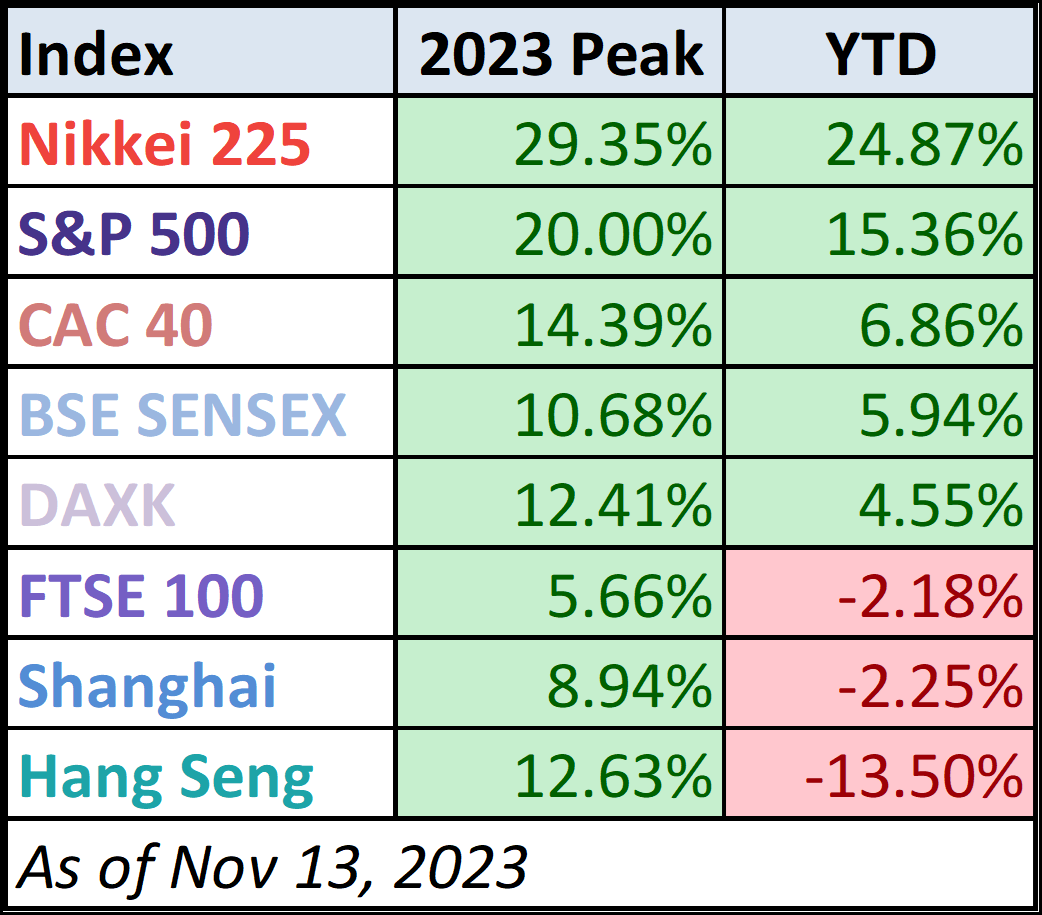

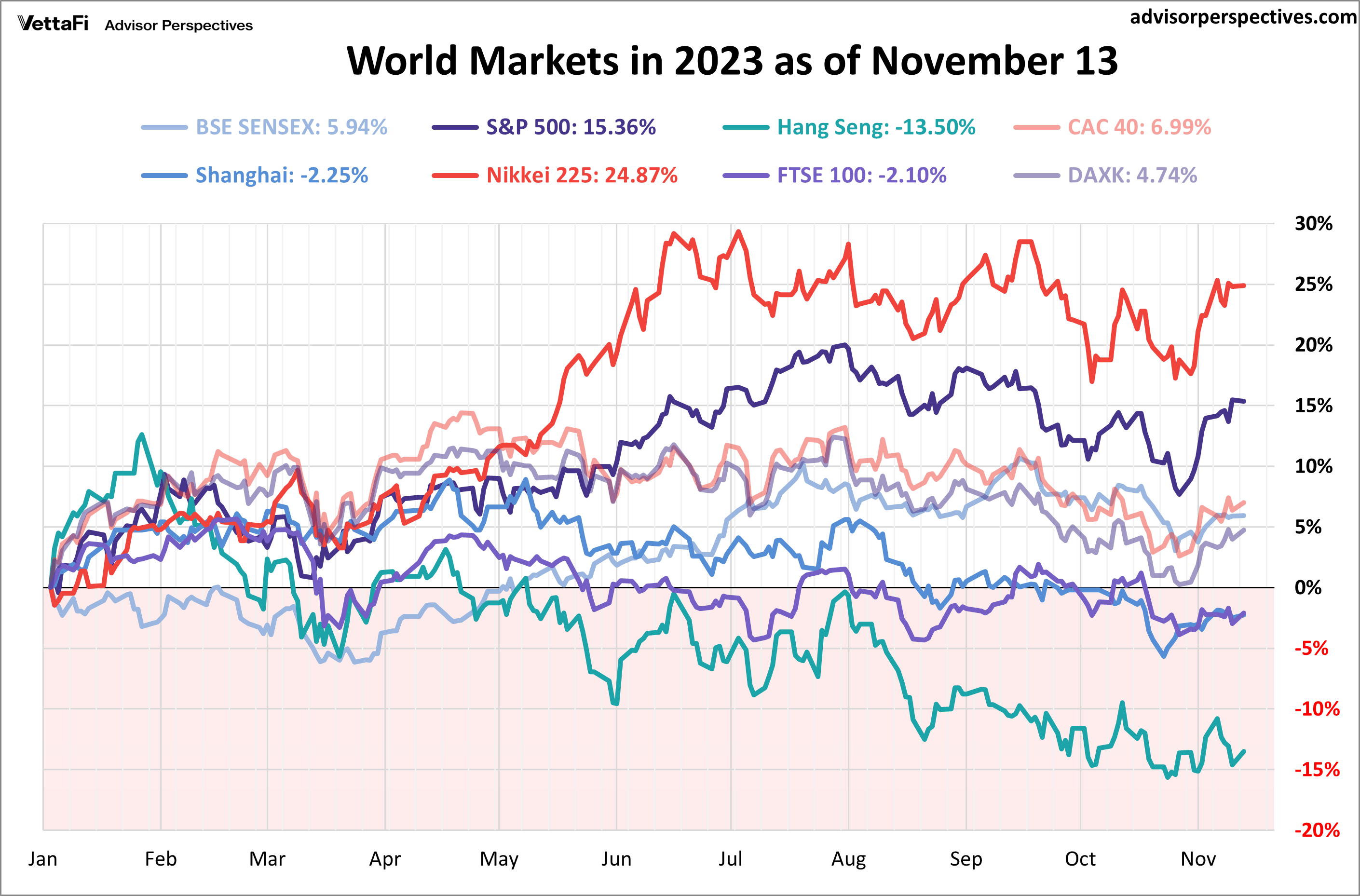

Five of the eight indexes on our world watchlist posted gains through November 13, 2023. Tokyo’s Nikkei 225 finished in the top spot, with a YTD gain of 24.87%. The U.S.’ S&P 500 finished in second, with a YTD gain of 15.36%, while France’s CAC 40 finished in third, with a YTD gain of 6.86%.

