Long-term corporate bond exchange traded funds were among the best performers on Monday after the Federal Reserve revealed an unprecedented bond purchasing program targeted at corporate debt in its latest bid to support an ailing economy that is suffering from a coronavirus pandemic.

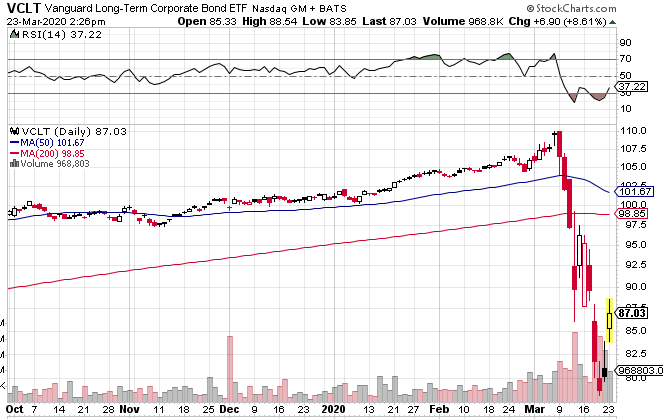

Among the best performing non-leveraged ETFs of Monday, the Vanguard Long-Term Corporate Bond ETF (NYSEArca: VCLT) jumped 8.6%, the iShares Long-Term Corporate Bond ETF (NYSEArca: IGLB) advanced 8.4% and SPDR Portfolio Long Term Corporate Bond ETF (SPLB) increased 7.9%. Meanwhile, the more widely observed iShares iBoxx $ Investment Grade Corp Bond ETF (NYSEArca: LQD) rose 6.9%.

The Federal Reserve has for the first time started buying corporate debt in an attempt to support credit markets. The central bank revealed it would launch two credit facilities to back corporate credit markets, a Primary Market Corporate Credit Facility for new bond and loan issuances and a Secondary Market Corporate Credit Facility to provide liquidity for outstanding corporate bonds, Forbes reports.

The Fed will focus on investment grade U.S. company debt, and it will even purchase U.S.-listed exchange-traded funds that provide broad market exposure to U.S. investment-grade corporate bonds.

“The Fed is proving that it can and will do anything in its power to support the economy. Some of the measures announced today in addition to what’s likely to come from the fiscal side takes the Armageddon scenario off the table. In order to get to a depression-like environment, you need policymakers who don’t have the ability or the will to fight and the Fed is showing that we aren’t in that situation. A U-shaped recovery is still the most likely outcome now. We’re not all going to go back to work in one week and pretend this never happened, but this is taking the worst-case scenario off the table. This doesn’t mean that the market is going to bottom here because there is still stress in the credit market and we need fiscal authorities to hold up their end of the bargain. But all things being equal the Fed is flexing its muscles here and that should be a big comfort to everyone from a market and an economics perspective,” Steve Chivalrousness, Portfolio Manager and Equity Strategist, Federated Hermes, told Reuters.

Vanguard Long-Term Corporate Bond ETF

For more information on the fixed-income market, visit our bond ETFs category.