Recent record-setting heatwaves in North America, Europe, and China are likely the new norm as global warming continues. As heat indexes soar and electricity demand surges, global carbon market prices are on the rise, particularly in California. It demonstrates the optimal positioning of these regulated markets as the world works to curb emissions and climate change impacts.

In a recent report from the World Weather Attribution, the record heatwaves and temperatures this summer in the Southern U.S., Mexico, Europe, and China are “made much more likely by climate change.”

“In line with what has been expected from past climate projections and IPCC reports these events are not rare anymore today,” the authors of the report wrote. “Without human induced climate change these heat events would however have been extremely rare.”

Temperatures above 126 degrees Fahrenheit in China historically happened once every 250 years. Now they come once every five because of man-made climate change. Record temperatures in the U.S. and Mexico in July were “virtually impossible” before human interference and pollution.

The World Weather Attribution predicts that in a world that is 2°C warmer than pre-industrial levels, heatwaves of this caliber will occur every two to five years. Currently, the world is 1.1°C warmer.

Carbon Markets Capitalize on Increased Energy Demand

As heat ravages much of the Northern hemisphere, energy demand continues to spike. This surge directly benefits regulated carbon markets. The heavy reliance on air conditioning and favorable policy outlooks for California’s cap-and-trade market sent carbon allowances higher this month.

California carbon allowances (CCAs) hit new highs of $34.67 in recent days. “That’s an increase of 14.2% YTD and 18.2% from their low of $29.34 on January 31,” explained KraneShares on the Climate Market Now blog.

Overseas, European Union allowances (EUAs) sit above €90, a gain of 7.8% this year. EUA prices remain resilient despite a number of potential headwinds this year. Chief amongst near-term challenges are falling gas prices that now put coal back at a competitive level.

“Carbon futures typically show a strong linkage to short-term fluctuations in energy prices,” KraneShares explained. “Consequently, carbon prices may rise with gas in order to maintain its advantage over coal.”

Investing in Carbon Allowances With KraneShares

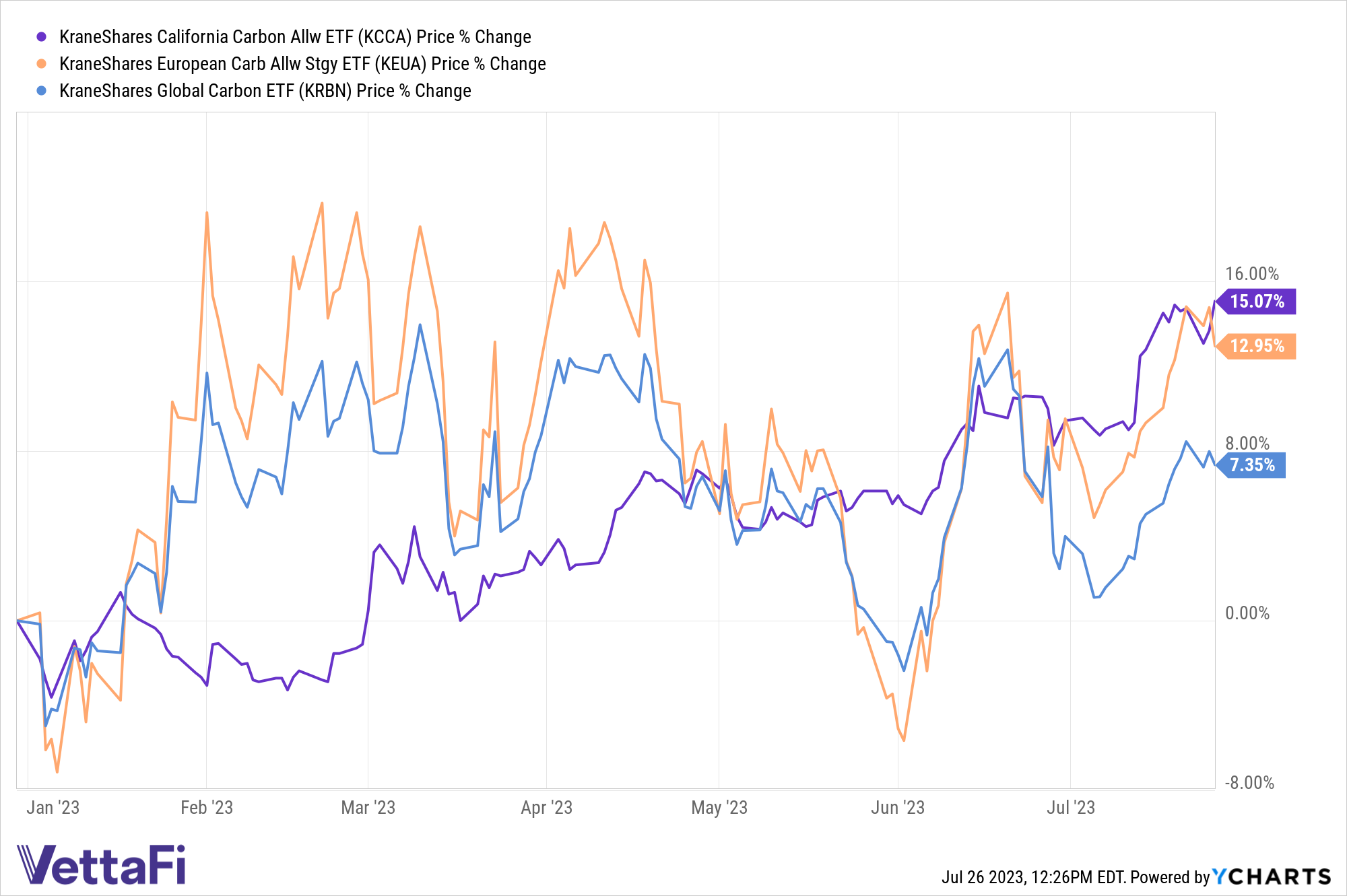

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market. The fund is benchmarked to the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts. This market is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein. Year-to-date, KRBN is up 7.35%.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide and is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market. Year-to-date, KCCA is up 15.07%.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide. KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA) and California Carbon Allowances (CCA). It also includes the Regional Greenhouse Gas Initiative (RGGI) markets, and the United Kingdom Allowances (UKA). Year-to-date the fund is up 12.95%.

For more news, information, and analysis, visit the Climate Insights Channel.