Regulatory fears drove a lot of investors away from exposure to China in 2021 as various agencies enacted new requirements that affected a broad swath of industries in China, but one area that always saw positive support was the focus on environmental policies and sustainability.

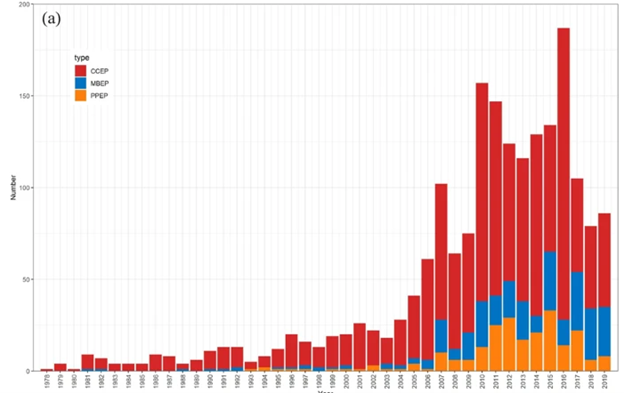

Environmental policies continue to be a focus for China, both on a regulatory agency level as well as through fiscal policies that pertain to environmental governance. A recent research paper published in Nature used both manual and machine learning analysis to track the policy intensity growth within China with regards to the environment and sustainability from 1978-2019 and found that the intensity had trended upwards over time, reflecting China’s increasing commitment to sustainability.

“This trend reflects that China has been reinforcing its regulations to fight environmental issues via various types of policy,” authors of the paper wrote. “The difference between different types of policy is also becoming more visible, which reflects that China is adopting a differentiated strategy in the process of environmental governance.”

The data used included an analysis of 1,912 environmental policies between 1978-2019, the first major analysis ever done on Chinese environmental policy.

Image source: Nature

The researchers found that command-and-control policies, or mandatory policies that have governance requirements and standards, have been a core driver of environmental regulatory support in China. At the same time, market-based environmental policy pressure also increased; this comes from fiscal policies that pertain to things such as emissions trading, environmental governance, and other instruments that are generated from markets.

The final policy measured was public participation environmental policy, which measures public and private sector participation in environmental sustainability and revolves around keywords such as “public participation,” “hearing,” “seek advice,” and “citizens,” among others.

“To our knowledge, our dataset is the first large collection of environmental policies with their intensity scores estimated by both human experts and learning-based models,” the authors wrote, explaining the alignment between the findings of the machine learning algorithms and the manual calculations done. “This shows that the intensity measured by the machine learning algorithms has a high degree of consistency with the results of manual quantification, reflecting the real changing trend in policy intensity.”

Investing in China’s Clean Energy With KGRN

For advisors looking to invest in China within an area that has had continued policy support at a time when other industries have come under scrutiny and regulation, investing in the clean energy sector could be one possibility.

China is currently the world leader in total renewable energy capacity, holding 31% of global capacity, and the KraneShares MSCI China Clean Technology Index ETF (KGRN) capitalizes on investing in clean technology in China’s growing economy.

KGRN tracks the MSCI China IMI Environment 10/40 Index and is based on five clean technology themes: alternative energy, energy efficiency, green building, sustainable water, and pollution prevention.

It allows investors direct exposure to ESG market movers in China such as Li Auto Inc. at 9.15%, Nio Inc. at 8.52%, and BYD Co. at 7.56%.

The ETF has an expense ratio of 0.78%.

For more news, information, and strategy, visit the Climate Insights Channel.