Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon discussed the pros and cons of investing in fossil fuels.

Elle Caruso, staff writer, VettaFi: Hello, Karrie! I’m looking forward to our conversation on fossil fuel investments and how much exposure – if any – an investor should have to energy equities and crude oil/ natural gas futures.

I see an opportunity here for a long-term position and 2022 was a great demonstration of what exposure to crude oil/ natural gas can do for your portfolio. Last year, international benchmark Brent gained about 10% and West Texas Intermediate (WTI), the U.S. benchmark, rose 7%. The benchmarks gained 50% and 55% the year prior, rebounding from 2020 lows.

Even as energy commodity prices have softened in 2023, traditional energy companies have demonstrated resilience. Exxon Mobil Corp (XOM) and Chevron Corp (CVX) collectively reported $18 billion in profits during the first quarter, marking a record first quarter for Exxon. These companies are continuing to deliver value to shareholders in the form of generous dividends and stock buybacks.

Net-Zero Energy Transition Nukes Fossil Fuel Demand

Karrie Gordon, staff writer, VettaFi: Elle, I’m excited to talk with you today about a topic I’m very passionate about. I’m glad you’re happy to take the bull side because I’m extremely bearish on the outlook for fossil fuels long-term.

There may be a strong short-term and possibly medium-term demand for fossil fuels, I will concede that. Over the long term though, that demand will very likely evaporate as the world transitions to meet net-zero goals.

As demand drops, I have no doubts that supply will be curtailed too to keep pricing pressures high. What matters in the long-term equation however is that companies are going to increasingly be punished for fossil fuel use. It’s going to cost more to pollute and do business with polluters — regulated carbon allowances markets are built on that premise.

It’s a phenomenon that’s already beginning, and it’s starting with Europe. The passage of the Carbon Border Adjustment Mechanism (CBAM) by the EU sets a carbon tax on imports of specific materials. These imports will include an added tax for the calculated emissions used to produce them based on EU allowances prices.

Countries that already have an existing carbon allowance program at an equivalent price will be exempt from the tax. CBAM creates a way for cap-and-trade participants to remain competitive with countries that may not have carbon regulation markets.

Changing Energy Tides Only Lift Some Boats

There are currently 68 different carbon pricing markets and mechanisms globally, covering almost a quarter (23%) of all greenhouse gas emissions according to World Bank. This is likely to continue expanding as more countries pass emissions regulations that will have direct impacts on fossil fuel demand.

Image source: BloombergNEF

The transition to net zero by 2050 means a significant long-term pullback from fossil fuels. This investment instead will funnel into renewable energy sources and electrification. According to research from BloombergNEF, for every dollar that goes to fossil fuel energies, five dollars will be invested in low-carbon options between now and 2050.

It’s why I’m a bear on fossil fuels but a bull on funds like the KraneShares Global Carbon ETF (NYSE: KRBN). KRBN provides diversified exposure to the largest carbon allowances markets globally that have some pretty convincing positive price pressures long-term. Carbon allowances are an attractive commodity for portfolios due to their low correlation and more convincing long-term prognosis.

Manipulating Supply Supports Fossil Fuel Investments

Caruso: You mention that supply will be curtailed to stabilize prices as demand fluctuates. I’d like to revisit that point because it’s a very important detail here. More OPEC+ production cuts began this month and will last until the end of the year.

OPEC+ oil producers will further cut their oil output by approximately 1.66 million barrels per day (MMBpd), bringing the total volume of cuts by OPEC+ to 3.66 MMBpd, equal to 3.7% of global demand.

In October, OPEC+ announced a cut of 2 MMBpd in response to rising interest rates and the softer global economy. While headlines focused on the announcement, the cut was based on August 2022 production quotas – not actual production levels. This is notable as nearly all the countries party to the agreement had been producing below their August targets.

The latest production cuts, announced in the aftermath of the banking crisis, were made as a precautionary measure to support market stability. The ability to manipulate supply to try to maintain a price floor is a favorable aspect for investors, and many analysts expect this is not OPEC+’s last production cut this year.

Geopolitical Risk Looms Large Over Energy Sector

Gordon: It’s impossible to talk about fossil fuels without addressing geopolitical risk. As Russia’s war in Ukraine continues, the global oil supply continues to grow. Embargoes on Russian fossil fuels have only prompted Russia to pivot to greater reliance on China, India, and the UAE.

The anticipated decline in global crude oil supply due to sanctions on Russia has failed to manifest, and prices continue to decline.

Not only has a decrease in supply not been realized, but Russia continues to export at close to its pre-war levels. China and India, whose imports of Russian crude rose 70% in November 2022, have been major beneficiaries of reduced prices.

Russian oil is also likely flooding into markets from other quarters as well. An analyst told CNBC recently that Malaysia is currently exporting 1.5 million barrels of oil daily to China. Malaysia currently only produces around 400,000 barrels daily. Russian oil remains an unpredictable element in global markets with emerging market countries the main beneficiaries.

