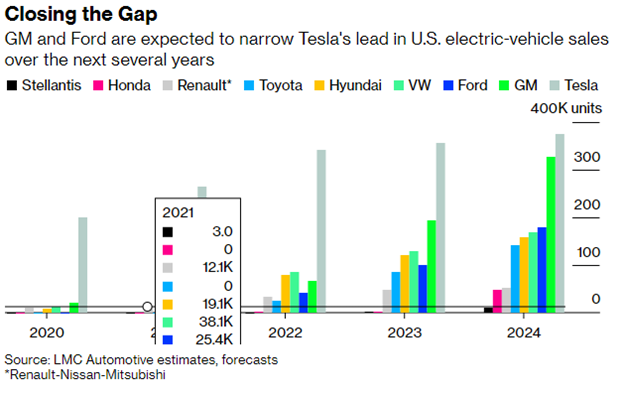

Tesla has long been the number one manufacturer of electric vehicles and will most likely account for nearly two-thirds of all EV sales this year, but Ford is racing to catch up, reported Bloomberg.

In an interview with Bloomberg Television, Jim Farley, Ford’s CEO, said he eventually wants to be the top EV company and is looking from jumping from the fourth spot in terms of the total production this year to the second within two years. Ford has announced that it will be increasing EV production to 600,000 units across its three-vehicle lineup.

“We really have a chance to get to No. 1,” Farley said in the interview.” “We’re competitors, and I race, and second is the first loser. So we’re going to go for it.”

Image source: Bloomberg

It’s a big milestone and will require doubling current output at the Dearborn, Michigan EV factory to meet the 160,000 demand annually for its electric pickup, the F-150 Lightning. The company recently capped reservations after hitting 200,000.

The ramped-up production for the electric Mustang Mach-E means that capacity and production will need to be increased at the company’s Mexico factory. For now, Ford has put off any production plans for the electric Explorer or Lincoln Aviator to meet the increased production demands.

“I really admire Tesla and Elon Musk,” Farley said. “But I wouldn’t bet against the Ford team.”

On Tesla’s end, the popular EV company has just opened a new factory in Texas, and between that and a new factory in Germany coming online next year, the company anticipates producing 1 million EV vehicles.

“This is going to be a tough battle,” said Jeff Schuster, senior vice president of forecasting at LMC. “As we get into the middle of the decade, we’re going to see this play out more and see how much these brands can eat into Tesla.”

Investing in a Booming Industry with ‘KARS’

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) invests in Ford, Tesla, GM, and many of the biggest players globally in the electric vehicle industry.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically, including exposure to electric vehicle manufacturers, electric vehicle components, batteries, hydrogen fuel cells, and the raw materials utilized in the synthesis of producing parts for electric vehicles.

The index has strict qualification criteria. Companies must be part of the Bloomberg World Equity Aggregate Index, have a minimum free-float market cap of $500 million, and have a 90-day average daily traded value of $5 million.

Tesla (TSLA) is carried at a 5.21% weighting, and Ford (F) is carried at a 5.18% weighting in the fund, while General Motors (GM) is carried at 4.50%.

The ETF has an expense ratio of 0.70%.

For more news, information, and strategy, visit the Climate Insights Channel.