This week in the top-performing ETFs data drop, carbon ETFs took the lead. While it was not immediately clear as to why they saw such a performance spike, investors can learn something from recent climate-change-related headlines.

China’s “World Bank,” for example, just announced its plans to triple climate change lending in the next seven years. Overall, public investment in effort to remediate carbon and limit greenhouse gas emissions may draw investors into the case for carbon funds.

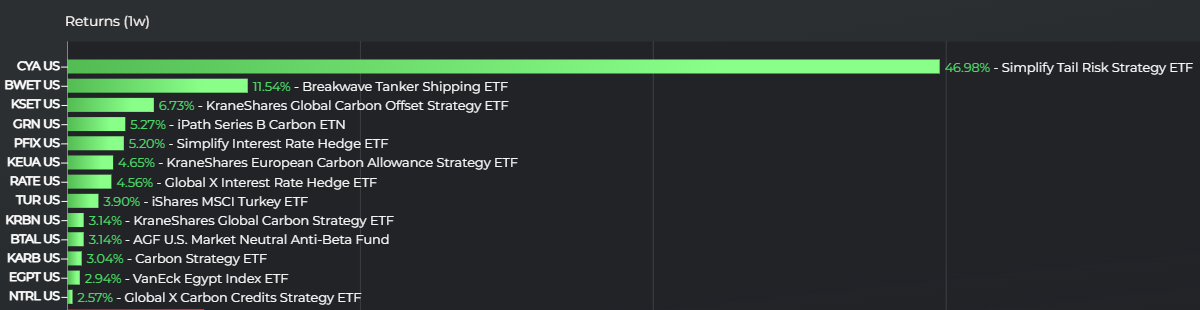

Per Logicly data, carbon ETFs led the way over the last week.

The KraneShares Global Carbon Offset Strategy ETF (KSET) and the KraneShares Global Carbon Strategy ETF (KRBN) both appear in the top-performing ETFs ranking. KSET and KRBN returned 6.7% and 3.1%, respectively, over one week, per Logicly data. The KraneShares European Carbon Allowance Strategy ETF (KEUA) also appeared in the ranking, returning 4.7%.

See more: “KSET: Prudent Avenue for Investing in Carbon Offsets”

KRBN, the largest of those three, recently hit its three-year mark. The strategy tracks the IHS Markit Global Carbon Index. It has returned 7.1% YTD and 22.4% over the last one year. The strategy charges 79 basis points (bps) to track the carbon credit futures index, holding December futures from three major cap-and-trade programs.

Rounding Out the Carbon ETFs

Of course, those strategies were not the only ETFs focusing on carbon remediation or offsets. The list also included the Global X Carbon Credits Strategy ETF (NTRL) as well as the Carbon Strategy ETF (KARB). The iPath Series B Carbon ETN (GRN) also merits a mention.

Carbon ETFs did not take all the spots in the list, however. The Simplify Tail Risk Strategy ETF (CYA) returned 47% for the week, far and away the performance leader. CYA actively invests in U.S. fixed income and income-generating ETFs for an 84 bps fee, embracing a hedge-fund-type strategy in an ETF wrapper.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit the Climate Insights Channel.