While exposure to carbon as an asset class has gained in popularity in recent years, many investors are still unaware of the compelling track record of KraneShares’ California carbon ETF.

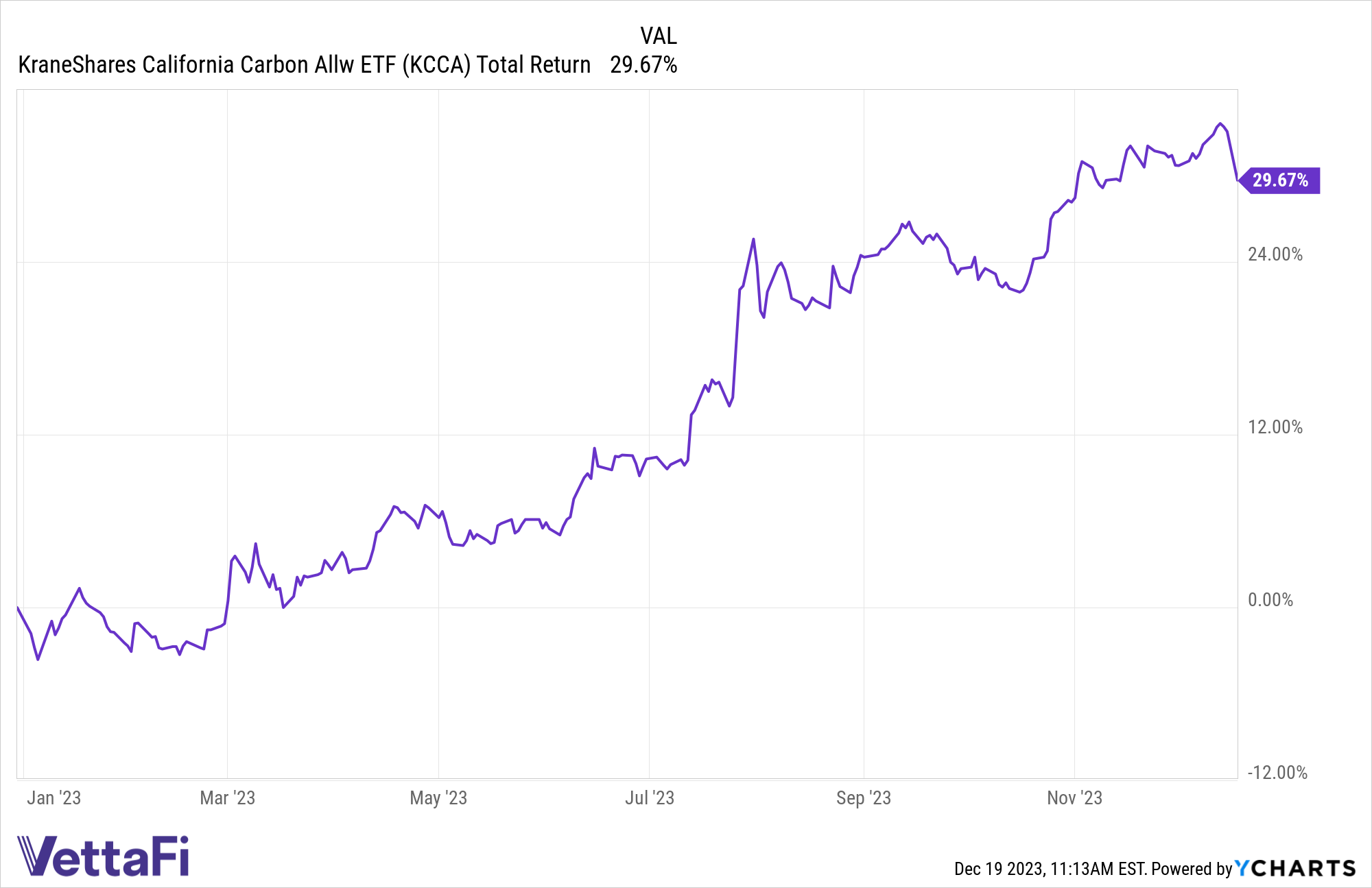

The KraneShares California Carbon Allowance ETF (KCCA) is up 30% year to date through December 18, strengthened by new policy tightening measures. The fund provides targeted exposure to the California Carbon Allowances (CCA) cap-and-trade carbon allowance program.

Carbon allowances, also called carbon credits, are a new type of investable asset class. Compliance carbon is based on cap-and-trade programs, also known as Emissions Trading Systems (ETS), which regulate emissions for mandated industries in their respective jurisdictions.

Notably, California’s cap-and-trade program regulator, the Air Resources Board (CARB), presented price models for the first time last month. This is a significant milestone for the space, marking the first time CARB has ever released its own price projections for the cap-and-trade program, according to KraneShares. Investors can use these projected price levels to gauge the return potential for the market.

While KCCA has provided attractive returns, it also serves as a meaningful portfolio diversifier. Carbon markets have historically shown low correlations to other asset classes, making them an attractive portfolio diversifier. Since 2014, carbon allowances have maintained a correlation of 0.3 or lower to other major asset classes, according to Data from Bloomberg and IHS Markit as of March 31.

See more: “Investors May Be Unintentionally Shorting Carbon”

Background on California’s Carbon Market

The CCA program is one of the fastest-growing carbon allowance programs globally. Carbon allowances are expected to continue to rise in value as demand remains consistent but supply is reduced over time.

The CCA cap-and-trade program was implemented by the California Air Resources Board (CARB) in 2012. The program covers approximately 80% of the state’s Green House Gas (GHG) emissions, according to KraneShares.

In 2014, the program was expanded to cover Quebec and its emissions. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

For more news, information, and analysis, visit the Climate Insights Channel.