Carbon allowances provide a strong diversification opportunity for portfolios, particularly amongst commodities. The difference in the underlying market mechanisms and structure of the major carbon allowance markets can often lead to diverging performance and diversification opportunity within carbon allowance investing.

Although the major allowance markets work towards the same goal — making emissions increasingly cost-prohibitive — they accomplish that goal in different ways. Each of the largest, regulated carbon allowances markets (also called cap-and-trade markets) have their own underlying fundamentals and mechanisms at work.

The EU Carbon Allowances Market

The European Union carbon market currently covers over 12,000 participants. Industries covered included agricultural, industrial, power, and aviation. This will be expanding in the next several years as EU Allowances (EUAs) broaden to cover the maritime industry. Forward-looking plans also gradually eliminate the free allowance allocations certain market participants currently receive. In addition, the market is set to tighten to more aggressive emissions reductions goals.

While outlooks remain positive for EUAs in the coming years, economic slowing led to power generation and demand decreases in the EU industrial sector this year. Despite these reductions, EUAs have proven resilient this summer.

See also: “An Advisor’s Guide to the EU Carbon Market”

The California Carbon Allowances Market

The California Carbon Allowance Market currently covers about 85% of emissions in California. The market has roughly 450 participants across industries such as electrical and fuel distribution.

The joint California and Quebec market is in the process of aggressively tightening it’s trajectories with plans likely finalized early next year. In addition to the price floor increase of 5% each year, the market also adjusts for inflation annually. The market is currently forecast for a supply deficit by 2030. This creates strong fundamental price pressures looking ahead.

See also: “A Guide to Understanding the California Carbon Market”

The Regional Greenhouse Gas Initiative Market

The Regional Greenhouse Gas Initiative Allowance Market covers 11 states in the North-East U.S. Virginia is working to withdraw from RGGI, though its withdrawal remains contentious and challenged within state courts by both Democratic representatives and environmentalists.

Market participants are currently discussing potential changes to the market cap, but nothing formal has been introduced. The market remains one of the least volatile in regard to carbon allowance prices but only covers emissions from power plants.

Invest in the Diversified Carbon Markets with KraneShares

KraneShares offers a number of ETFs that offer exposure to global carbon markets. Investors have options in both targeted investment or broad, diversified exposure across major global markets.

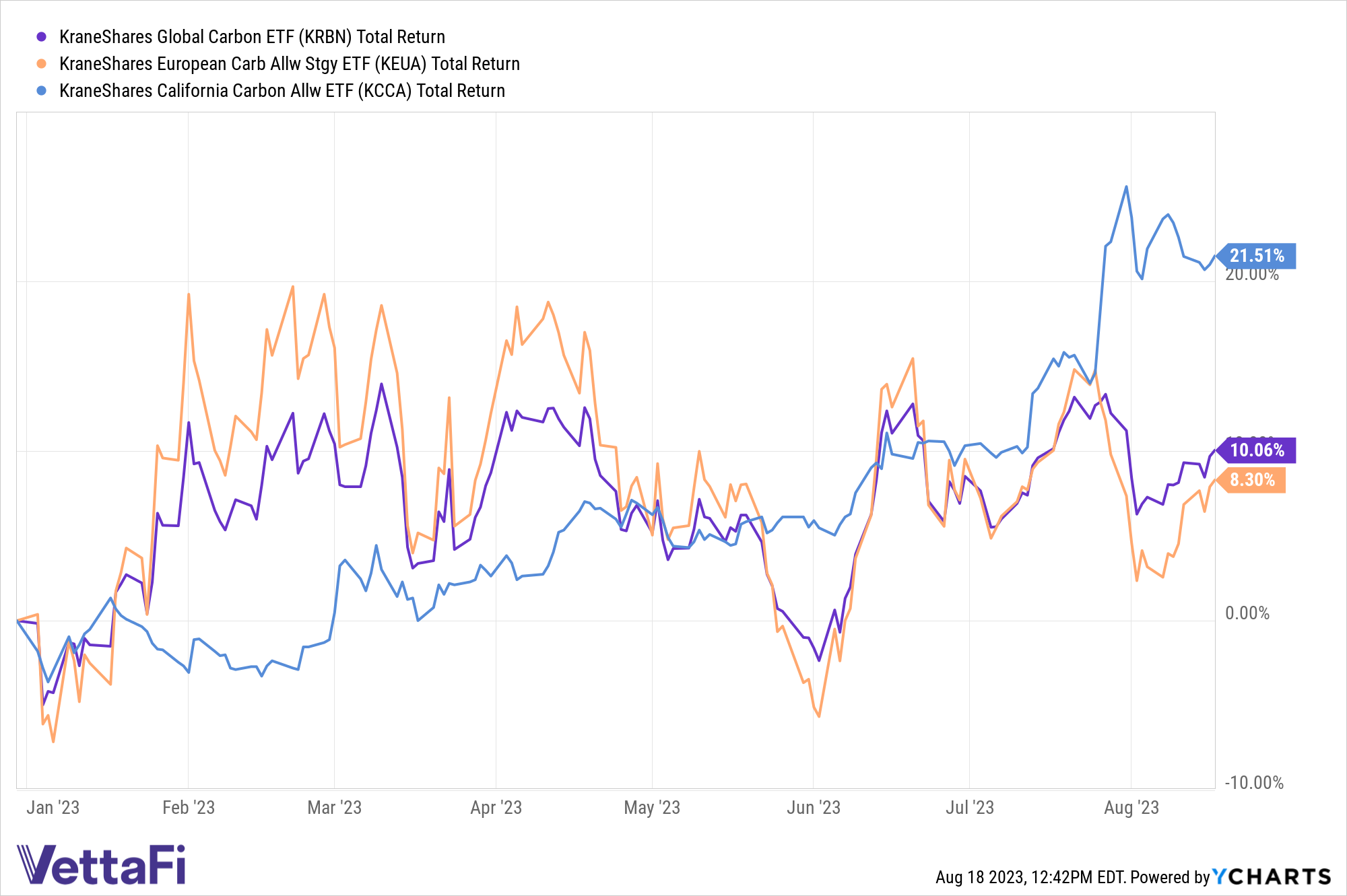

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide. KCCA is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide and is one of the only major funds to target RGGI. KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA) and California Carbon Allowances (CCA). It also includes the Regional Greenhouse Gas Initiative (RGGI) markets, and the United Kingdom Allowances (UKA).

For more news, information, and analysis, visit the Climate Insights Channel.