World Indexes and Recent Recessions

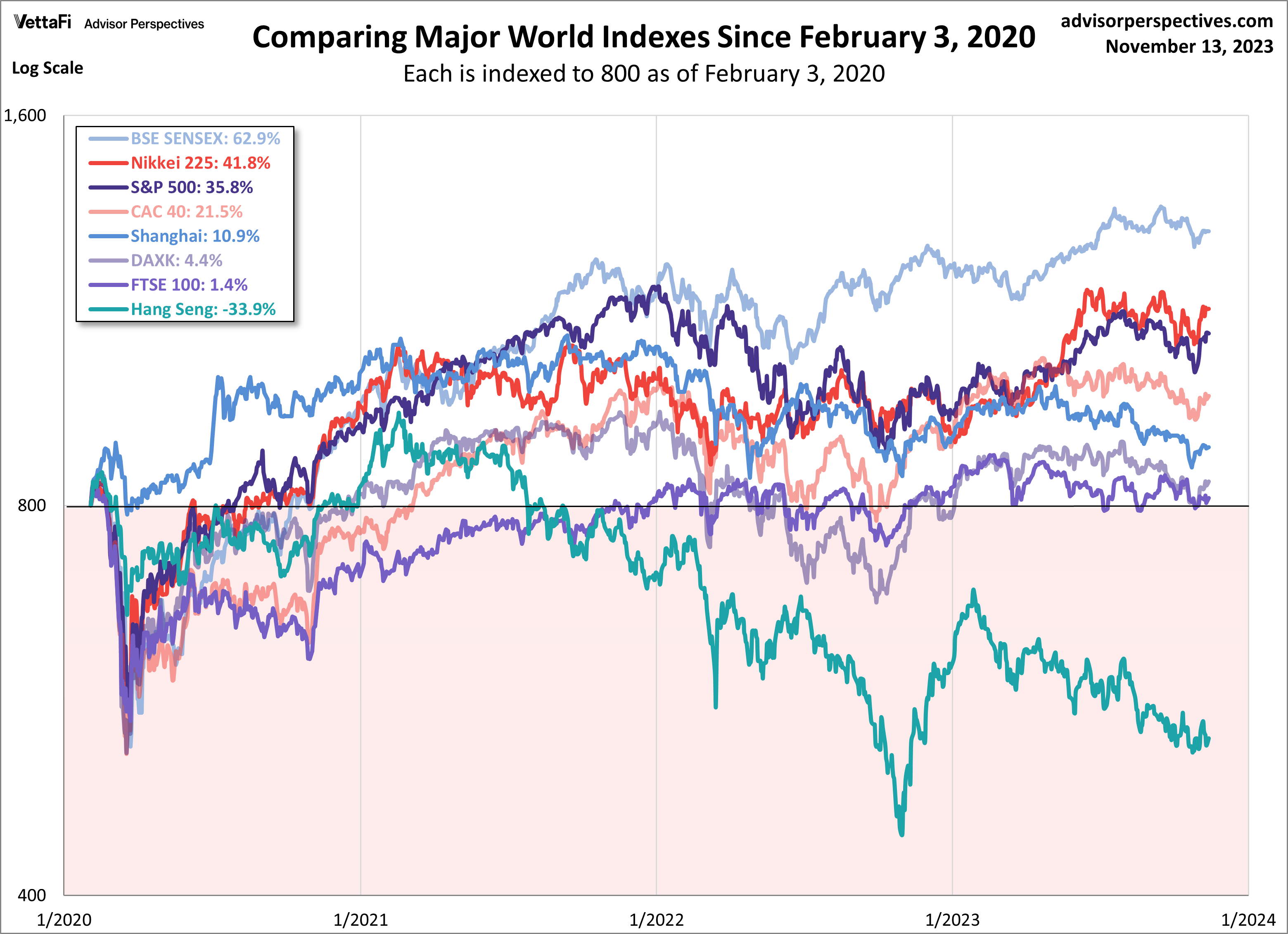

Let’s start with a very recent chart with the latest recession. We’ve used February 3, 2020 for our start date (this is the official NBER recession start).

