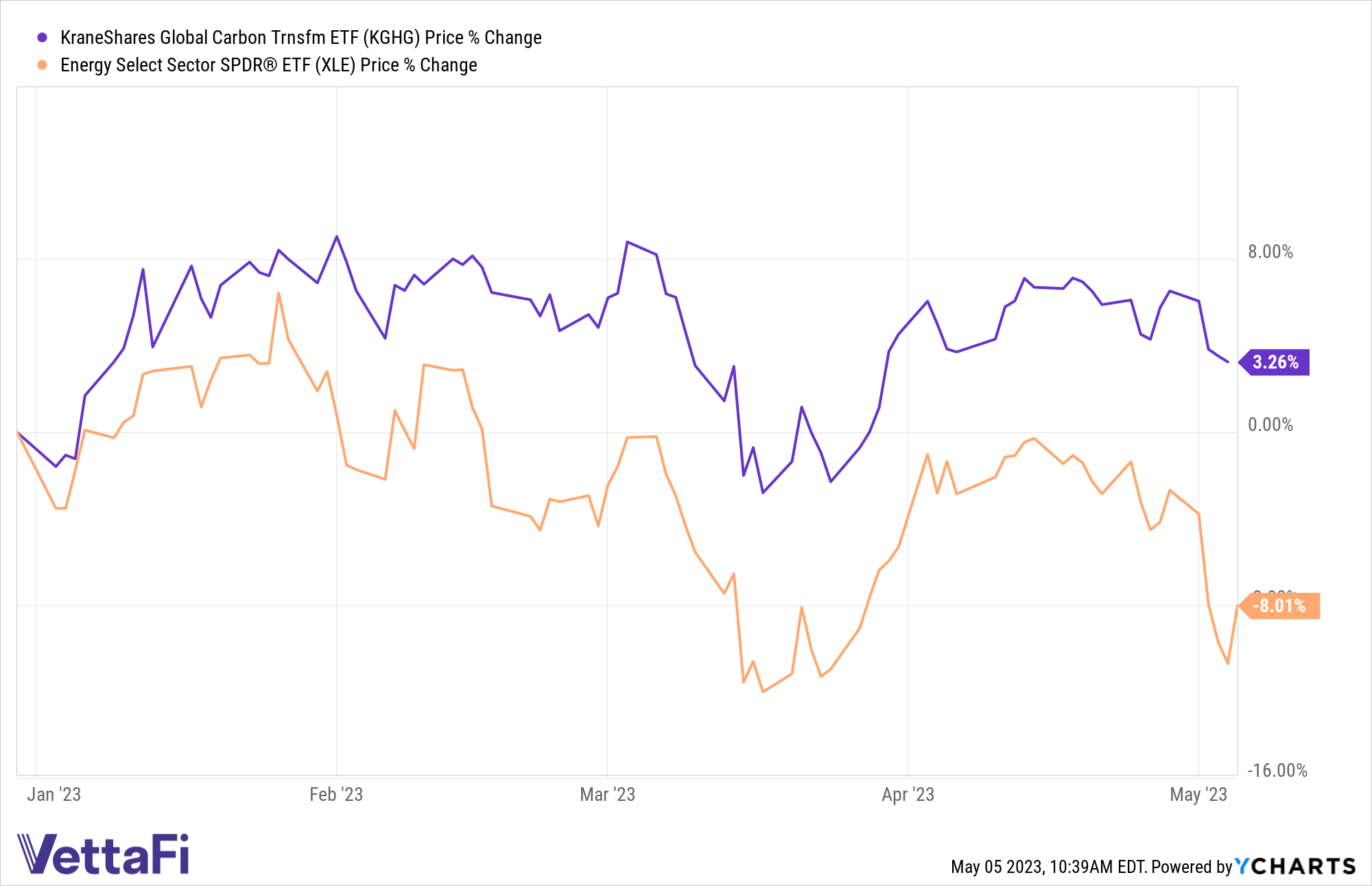

There are a number of options when looking to energy ETFs for portfolio diversification as the U.S. trundles towards recession this year, but advisors shouldn’t sleep on the opportunities that the KraneShares Global Carbon Transformation ETF (KGHG) can provide. KGHG is outperforming the energy sector year-to-date and is positioned to capture the companies that are likely to emerge as the leaders within their industries in a low- and zero-carbon emissions future, particularly within the energy sector, it’s heaviest weighted sector.

Despite OPEC+’s announcement at the beginning of April that it would be curtailing oil production this year, the price of crude oil remains volatile and has been a drag on the broader energy sector for much of the year: the S&P GSCI Crude Oil Index is down 14.58% YTD according to S&P Dow Jones Indices while the Energy Select Sector SPDR ETF (XLE) is down 8.37% YTD.

KraneShares Global Carbon Transformation ETF (KGHG) seeks to capture the true potential within the carbon transition by focusing on companies from within industries that are traditionally some of the highest emission offenders but are on the precipice of transitioning to renewable technologies, and is up 3.26% YTD.

The fund is currently trading at $24.54 and is above its 200-day SMA of $24.05 but has dipped below its 50-day SMA of $24.72 as of the beginning of the month. For trend-followers, KGHG is a fund to watch and is likely to be well positioned looking ahead as regulatory pressure increases globally on heavily polluting industries.

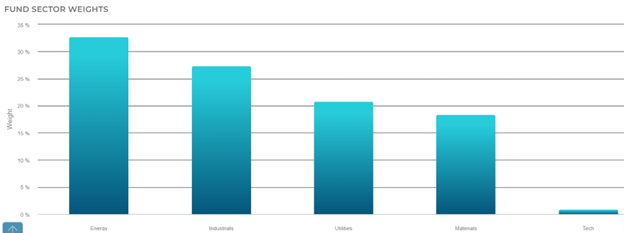

KGHG isn’t a pure energy sector play, but energy is its largest sector by weight, and it could be a strong potential addition to an energy and diversification sleeve.

Energy sector weight 32.62%; Industrials 27.33%; Utilities 20.77%; Materials 18.36%; Tech 0.92%

Image source: LOGICLY

KraneShares believes that the upside potential of investing in companies as they transition is enormous. These companies that are set to disrupt their industries would benefit greatly from being leaders in the transition, as the cost of carbon emissions will only become more expensive, cutting into the bottom line as demand decreases for high emissions offenders.

KGHG is an actively managed fund that invests globally across market caps and sectors in carbon emissions reducers that are taking active steps to reduce their carbon footprints and services or the carbon footprints of other companies. This also includes companies within the supply chain of the carbon-reducing companies and companies that are growing their businesses with companies that are materially reducing carbon emissions.

The fund utilizes proprietary, fundamental, bottom-up analysis using information disclosed by companies and third-party data.

KGHG carries an expense ratio of 0.89%.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit the Climate Insights Channel.