Consistent, growing demand for California carbon allowances (CCAs) creates strong opportunity for investors looking to tap into a diversified asset class. Results of the most recent CCA auction underscore robust demand within a market offering strong fundamentals.

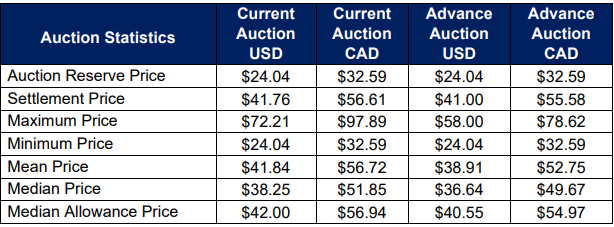

California held its quarterly carbon allowances auction last week, selling out once more at record prices. The California Air Resources Board reported a settlement price of $41.76 per allowance. Each carbon allowance equates to one metric ton of carbon dioxide.

Image source: California Air Resources Board

It’s the third consecutive auction that carbon allowances sold at record prices and a 50% gain year over year. Of 2024 allowances sold, 86.50% went to compliance entities, a 5% gain over the previous quarter’s auction.

California’s carbon allowances market remains attractive for investors for a multitude of reasons. The prices of CCAs are built in such a manner as to become increasingly constructive over time. Each year, prices rise by a floor of 5%, plus the cost of inflation. Additionally, proposed legislation could see a more aggressive reduction in the number of allowances in the coming years. Both provide strong fundamentals for potential positive price momentum over time.

Another potential positive catalyst is the proposed joining of Washington state to the already-linked California and Quebec markets. Washington passed a proposal this week to link its carbon market with the joint California and Quebec market. It’s a move that could encourage more participation in the carbon market by reducing cost burdens on companies, as well as bringing further stability. Next steps involve California researching the feasibility and long-term impacts of such a proposal.

Invest in the California Carbon Allowance Market with KCCA

Investors wanting to harness the long-term potential of CCAs would do well to consider the KraneShares California Carbon Allowance ETF (KCCA). The fund offers targeted exposure to the joint California and Quebec carbon allowance markets, and will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market. Carbon allowance investing is worth consideration for the diversification benefits that they offer portfolios as well as the strong long-term outlook.

KCCA is currently up 2.77% YTD and 37.37% in the last 12 months on a price return basis. The fund is also above both its 50-day simple moving average (SMA) as well as its 200-day SMA — both strong buy signals for trend followers.

KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA. The fund uses a wholly owned subsidiary in the Cayman Islands to prevent investors from needing a K-1 for tax purposes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.