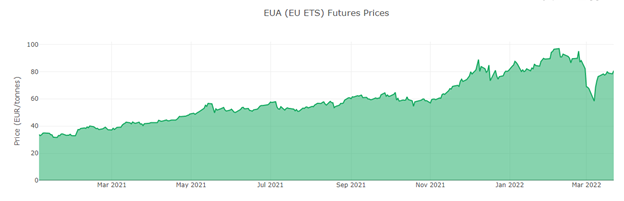

European carbon allowances have settled around a new resistance band of 80 euros for now, previously a support level before the technical sell-off that occurred earlier this month. Luke Oliver, managing director and head of strategy at KraneShares, believes that this could be an opportunity for investors to gain entry to the market before it possibly gains more ground as the EU commits to carbon emission reductions.

Support and resistance bands are part of a more technical analysis of asset price movements and broadly are the price points at which an asset is expected to pause or reverse. A support band is the lower price resistance that an asset is expected to meet in a downtrend as it is driven by a more concentrated demand at that level. A resistance band is the higher price resistance that an asset is expected to meet in an uptrend based around a concentrated supply and investor desire to sell.

Support and resistance bands are derived from moving averages of an asset as well as from identifying trendlines on charts, but a lot more contributes to these bands, such as investor psychology and broad market trends. Regardless, these “floor” and “ceiling” points give investors reasonable price expectations for an asset, and should the price movement break out either high or low, new support and resistance levels are defined.

“Carbon may consolidate around this 80 Euro level, which translates roughly to a $45 carbon level opportunity to be able to do their research and enter before the market potentially legs high,” said Oliver on a call with ETF Trends.

Concerns around the EU’s commitment to decarbonization as it works to pivot away from Russian oil and natural gas had helped to create volatility, but those fears should be allayed with the recent vote by the European Commission to extend the reductions of carbon allowances within the market until 2030 and commit to a carbon border adjustment mechanism, as reported in the KraneShares Climate Market Now blog.

Image source: Ember-climate.org

The 80 euro price point for carbon, which was once a support level, has become the ceiling for now. Oliver tweeted on March 17 that “we either get a little resistance here, or we could leg up another 5%, looking for $83.80 in the coming days.”

See also: European Carbon Allowances Markets on the Rise Again, KEUA Captures

Investing in European Carbon Allowances With KEUA

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed.

The fund’s benchmark is the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts, which is the oldest and most liquid market for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein. The annual cap reduction was recently increased from 2.2% to 4.2% to meet long-term carbon emission targets.

As the fund is actively managed, it may invest in carbon credit futures with different maturity dates or weight futures differently from the index. The fund potentially trades in CTFC-regulated futures and swaps above the CFTC 4.5 limit and is therefore considered a “commodity pool.”

KEUA has an expense ratio of 0.79%.

For more news, information, and strategy, visit the Climate Insights Channel.