While it’s been a rocky year for most commodities, it’s been a relatively good one for carbon markets despite volatility. Investors looking to diversify their commodity exposure and portfolios should look to opportunities in California’s carbon market . The KraneShares California Carbon Allowance ETF (KCCA) offers exposure and is noteworthy, given strong performance this year.

KCCA offers targeted exposure to the joint California and Quebec carbon allowance markets. It stands to benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market.

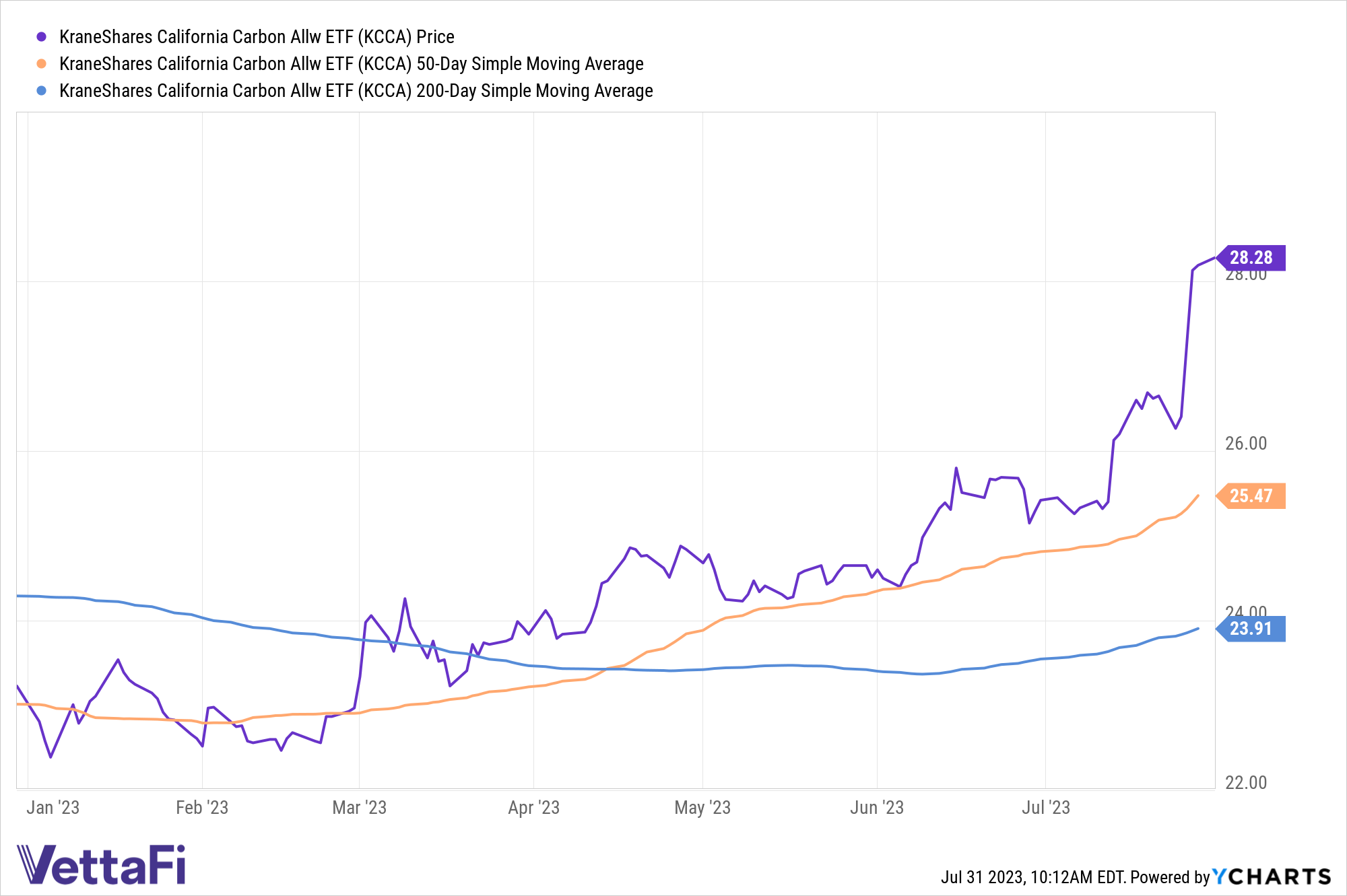

The fund is up 21.74% YTD, soaring over 11% in July alone as California policy support remains strong. While the finalization of tightening measures is ongoing, more aggressive emissions reductions will benefit the state’s cap-and-trade-market. Greater tightening also is likely to lead to demand and supply imbalance in the long-term, creating positive pricing pressure for allowances.

See also: “California’s Carbon Market Forecast for Supply Deficit by 2030”

KCCA remains solidly in “buy” territory. The fund remains significantly elevated above both its 50-day SMA and 200-day SMA. Funds above their SMAs are considered a buy for both investors and trend followers. It has been above both SMAs since March 21, 2023.

This market is one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The index includes up to 15% of the carbon credits from Quebec’s market.

KCCA’s index measures a portfolio of futures contracts on carbon credits issued by the CCA. The index only includes futures with a maturity in December in the next year or two. The fund also uses a wholly owned subsidiary in the Cayman Islands, which makes a K-1 unnecessary for taxes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.