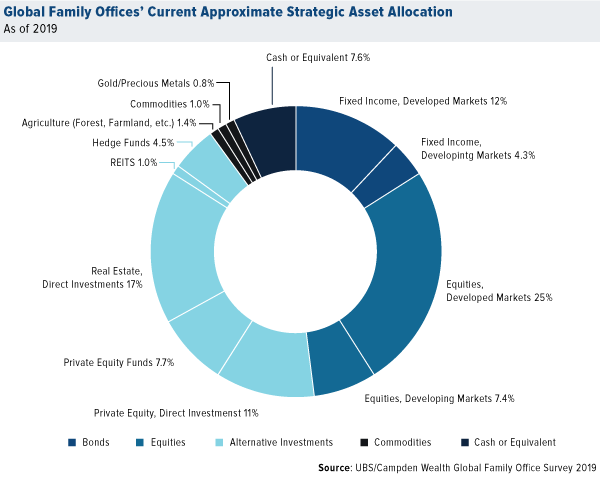

This underexposure can be seen in a recent review of global family offices’ asset allocations. UBS’ Global Family Office Report 2019, released this week, shows that gold represents as little as 0.8 percent of portfolios on average. Equities in developed markets are the top position, representing a full quarter of portfolios, but some managers say they are trimming their exposure in preparation for a potential recession. A full 55 percent of family offices believe a recession will make landfall by 2020, according to the study.

The good news is that, of the 360 family offices surveyed—which collectively manage approximately $5.9 trillion—17 percent said they were planning to increase their gold position in 2020. More than three quarters said they were keeping it the same. Only 5.3 percent said they would be decreasing their exposure.

Increasing their gold exposure, I believe, would be rational and prudent at this time. As I told Kitco News’ Daniela Cambone at last week’s Denver Gold Forum (DGF), the longer yields stay negative around the world, the better the chances are of gold rocketing up to $10,000 an ounce. You can watch the entire interview by clicking here.