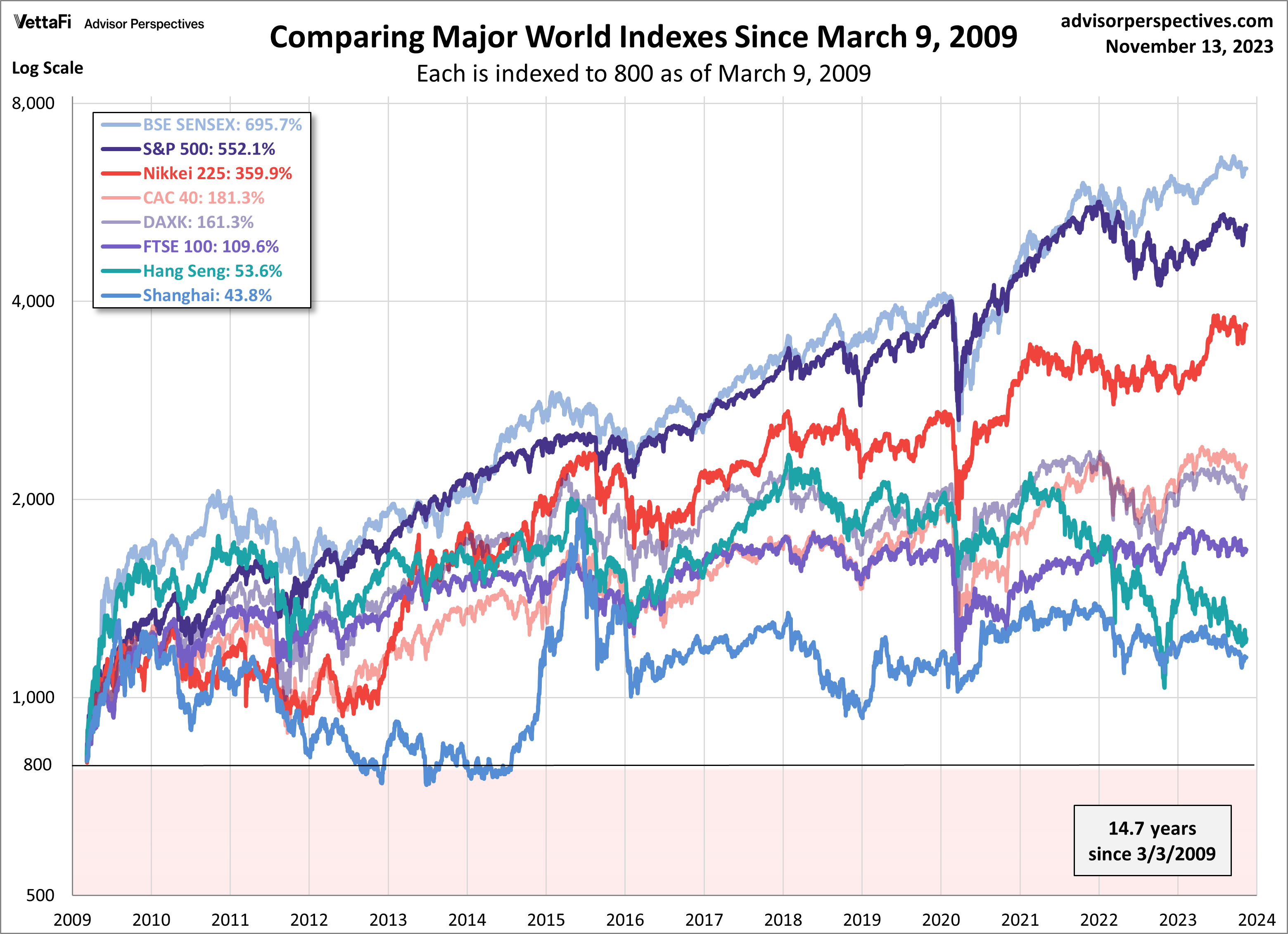

The chart below illustrates the comparative performance of world markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40, and BSE SENSEX hit their lows on March 9, the Nikkei 225 on March 10, the DAXK on March 6, the FTSE on March 3, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier, on October 27, 2008. However, by aligning on the same day and using a log-scale vertical axis, we get an excellent visualization of the relative performance. I’ve indexed each of the eight to 800 on the March 9 start date. The call-out in the upper left corner shows the percent change from the start date to the latest weekly close.

