The new framework to better define high-quality carbon credits for market participants and buyers was finalized July 27. The hope is that it will instill confidence for investors and bring more liquidity to the market.

Credits evaluated using the new Assessment Framework from the Integrity Council for the Voluntary Carbon Market (ICVCP) will begin selling by the end of this year. The designation ensures that specific criteria (Core Carbon Principles) for programs and projects which create carbon credits are met.

To qualify as a CCP credit, the carbon credit must go to projects that meet net-zero targets. It also must be a new credit, and it must be permanent.

“We know there is strong demand for high-integrity credits and the CCP label will give more companies confidence to invest. We expect high-integrity credits to trade at a premium, which will incentivize the market to adopt CCP criteria,” Annette Nazareth, chair of the ICVCP, told S&P Global.

The creation of the framework should help high-quality carbon credits filter to the top of the market. These CCP-designated credits will also likely trade at higher prices. Many carbon credit programs are already underway revising their methodologies to meet the new frameworks.

“Although assessment frameworks may increase overall quality, ultimately some projects will still be more effective than others,” said Sebastien Cross, CIO at BeZero Carbon, a carbon rating agency. “A spectrum of quality will always exist. Assessing credit quality does not stop at the CCPs, but requires the project level approach that ratings provide as a tool.”

Some projects and credits will always be more favorable over others. The creation of a standard for high-quality credits will likely go a long way to instill confidence for investors, however. More investment into the space will also support greater market liquidity over time.

Investing in Opportunity in Carbon Credits With KSET

Image source: S&P Global

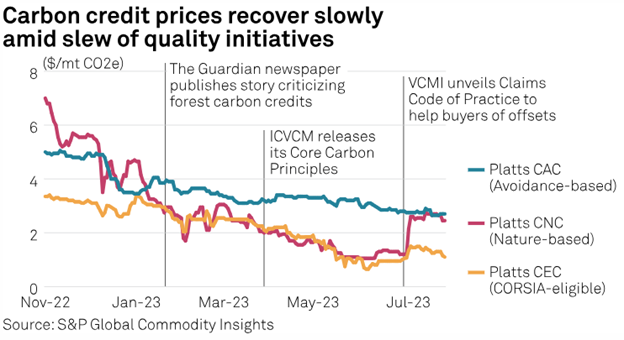

The S&P Global Commodity Insights’ Platts CNC assessment reached levels this week that were last seen in March. The CNC assessment is a measurement of the “most competitive nature-based carbon credit prices” currently on the market. It hit $2.45 per metric ton of carbon dioxide emissions on July 26, a strong recovery from $1 per metric ton lows at the end of May.

The KraneShares Global Carbon Offset Strategy ETF (KSET) is the first U.S.-listed ETF that offers investors carbon offset investing opportunities and exposure to the voluntary carbon markets. It tracks the S&P GSCI Voluntary Carbon Liquidity Weighted Index. The index offers a first-of-its-kind benchmark for the global voluntary carbon futures market performance that trades through the CME group.

The fund aims to offer global coverage of voluntary carbon markets. KSET tracks carbon offset futures contracts comprised of nature-based global emissions offsets (N-GEOs). It also includes global emissions offsets (GEOs) that trade via the CME group.

The voluntary carbon markets are a dynamic space. As such, the index is structured in a way that will allow flexibility in re-weighting the securities it tracks. It will also move securities in and out of the index regularly. The index only tracks carbon offset credit futures that have a maturity within the next two years. Furthermore, the index weights the offset futures it tracks by the total value of their traded volume over the last six months.

KSET carries an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.