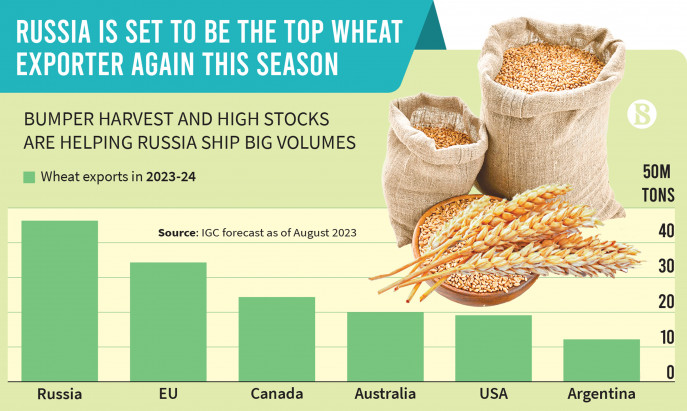

Russia, a top exporter in wheat, is coming off a bumper harvest, which should inject a healthy supply that could put downward pressure on prices. It’s welcome news for consumers, but traders may want to watch prices closely as they continue to trend downward.

Wheat has fallen over 20% for the year, continuing to head lower after reaching a high last year following Russia’s invasion of Ukraine. Of course, the bumper harvest only applies additional downward pressure.

“Russia’s second consecutive bumper wheat harvest is reinforcing its position as the No. 1 exporter, but it’s also easing price pressures stemming from Moscow’s invasion of Ukraine,” Bloomberg reported, reiterating last year’s invasion of Ukraine, which “hobbled Ukraine’s food exports, helping cement Russia’s domination of the global wheat market. That’s reflected in record Russian shipments, as the nation’s traders overcome the financing and logistical challenges some faced in the aftermath of the invasion.”

The lower prices could be a potential entry point for traders looking for an area of value, especially after last year’s peak. For long-term investors, wheat exposure always adds asset diversification to a portfolio.

“However, Russia’s overflowing grain ports have also yielded a silver lining for wheat consumers buffeted by a cost-of-living crisis: the lowest prices in almost three years,” the report added further. “Despite the Kremlin’s efforts to exploit the situation — by shoring up wheat prices to replenish its own coffers — the Chicago market is trading at less than half the peak reached after Moscow first invaded.”

“There are not a lot of competitors for Russian wheat,” said Hélène Duflot, a grain-market analyst at Strategie Grains. “Russia is the price maker at the moment.”

Trade Wheat and Broad Ag Commodities

As geopolitical forces continue to play out, traders can look to wheat prices for opportunities, especially if volatility continues — a trader’s best friend when it comes to scalping the markets for profits. One option to consider as opposed to trading futures prices directly is the Teucrium Wheat Fund (WEAT), which offers an easy way for investors to gain exposure to wheat price fluctuations via one ETF.

For a more broad play on agricultural commodities, consider the Teucrium Agricultural Fund (TAGS), which is essentially a fund of funds, and it features a low 0.13% expense ratio. In addition to WEAT exposure, it combines corn, soybeans, and sugar through other Teucrium funds that focus specifically on these commodities.

Other funds featured in TAGS (in addition to WEAT):

For more news, information, and strategy, visit the Commodities Channel.