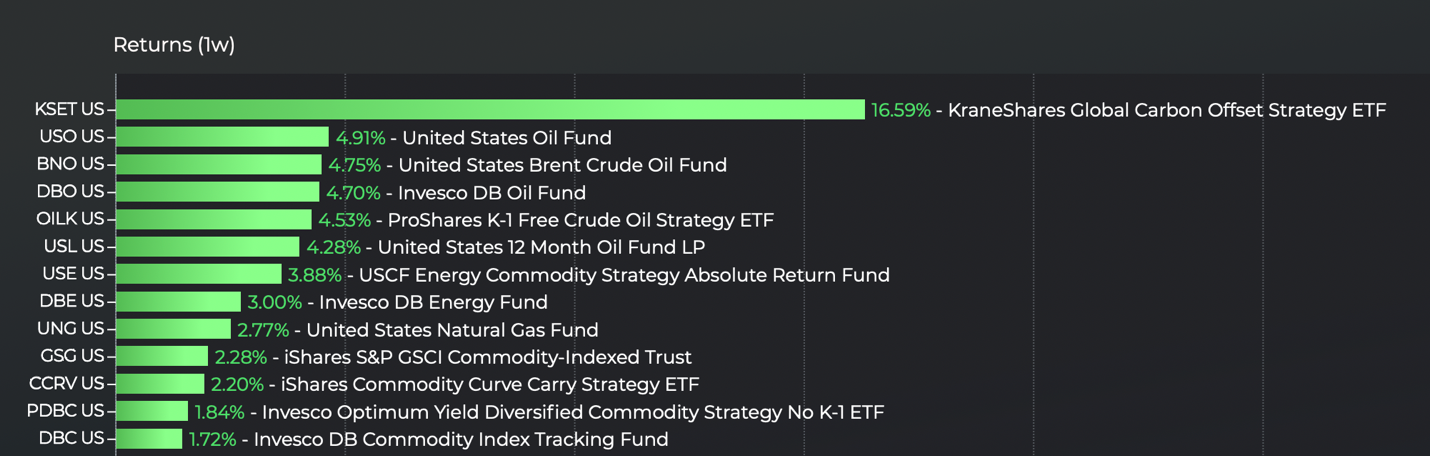

A carbon offset ETF handily outpaced its commodity ETF peers last week.

The KraneShares Global Carbon Offset Strategy ETF (KSET) impressively rallied 16.6% in the one-week period trailing September 1. The fund beat the next top performing commodity ETF by over 1,000 basis points during the week.

“While carbon futures ETFs garner far less attention than commodity peers, they provide differentiated and often very strong returns,” Todd Rosenbluth, head of research at VettaFi, said.

KSET tracks the S&P GSCI Global Voluntary Carbon Liquidity Weighted Index. KSET’s underlying index provides broad coverage of the voluntary carbon market by tracking carbon offset futures contracts.

Under the Hood of Carbon Offset ETF KSET

The fund is structured to offer global coverage of voluntary carbon markets by tracking carbon offset futures contracts comprising Nature-Based Global Emission Offsets (N-GEOs) and Global Emission Offsets (GEOs), which trade through the CME Group. KSET is designed to dynamically add additional offset markets as they reach scale, according to KraneShares.

The index is structured in a way that will allow flexibility in re-weighting the securities it tracks. KSET’s underlying index can also move securities in and out of the index regularly, and it only tracks carbon offset credit futures that have a maturity within the next two years. The index weights the offset futures it tracks by the total value of their traded volume over the last six months.

The global carbon offset ETF was trailed by traditional fossil fuel commodity ETFs in returns last week. Oil and natural gas commodity ETFs notably provided just a fraction of KSET’s returns during the week.

Source: Logicly

See more: “Check Out KEUA as Long-Term EU Carbon Outlook Strengthens“

KSET has climbed 44.2% since its bottom on June 1, but is still down since inception in April 2022.

KSET carries an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.