It’s been a rocky road for Ford’s transition to electric vehicles, marked by delays and setbacks. The ICE manufacturer remains more committed than ever to the EV transition, however, a direct reflection of broader industry changes.

Ford (F) has teased several unique electric vehicles built on its own EV platform. These include a truck capable of hauling, towing, power generation, and more, and a three-row SUV reported Electrek. The EV overhaul includes building out a massive plant in Tennessee fully dedicated to EVs. It also includes re-outfitting the company’s Ontario assembly plant for battery and EV manufacturing.

Ahead of the release of these next-gen EV vehicles, Ford announced the discontinuation of the gas-powered Escape, Edge, and Transit Connect. These latest discontinuations follow on the heels of the cessation of production on the gasoline-powered Ford Fiesta last month.

The choice to discontinue the gas-powered versions allows for a greater focus on EV development and manufacturing. The plant where the Fiesta was produced is being retooled for the production of the electric Explorer. The company seeks to be one of the traditional ICE manufacturers early movers in the transition to EVs.

Ford currently offers the Lighting F-150, an all-electric Explorer (currently available in Europe), Mustang Mach-E, and an electric van.

See also: “Electric Vehicle Investment Thesis is Revving Up“

Invest in Ford and the EV Transition With KARS

The KraneShares Electric Vehicles and Future Mobility ETF (KARS) offers a good solution for investors looking to capture the potential growth of major EV producers globally. The fund takes not just a global approach to EV exposure, but also invests along the entirety of the value chain.

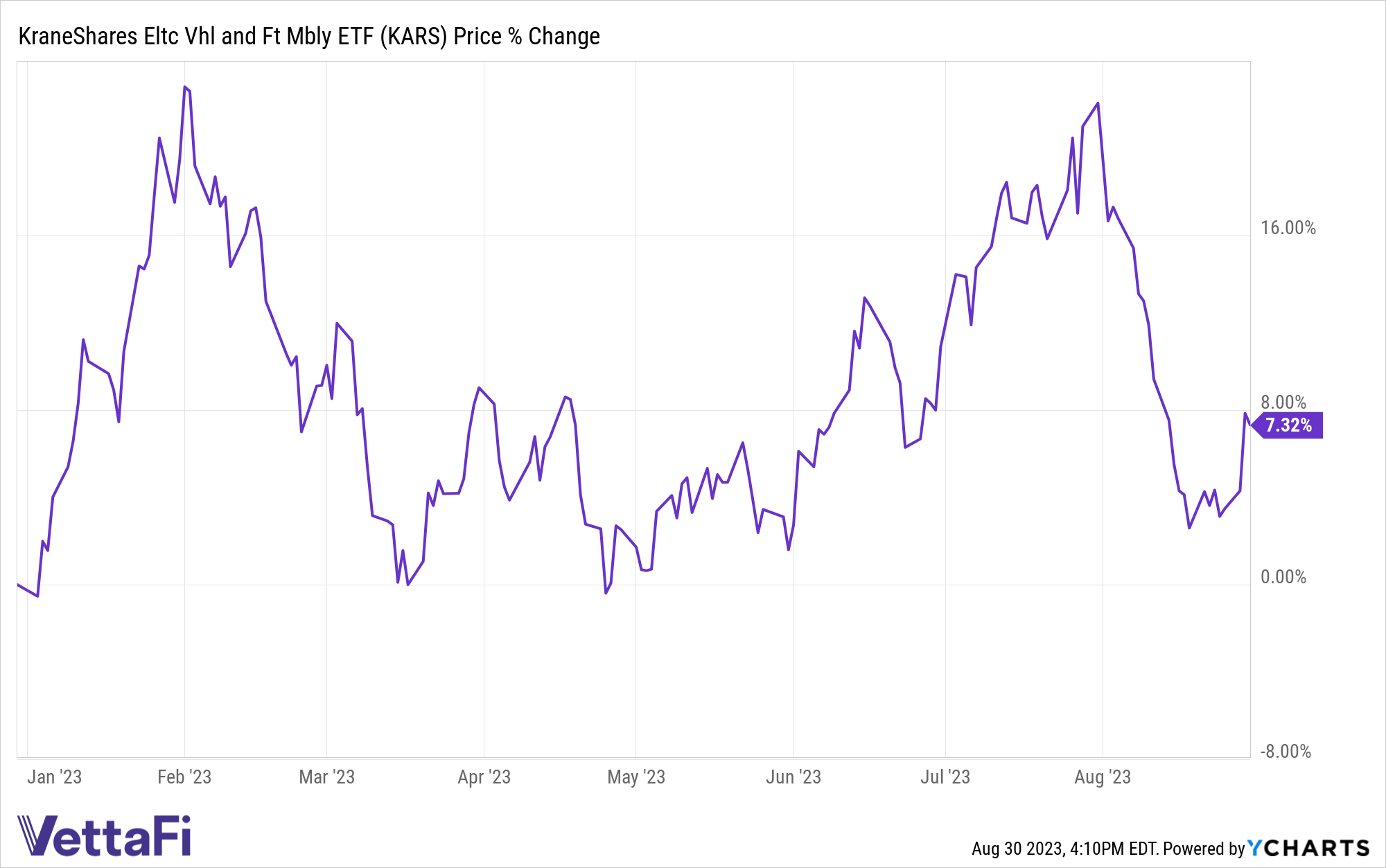

The ETF offers diversification for EV investors and is up 7.32% YTD, with nearly $3 million in net flows in August. Ford is currently carried in the fund at a 1.03% weight.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically. This includes exposure to electric vehicle manufacturers, electric vehicle components, and batteries. It also includes hydrogen fuel cells and the raw materials utilized in the synthesis of producing parts for EVs.

KARS invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as Li Auto, Nio, and BYD. It also goes a step beyond and invests in the companies that contribute to the EV value chain. These include Samsung, Panasonic, and Albemarle, a major lithium manufacturer.

KARS carries an expense ratio of 0.70%.

For more news, information, and analysis, visit the Climate Insights Channel.