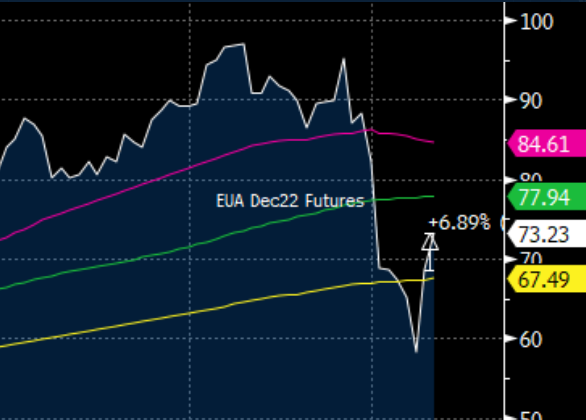

It’s been a rocky couple of weeks for carbon allowances markets, particularly in Europe, as the conflict in Ukraine has driven volatility, price declines, and sell-offs across industries and sectors, including in the futures market for carbon. Today saw EUA December futures rising another almost 7% after a 10% gain yesterday.

Image source: Luke Oliver Twitter

Yesterday Luke Oliver, managing director and head of strategy at KraneShares, tweeted about the EUA December 2022 futures closing on their 200 moving day average on Monday after previous price drops had triggered a technical sell-off. Oliver remarked that if no resistance was seen, prices could continue to move higher, which they since have, gaining 6.89% as of his follow-up tweet this morning.

Image source: Luke Oliver Twitter

“The sell-off was largely technical, yet the market was hesitant to jump back in,” Oliver explained in a communication to ETF Trends. “Technical traders flipped long to short. These same shorts are likely now getting blown out, which could move European carbon higher, back towards fundamentals.”

Carbon market price movements are part of the larger volatility being seen in global markets as the conflict in Ukraine continues to add stressors to already uncertain markets, particularly in the U.S. Energy-related investments and their assorted futures markets have taken big hits, with several countries committing to permanent withdrawal from Russian oil.

“While oversold, the risk in the carbon market is heightened as a result of energy supply disruptions and geopolitical tensions,” Oliver cautions.

KEUA Invests in European Carbon Allowances

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed.

The fund’s benchmark is the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts, a market that is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein. The annual cap reduction was recently increased from 2.2% to 4.2% to meet long-term carbon emission targets.

As the fund is actively managed, it may invest in carbon credit futures with different maturity dates or weight futures differently from the index. The fund potentially trades in CTFC-regulated futures and swaps above the CFTC 4.5 limit and is therefore considered a “commodity pool.”

KEUA has an expense ratio of 0.79%.

For more news, information, and strategy, visit the Climate Insights Channel.