Regulated carbon markets vary in their outlooks this year. California continues to benefit from strong fundamentals, while the European Union faces ongoing diminished economic activity and a bearish forecast. However, a narrow window of opportunity exists for investors interested in capturing the full potential of the EU’s energy transition.

The prognosis for European Union carbon allowances (EUAs) is a muted one this year. S&P Global calls for a price range for EUAs in 2024 between 80.9 and 95.5 euros for much of the year. Prices currently sit at 63.58 euros per CO2 ton as of 02/06/24. That is not unexpected given the confluence of bearish factors in play.

“Short of a prolonged weather snap, I wouldn’t be surprised to see a Eur65-75 range through early 2024,” Tim Atkinson of CFP Energy told S&P Global.

EUAs must currently contend with reduced economic activity and the subsequent drop in demand. Alongside reduced economic demand is the reduction in demand this year due to rapid decarbonization by EU industries. The long-term goal of the carbon market is to drive the conversion to green energy. But the rapid uptake has outpaced expectations. Collectively it creates bearish sentiment for EU carbon allowances this year.

The impact of the additional EUAs at auction to fund ongoing EU recovery from Russian fossil fuel reliance presents another challenge to price gains in 2024. While the additional allowances are being brought forward from existing future supply, they will likely constrain prices in the short term.

That said, potential economic and industrial recovery could buoy prices later in the year. Additional bullish factors to watch for include changing weather patterns, which result in greater energy usage, or regional natural gas supply shocks, according to a UK-based carbon trader.

If Everything Is Bearish, Why Buy EU Carbon Now?

Though the outlook for EU carbon allowances remains muted this year, Macquarie forecasts strong price momentum beginning in 2025. The bank currently calls for EUA prices of 69 euros in 2024, 93 euros in 2025, and 120 euros in 2026.

The effects of added supply at auction will taper off in the next two years. The elimination of free allowances for certain industries as well as the shortened future EUA supply from the front-loaded allowances creates tightening. Increased demand and shortening supply lends itself to the potential for significant price increases looking ahead long term.

The window of opportunity for investors to capture the full price appreciation potential of decarbonization via EUAs is this year. There are two different avenues to gain exposure for investors via the KraneShares suite of climate funds, either targeted or broad.

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein. The fund carries a management fee of 0.79%

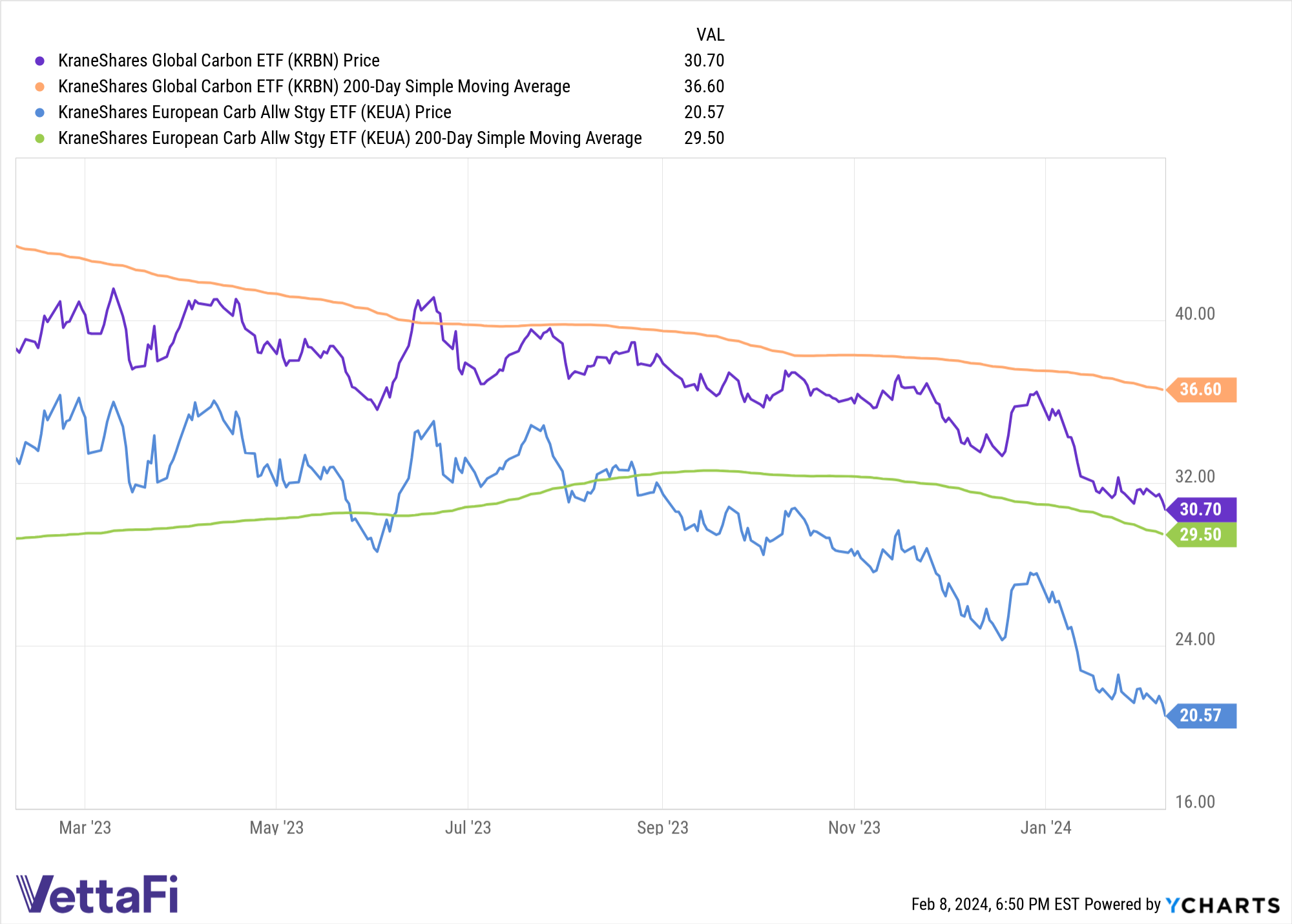

Meanwhile, the KraneShares Global Carbon ETF (KRBN) provides diversified exposure to major carbon markets worldwide. The fund was the first of its kind to offer an investment take on carbon credits trading. KRBN tracks the IHS Markit Global Carbon Index, which follows the world’s most liquid carbon credit futures contracts.

This includes contracts from the European Union Allowances (EUA) and California Carbon Allowances (CCA). It also includes the Regional Greenhouse Gas Initiative (RGGI) markets and the United Kingdom Allowances (UKA). KRBN carries a management fee of 0.79%.

Both funds are currently trading below their 200-day moving average and are ones to watch as the global economic outlook improves.

For more news, information, and analysis, visit the Climate Insights Channel