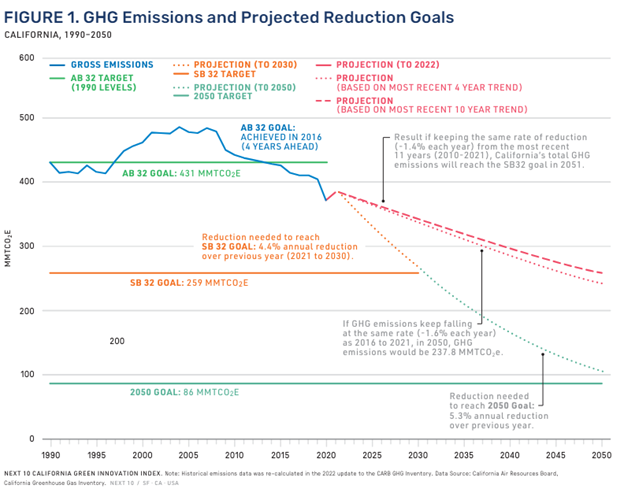

California remains a leader in emissions reductions in the U.S., but its current aggressive trajectories aren’t enough. The state must triple its emissions reduction rate to meet 2030 goals. The new findings provide further potential constructive support for the state’s shared carbon allowance market.

A new report from Next 10 and Beacon Economics revealed that California must cut emissions at a 4.4% annual rate. Currently, the state averages around 1.4% emissions reductions annually.

Image source: Next 10

Emissions from the transportation industry rebounded in 2021 after sharp COVID-19-fueled declines in 2020. Between 2020 and 2021, transportation emissions rose 7.4% after three years of declines. Transportation currently accounts for 38.2% of the state’s emissions as of 2021.

That said, California reached its goal of 1.5 million zero-emission vehicles (ZEVs) two years early. As EVs and ZEVs become increasingly more affordable, the market share will likely grow.

Renewable energy targets also lag behind current targets of 50% renewable energy by 2026. Although renewable energy sources generated 35.8% of the state’s power in 2022, market share must grow by 8.7% annually.

Aggressive California Emissions Reductions Benefit KCCA

California remains a pioneer within the U.S. with its aggressive emissions reductions and renewable energy conversion. As aggressive as that trajectory was, it must decarbonize at a significantly faster rate looking ahead. Increasingly aggressive emissions reduction targets benefit the KraneShares California Carbon Allowance ETF (KCCA).

KCCA offers targeted exposure to the joint California and Quebec carbon allowance markets and will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market. Carbon allowance investing is worth consideration for the diversification benefits that they offer portfolios as well as the strong long-term outlook.

California’s carbon market is one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA. The fund uses a wholly-owned subsidiary in the Cayman Islands to prevent investors from needing a K-1 for tax purposes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.