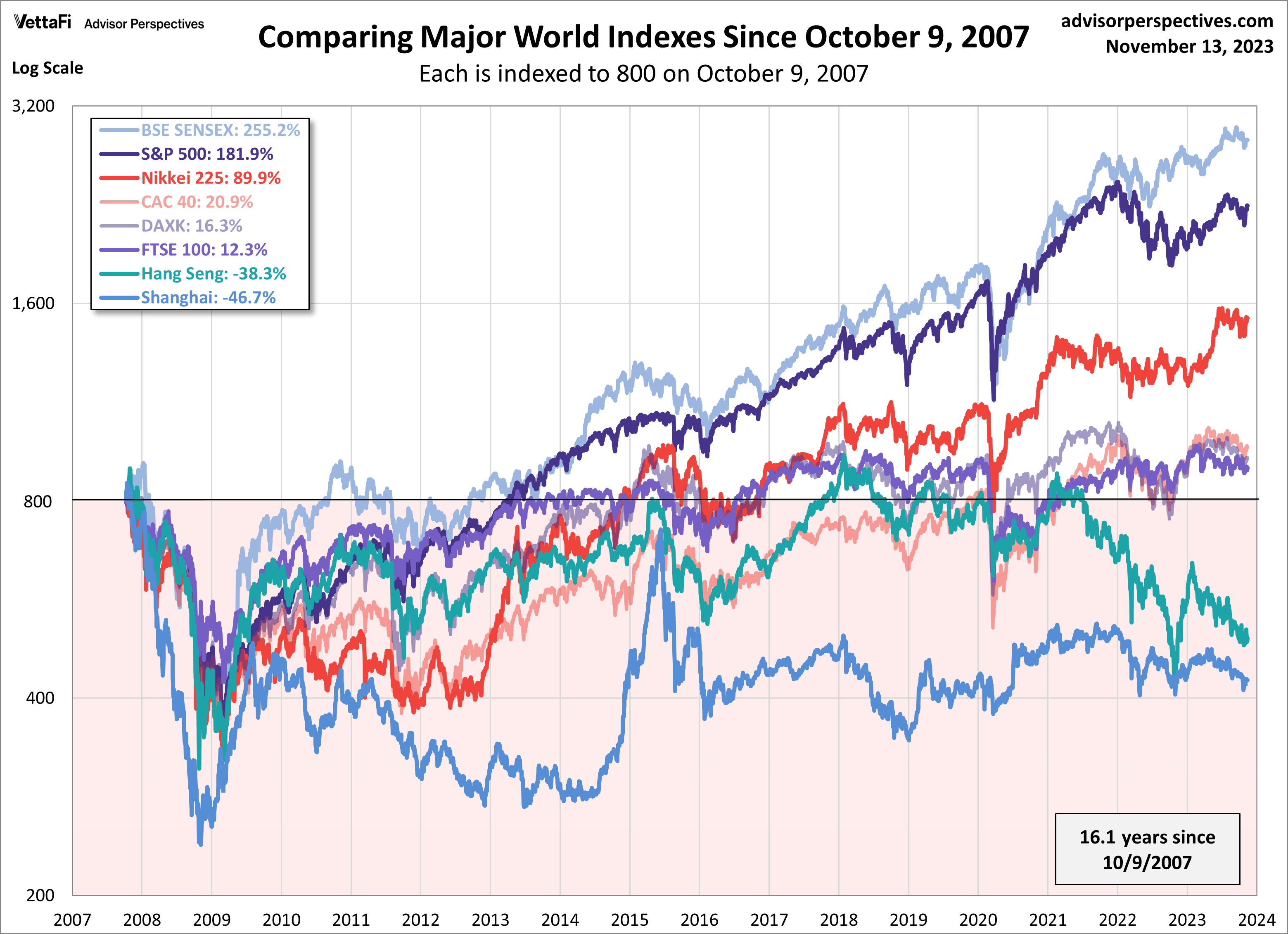

Here is the same visualization, this time starting on October 9, 2007, a previous closing high for the S&P 500. This date is also approximately the midpoint of the range of market peaks, which started on June 1 for the CAC 40 and ended on January 8, 2008 for the SENSEX.

