The three primary heat-trapping greenhouse gases increased last year, underscoring the urgent work ahead to curtail emissions. Regulated carbon allowance markets play a critical role in the journey to net zero, providing investors with opportunity.

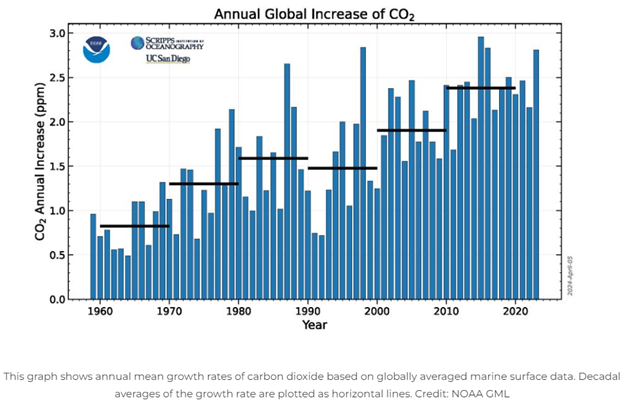

The levels of carbon dioxide, methane, and nitrous oxide all increased in 2023 according to the National Oceanic and Atmospheric Administration (NOAA). The rise aligns with the rapid increase of GHGs in the last decade.

“The 2023 increase is the third-largest in the past decade,” said Xin Lan, CIRES scientist for the NOAA’s Global Monitoring Laboratory (GML) in the report. It’s “likely a result of an ongoing increase of fossil fuel CO2 emissions, coupled with increased fire emissions possibly as a result of the transition from La Nina to El Nino.”

Image source: NOAA

Carbon dioxide emissions continue to rise at an exponential rate. Last year CO2 reached 36.6 billion tons annually, a far cry from the 10.9 billion in the 1960s when measurements began.

“As these numbers show, we still have a lot of work to do to make meaningful progress in reducing the amount of greenhouse gases accumulating in the atmosphere,” said Vanda Grubišić, director of GML.

Nitrous oxide grew at 1 part-per-billion last year, reaching 336.7 ppb. Since 2000, the highest annual gains were in 2020 and 2021 at 1.3 ppb each year. Pre-industrial levels measured at just 270 ppb.

Meanwhile, atmospheric methane grew in 2023 to the 5th highest level since 2007. It increased to 1922.6 ppb for a gain of 10.9 ppb annually. It registers slightly behind 2021’s 18 ppb annual gain and the 15.2 ppb gain in 2020. Methane is arguably the most damaging ghg due to its efficiency in trapping heat.

Carbon Markets Encourage Reductions in Greenhouse Gases

Portfolios stand to benefit by being on the correct side of the climate transition as industries and countries decarbonize. One method of capturing that transition is through carbon allowance investing.

Carbon allowance markets are heavily regulated and bring increasing pressure to bear on polluting companies. They do this by tightening supply, either annually or in an expected trajectory, thereby raising prices over time. KraneShares offers several ETFs with exposure to the major global carbon markets.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide and is one of the only major funds to target RGGI.

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The fund’s benchmark tracks the most-traded EUA futures contracts in the oldest and most liquid carbon allowances market.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide.

For more news, information, and analysis, visit the Climate Insights Channel.