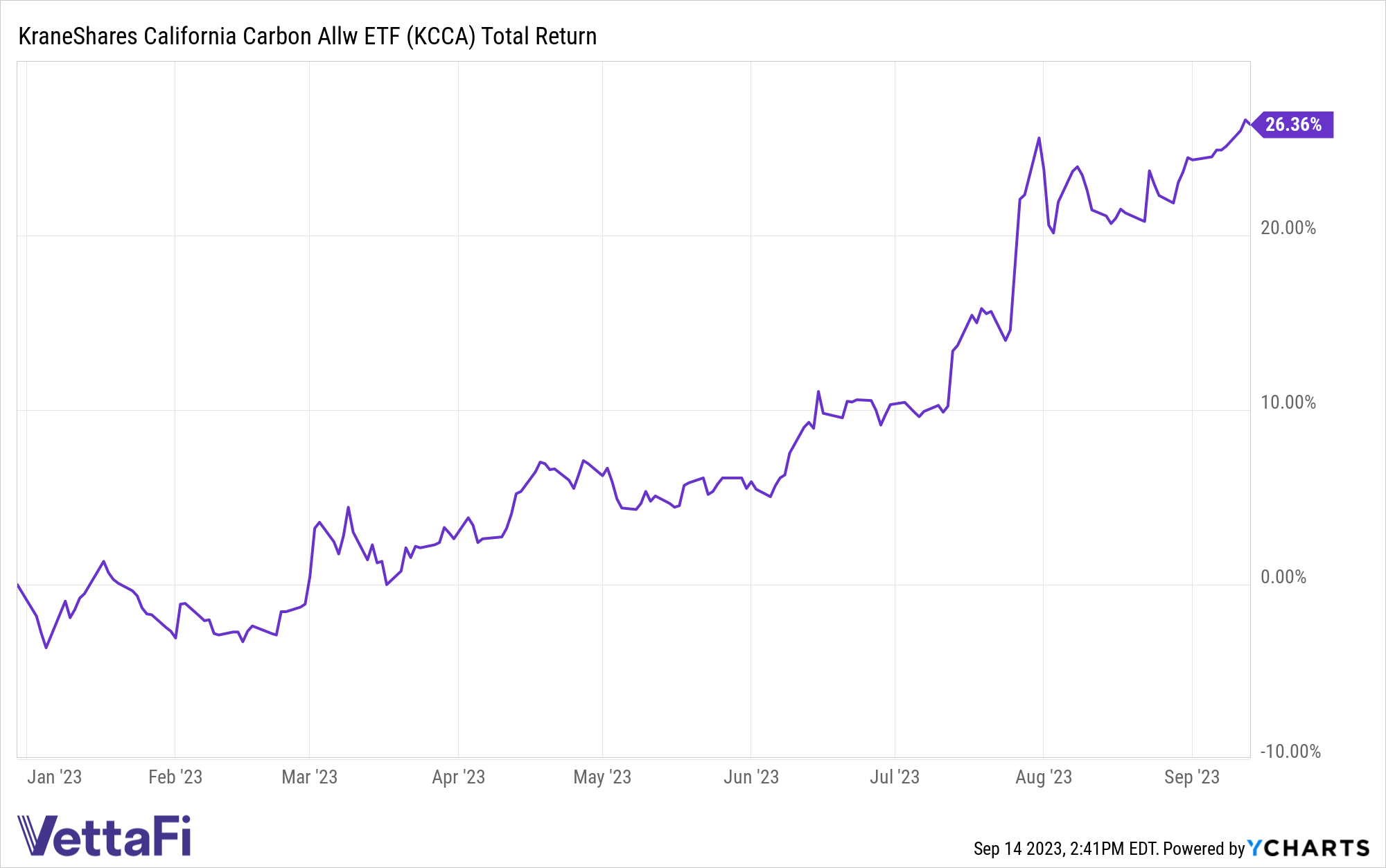

The KraneShares California Carbon Allowance ETF (KCCA) has offered compelling returns this year as carbon allowances markets increase.

KCCA offers targeted exposure to the California Carbon Allowances (CCA) cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs globally.

The fund is up an impressive 26.4% year to date. KCCA has climbed 28.5% over a one-year period.

Prices have risen steadily in the third quarter, with CCAs posting a sharp rally toward the end of August into September, according to KraneShares.

KCCA tracks the IHS Markit Carbon CCA Index. The index includes the most traded CCA futures contracts.

The CCA cap-and-trade program was implemented by the California Air Resources Board (CARB) in 2012. The program covers approximately 80% of the state’s Green House Gas (GHG) emissions, according to KraneShares.

In 2014, the program was expanded to cover Quebec and its emissions. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

How a Carbon ETF Can Enhance Portfolios

While KCCA has provided compelling returns year to date, it additionally adds value to portfolios in other ways.

Notably, KCCA can serve as a portfolio diversifier. KCCA and CCA future contracts each have historically low correlations to traditional asset classes.

Finally, the fund allows investors to support responsible investing and impact investment goals while participating in the price of carbon.

Other funds in KraneShares’ suite of carbon ETFs include the KraneShares Global Carbon Strategy ETF (KRBN) and KraneShares European Carbon Allowance Strategy ETF (KEUA).

See more: “Check Out KEUA as Long-Term EU Carbon Outlook Strengthens”

KEUA offers exposure to the European Union Allowances (EUA) program. The EUA program is the is the world’s oldest and most liquid carbon allowance market.

Conversely, KRBN provides broader exposure to carbon allowances. The fund tracks the major global cap-and-trade programs, including European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gas Initiative (RGGI).

For more news, information, and analysis, visit the Climate Insights Channel.