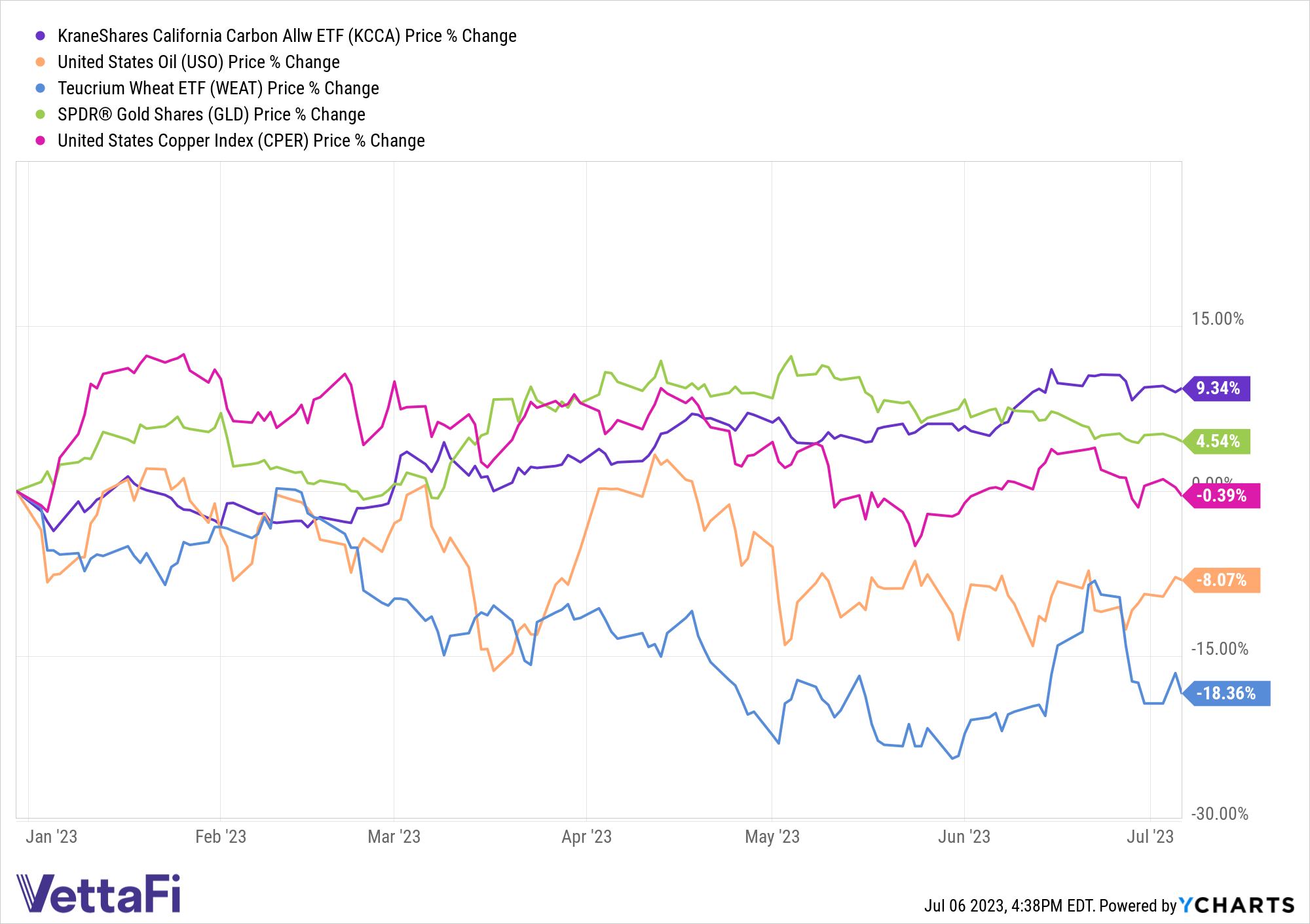

This year remains a challenging one for most commodities as global economic slowing undermines demand. Ongoing uncertainty in the U.S. led to prolonged market volatility in the last six months — volatility that extended to most commodity classes. California carbon allowances are one asset class within commodities that continue to prove less volatile in recent months.

Many of the outperforming commodities of last year such as crude oil and natural gas fell in the first half. ETFs that track many of the major commodities underperformed YTD, some significantly. The United States Oil Fund LP (USO) fell 8.07% YTD while the Teucrium Wheat ETF (WEAT) dropped 18.36% this year as of 07/06/2023.

The United States Copper Index Fund (CPER) fared better for the most part in the first half, down just 0.39% YTD, and gold rose. The SPDR Gold Shares (GLD) is up 4.54% YTD. Meanwhile, the KraneShares California Carbon Allowance ETF (KCCA) gained 9.34% this year.

KCCA Offers Lower Volatility Within Commodities This Summer

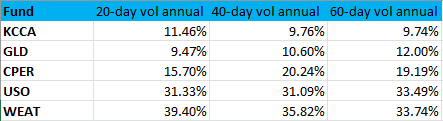

What’s more, KCCA outperformed and provided a smoother ride in recent months. The 20-day volatility annualized of KCCA was 11.46% as of 07/06/2023 according to LOGICLY data. GLD was the only commodity fund of the five that proved smoother in the short term at 9.47%. CPER’s 20-day volatility annualized was 15.70% and USO came in at 31.33%. WEAT proved the most volatile recently at 39.40%.

Data collated from LOGICLY

Stepping back to look over a slightly longer period, KCCA proved the least volatile of all five commodity funds. The 60-day volatility annualized for KCCA was 9.74% as of 07/06/2023. GLD and CPER both demonstrated volatility of less than 20% while USO and WEAT each exhibited volatility of 33% over the same period.

The KraneShares California Carbon Allowance ETF (KCCA) is worth consideration in a commodity sleeve, particularly given YTD performance and recent volatility measures. The fund offers targeted exposure to the joint California and Quebec carbon allowance markets. It will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market.

This market remains one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The index includes up to 15% of the carbon credits from Quebec’s market.

KCCA’s index measures a portfolio of futures contracts on carbon credits issued by the CCA. The index only includes futures with a maturity in December in the next year or two. The fund also uses a wholly-owned subsidiary in the Cayman Islands, which makes a K-1 unnecessary for taxes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.