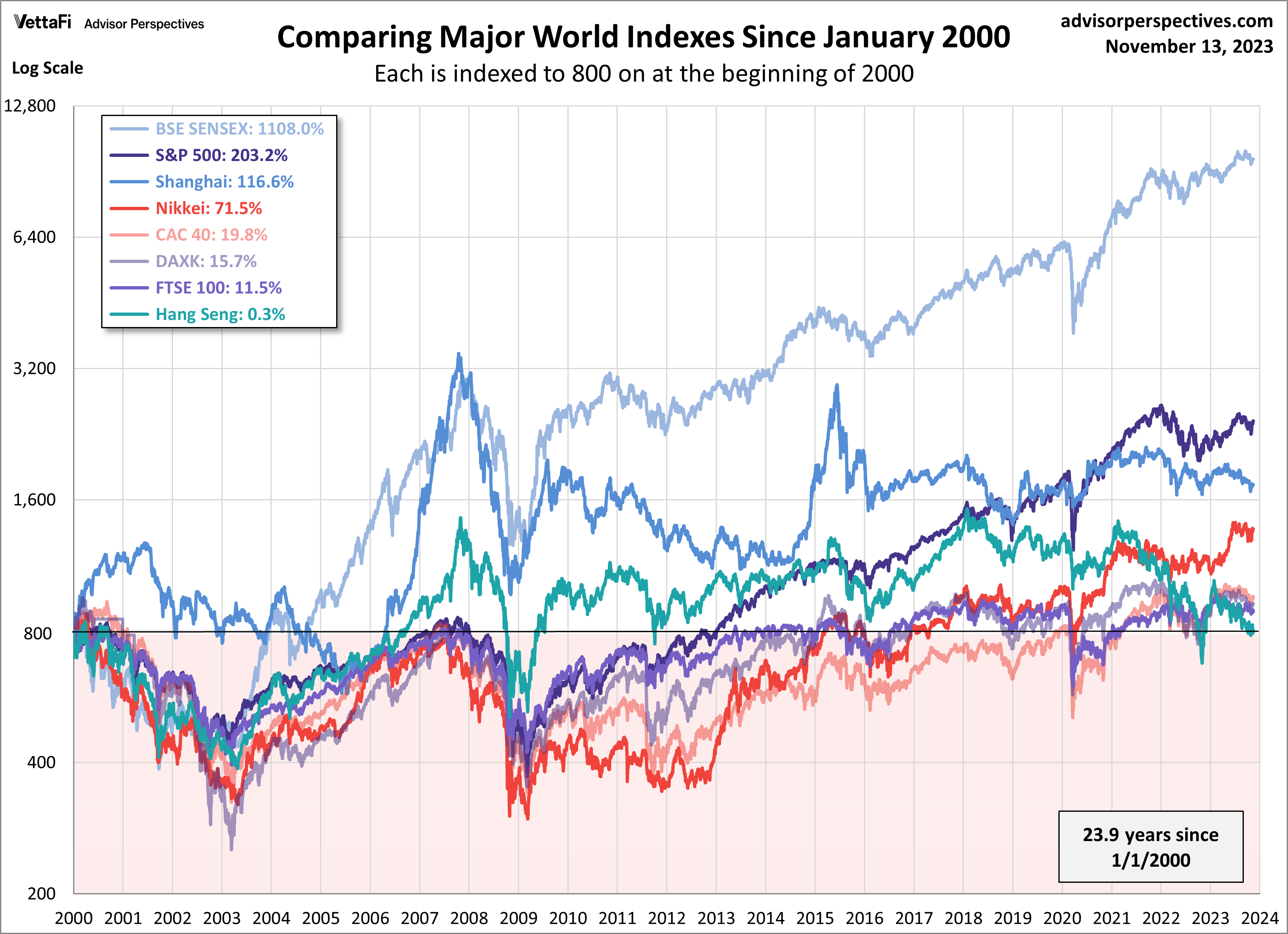

For a longer look at the relative performance, our final chart starts at the turn of the century, again indexing each at 800 for the start date.

Examples of single-country ETFs:

- WisdomTree Japan Hedged Equity Fund (DXJ)

- WisdomTree Europe Hedged Equity Fund (HEDJ)

- KraneShares CSI China Internet ETF (KWEB)

- iShares MSCI India ETF (INDA)

- iShares MSCI Hong Kong ETF (EWH)

- SPDR S&P 500 ETF Trust (SPY)

Note: I track Germany’s DAXK a price-only index, instead of the more familiar DAX index (which includes dividends), for consistency with the other indexes, which do not include dividends.

For more news, information, and strategy, visit the China Insights Channel.