China announced an extension of tax waivers on electric and green vehicles through 2027. Chinese EV manufacturer’s stocks gained in overnight trading, a potential benefit for the KraneShares Electric Vehicles and Future Mobility ETF (KARS), a fund currently in strong buy territory.

The Chinese government revealed a tax break package worth 520 billion yuan ($72.3 billion USD) for the purchase of new energy vehicles through 2027, reported Nikkei.

It’s the largest to date as China looks to boost flagging vehicle sales, and exceeded investor predictions.

“The extension by another four years beat market expectations,” Cui Dongshu, secretary general of the China Passenger Car Association, told Nikkei. Major Chinese EV manufacturers rose in trading post-announcement. NIO closed 3.97% higher, while Xpeng gained 2.23%. Li Auto also rose 2.18% and BYD climbed 0.61% in overnight trading.

Rystad Energy, an energy research agency, predicts 2023 EV sales to gain 15% over last year and for EV sales to rise 30% in 2024.

Capture EV Stocks Gains With KARS

The KraneShares Electric Vehicles and Future Mobility ETF (KARS) offers a good solution for investors looking to capture the potential growth of major EV producers globally. The fund takes not just a global approach to EV exposure, but also invests along the entirety of the value chain.

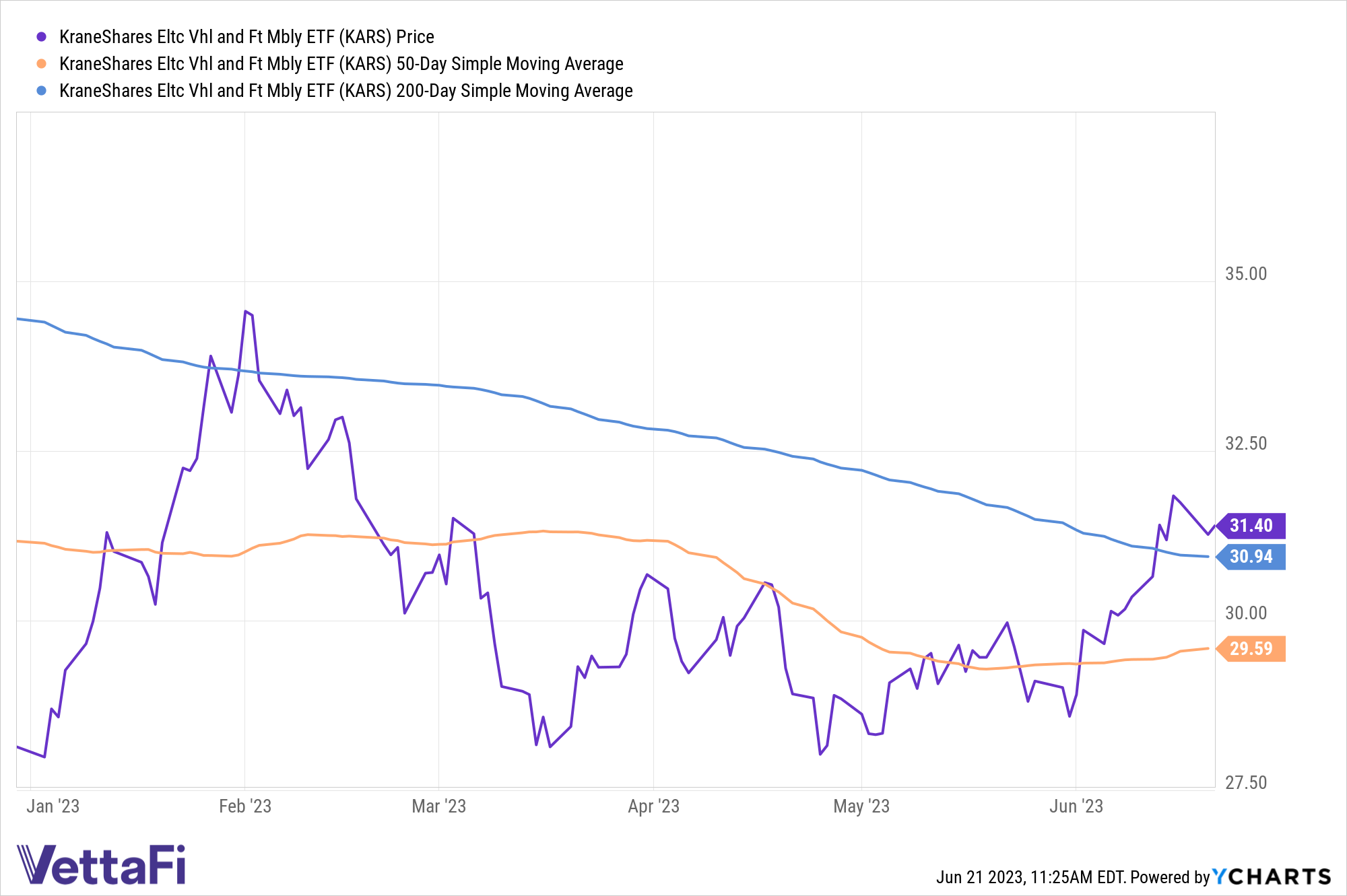

The ETF offers diversification for EV investors and is up 10.06% YTD. KARS recently crossed above its 200-day Simple Moving Average and remains above its 50-day SMA, a buy signal for investors and trend followers.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically. This includes exposure to electric vehicle manufacturers, electric vehicle components, and batteries. It also includes hydrogen fuel cells and the raw materials utilized in the synthesis of producing parts for EVs.

KARS invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as Li Auto, Nio, and BYD. It also goes a step beyond and invests in the companies that contribute to the EV value chain. These include Samsung, Panasonic, and Albemarle, a major lithium manufacturer.

See also: “How to Capture Growing Electric Vehicle Demand With KARS“

KARS carries an expense ratio of 0.70%.

For more news, information, and analysis, visit the Climate Insights Channel.