No matter how you personally feel about climate change, there’s no denying that some governments and corporations are taking emissions seriously and changing their practices. In the coming capital cycle of rapid emissions transition that the world is set to undergo, there are three specific ways to ensure your portfolios are climate-aligned with the changing business models and practices across industries as the world strives for net zero emissions by 2050.

“We believe these three opportunities transcend what investors typically refer to as megatrends and, in fact, represent gigatrends for the next 30 years,” wrote Luke Oliver, managing director, head of climate investments, and head of strategy at KraneShares, in a recent paper.

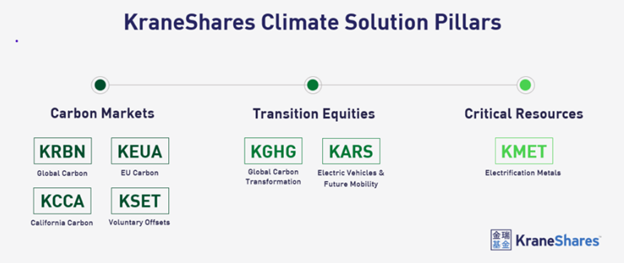

Image source: “The Biggest Short: Carbon Markets & the Energy Transition”

Climate-Aligned Strategy: Carbon Markets

There are several established carbon cap-and-trade systems backed by governments, with more being brought online in the coming months and years. The existing cap-and-trade allowances programs traded over $900 billion in the last 12 months and have increased from covering 32% of global emissions to 40%, explained Oliver.

“Investors can, and are explicitly encouraged to, participate as part of the price discovery mechanism in these global markets. As governments actively tighten the market systems, prices are modeled to rise as industry is forced to reduce emissions,” Oliver wrote.

KraneShares’ carbon allowances suite of funds includes the KraneShares Global Carbon Strategy ETF (KRBN), an ETF that invests in carbon allowances futures globally from the EU, California, RGGI, and the U.K.; the more targeted KraneShares European Carbon Allowance Strategy ETF (KEUA); and the KraneShares California Carbon Allowance Strategy ETF (KCCA).

The voluntary offsets market where carbon credits are created based on projects and activities (carbon capture, planting trees, etc.) are still developing but are growing rapidly. As the offset industry works to create standards and regulations for itself, the increased reliance on offsets to meet emissions goals by corporations is likely to create strong underlying price support and momentum for the market looking ahead.

The KraneShares Global Carbon Offset Strategy ETF (KSET) is the first U.S.-listed ETF offering investors exposure to the voluntary carbon markets.

Climate-Aligned Strategy: Transition Equities

As companies work to transition, those at the forefront of emissions reductions and better, more efficient business practices in terms of clean energy are likely to become the industry leaders of tomorrow. The valuation potential for companies within the dirtiest industries that navigate a path forward to reduced emissions is enormous, and the KraneShares Global Carbon Transformation ETF (KGHG) is a fund positioned to capture that potential.

“With $130 trillion set to be deployed to the clean energy transition, we believe there will be a long runway of structural growth for companies that can move within traditionally high-emitting industries to be future low-carbon leaders. Driven by policy, we believe this growth has higher certainty than in discretionary sectors,” Oliver wrote.

Climate-Aligned Strategy: Critical Resources

The amount of minerals needed to meet the growing demand for renewable energy and electrification of the global energy infrastructure is expected to triple by 2040, according to the International Energy Agency. As this demand continues to grow, it’s expected to drive prices for these critical resources upwards in the next decade.

“Already in motion and at the forefront of this theme are the key metals that will be used to upgrade global grids, electrify mobility and industry, generate renewable energy, and transport and store power,” Oliver explained. “Much of this is embodied by the accelerating shift to electric vehicles, though the scope is exponentially larger as over 20% of the global economy needs to be overhauled.”

The KraneShares Electrification Metals ETF (KMET) offers targeted exposure to the metals that will be necessary for the electrification and clean energy transition of the world’s economy in the pivot to net zero emissions, and the KraneShares Electric Vehicles and Future Mobility ETF (KARS) invests across the EV ecosystem to capture the growth in batteries, hydrogen fuel cell manufacturing, EV production, and more.

For more news, information, and analysis, visit the Climate Insights Channel.