The energy transition continues to drive demand for specific metals upwards, increasing their market size two-fold in the last five years. With demand set to double by 2030 compared to 2021 levels, there is strong investment opportunity in electrification metals at an attractive entry point right now.

New research from the International Energy Agency found that between 2017–2022, the energy sector drove significant demand spikes in a number of metals. Lithium experienced a three-fold increase in demand, and cobalt demand grew 70% in the last five years.

“Driven by rising demand and high prices, the market size of key energy transition minerals doubled over the past five years, reaching USD 320 billion in 2022,” the IEA wrote. This put the critical minerals market on par with iron ore mining over the same period.

The energy transition brings a number of opportunities for investors and the broader economy. These include “new revenue opportunities for the industry, creates jobs for the society, and in some cases helps diversify economies dependent on coal.”

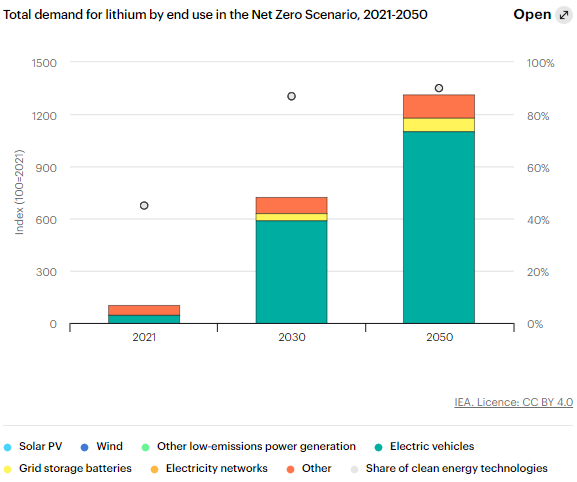

The underlying global regulatory support for climate change creates a strong foundation and investment case for these commodities. The IEA calculated demand looking ahead to 2030 in two different scenarios. Based on the trajectory of existing policies, demand for critical metals doubles by 2030. It grows three-and-a-half times by 2030 if following true net-zero trajectories, particularly for lithium.

Image source: International Energy Agency

Capturing Long-Term Demand for Energy Transition Metals

Given the demand forecast, investors have a window of opportunity while commodity prices remain at current lows. The KraneShares Electrification Metals ETF (KMET) offers targeted exposure to the metals necessary for electrification, such as copper, lithium, and nickel. The fund provides exposure to growing metal demand from the clean energy transition via the futures market.

KMET, like many commodities, is down year-to-date. As of July 11, the fund is currently down 16.17%. This provides an attractive entry point for commodities with long-term demand support in the years to come.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 24.38% and a 24.38% allocation to nickel futures. The fund has an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.