Supply Side Manipulation Yields Lackluster Results Thus Far

On top of supply-side uncertainty, the surprise supply cuts in April caused great consternation across much of the developed world. It was an attempt to stimy plummeting oil prices that hit 15-month lows in March at $70 a barrel. Prices rose briefly to $83 a barrel in April before falling once more.

The supply tightening aims to accommodate global slowing and recession later this year. Supply reductions began this month, but Brent crude oil is currently priced at $75 a barrel, dropping over 6% in the last month.

Failed supply-side crude oil price manipulation thus far alongside Russian oil resilience in global markets creates an environment of unpredictability and further volatility. Global demand is set to drop with a recession on the horizon. If there is already a supply-side imbalance now, how will that look in six months when demand drops further?

How To Add Energy Exposure to Portfolios

Caruso: The last point I’ll make is that energy exposure isn’t all futures contracts. There are a plethora of energy ETFs currently trading. Advisors can get energy exposure that aligns with a client’s desired risk profile.

If investors are bullish on crude oil/natural gas prices due to OPEC+ production cuts and driving season kicking off this weekend, they might want exposure to the upstream segment. Exploration and production are more sensitive to commodity prices, and investors can get access with the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) or the Invesco Dynamic Energy Exploration & Production ETF (PXE). Alternatively, oilfield services work closely with upstream and are also more sensitive to commodity prices. The VanEck Oil Services ETF (OIH) offers targeted exposure.

If investors prioritize income and want less direct exposure to commodity prices, midstream is the way to go. The Alerian MLP ETF (AMLP) and the Alerian Energy Infrastructure ETF (ENFR) offer access to midstream, which is more defensive than other energy subsectors. MLPs/midstream have less sensitivity to commodity prices given their fee-based business models. This leads to more stable cash flows despite the price of energy commodities.

Alternatively, there are integrated companies like Exxon and Chevron, which have upstream and downstream exposure. They usually focus on renewables as well. The Energy Select Sector SPDR Fund (XLE) and the Vanguard Energy ETF (VDE) are two funds that offer broad exposure.

The Collapse of the Fossil Fuel Cycle and Macro Sensitivity

Gordon: Fossil fuels are a cyclical commodity historically, running in six to seven-year cycles. Investors hoping to capture oil in an upswing could be setting up for disappointment, however. The move towards net zero means perpetually diminishing global demand on a forward-looking basis.

It’s something the IMF addressed in 2021 and if global fossil fuel demand hasn’t peaked yet, that peak is close at hand. The collapse of the cyclical fossil fuel trade is near if not already manifesting.

Fossil fuels remain susceptible to macro risks unrelated to their fundamentals. Oil prices plummeted in the wake of the regional bank collapse in March as bank contagion fears rocked markets. The sharp decline was entirely unrelated to fundamentals — oil slid 5% on March 14 and another 5% on March 15.

The world and the U.S. face recession and an ongoing inflation battle in the months to come. It’s an environment that typically favors risk-off positioning, particularly with banking sector risk added in. This could be a further detriment to macro-sensitive oil prices in an environment rife with risk.

Investing for the New Energy Economy

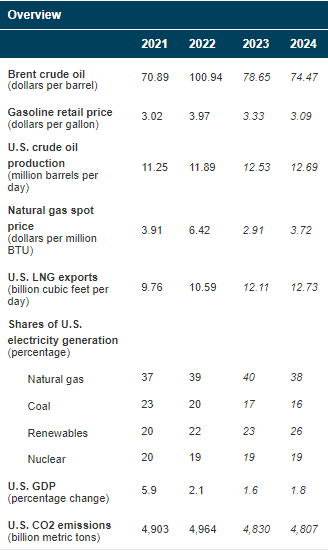

Image source: EIA

The U.S. Energy Information Administration’s May short-term outlook for energy in 2024 calls for lower Brent crude oil prices compared to this year. Electricity generated from natural gas in the U.S. should fall next year to 38% from 40%. Meanwhile, U.S. renewable energy generation is forecast to grow from 23% this year to 26% next year.

Given the enhanced risk both in the near and long term for fossil fuels, I’m too bearish on this diminishing energy commodity. Instead, I favor renewable energy plays that have both regulatory support and increasing demand forecasts in the years to come. The Invesco Solar ETF (TAN) is a noteworthy and top-performing fund with 5-year returns of 21.78%.

For an alternative take on energy investing, the Engine No 1 Transform Climate ETF (NETZ) is worth strong consideration. NETZ seeks to capture equity companies engaged in the energy transition from fossil fuels to renewables. These companies come from the most emissions-intensive industries and will likely become the leaders of the new energy economy.

For more news, information, and analysis, visit the Climate Insights Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and ENFR, for which it receives an index licensing fee. However, AMLP and ENFR are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and ENFR.