Though equities rose for much of June, many commodity classes tumbled, particularly within the energy sector. Carbon allowances climbed in June and investors seeking to capture global performance should consider the KraneShares suite of carbon ETFs.

Major energy commodities like crude oil currently suffer from global oversupply. Forward-looking projections for energy commodities remain dim on concerns of second-half demand pullback and a potential recession.

It’s a challenging environment for commodities after last year’s strong performance. Carbon allowances, however, rose globally in June, and the carbon suite of ETFs from KraneShares benefited.

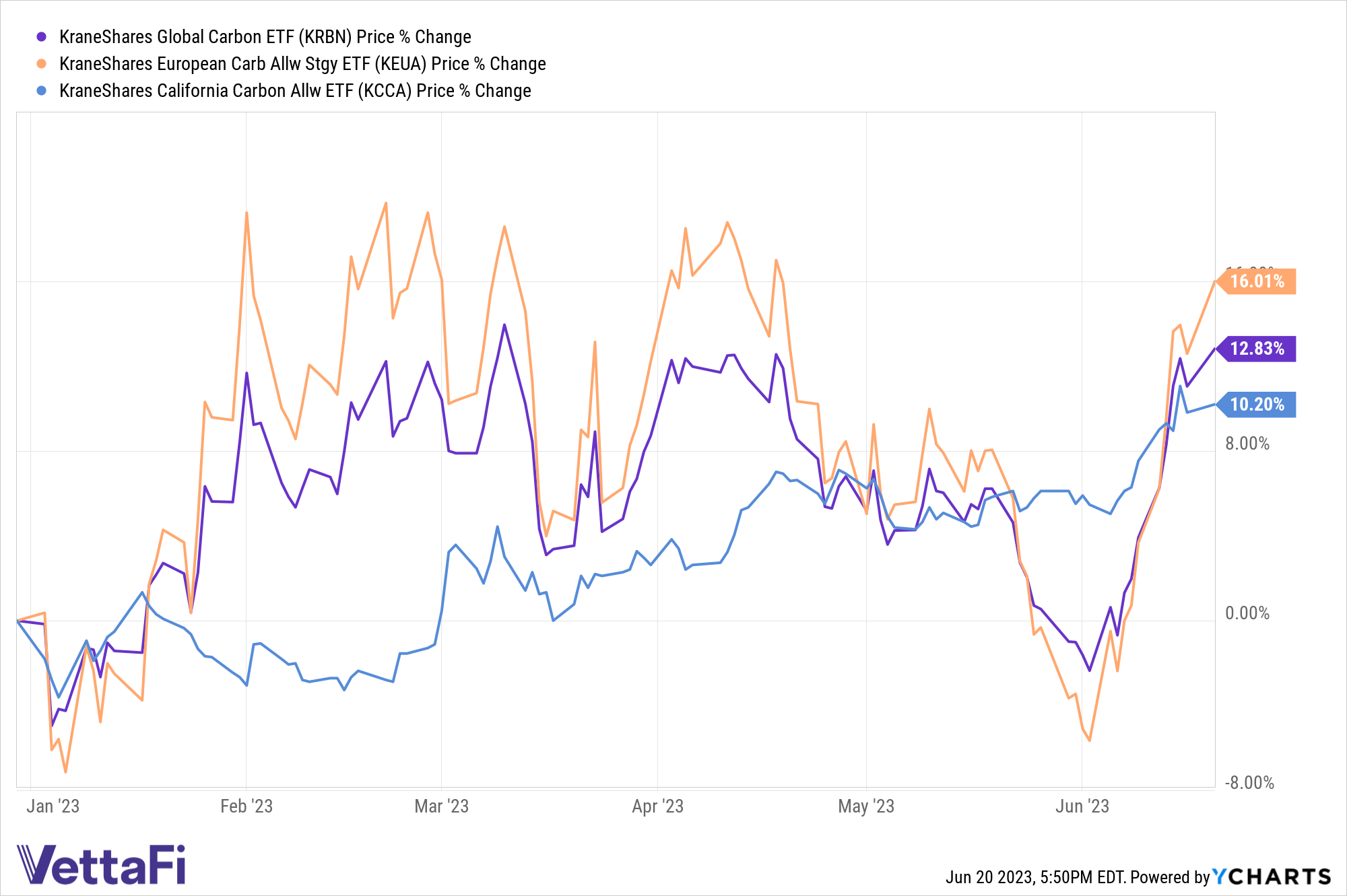

Thus far this month, the KraneShares European Carbon Allowance ETF (KEUA) rose 22.24% while the KraneShares California Carbon Allowance ETF (KCCA) gained 4.04%. The globally diversified KraneShares Global Carbon ETF (NYSE: KRBN) climbed 14.69% through June 20.

Cap-and-trade markets issue carbon allowances that equate to one ton of carbon dioxide. Participants must account for their emissions at the end of each year through the equivalent amount of carbon allowances. They are regulated, mandatory markets that cover various industries.

Carbon allowances stand to benefit as countries work to curtail emissions. Many major carbon allowance markets have built-in tightening mechanisms that reduce allowance supply over time. Reduced supply and increasing demand are likely to create upward price pressure on carbon allowances in the coming years.

Three Carbon Allowances ETFs on the Rise This Summer

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market. The fund is benchmarked to the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts. It’s a market that is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein. Year-to-date, KRBN is up 16.01%.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide and is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market. Year-to-date, KCCA is up 10.20%.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide. KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA) and California Carbon Allowances (CCA). It also includes the Regional Greenhouse Gas Initiative (RGGI) markets, and the United Kingdom Allowances (UKA). Year-to-date the fund is up 12.83%.

For more news, information, and analysis, visit the Climate Insights Channel.