It’s been a raucous past year for fixed income investors. Following years of quiet for rate markets, the Fed’s rapid rate hikes, and subsequent signals about rate cuts, have reinvigorated fixed income investing.

That said, those cuts have yet to materialize. While your average investor may have turned toward investment-grade offerings for their fixed income allocation awaiting those rates, they may want to look elsewhere given the wait.

See more: Long-Term China ETF KBA to Hit Tenth Anniversary

The place they should look may be high yield Asia bonds. Though perhaps surprising to some, Asia high yield investing offers much more reduced interest rate risk and improving credit outlooks.

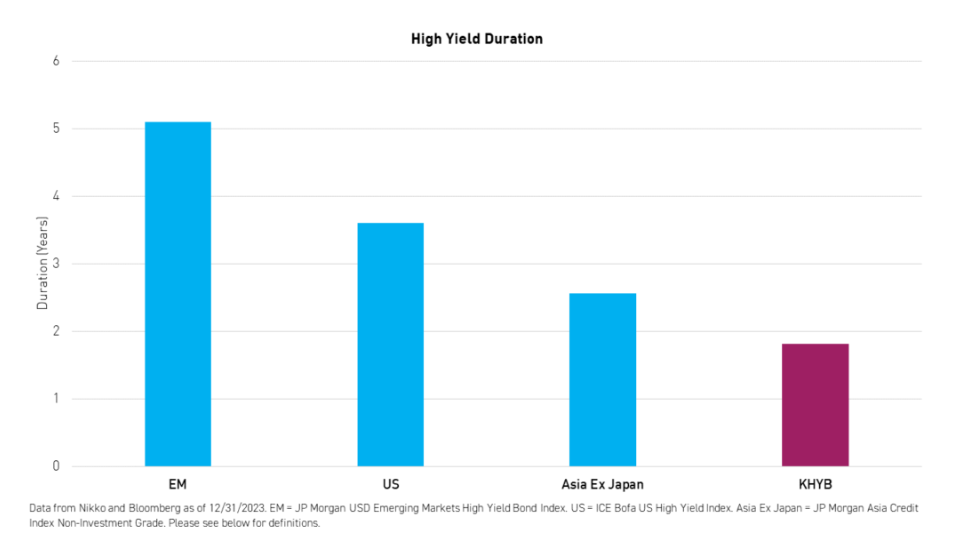

For example, when looking at the KraneShares Asia-Pacific High-Income Bond ETF (KHYB), investors see how Asia high yield offers lower duration than high yield in other markets. That lower duration offers reduced interest rate sensitivity, which continues to loom over U.S. fixed income. Consider the below graph from KraneShares.

KHYB can provide less rate sensitivity to a fixed income allocation than a U.S. exposure might, per this chart from KraneShares.

That reduced interest rate sensitivity can help a fixed income allocation. At the same time, Asia high yield is seeing reduced credit risk, too, as China works out its real estate debacle. That could help reduce corporate default rates, which are expected to fall notably this year in Asia, as well.

So, how does KHYB invest, exactly? The strategy charges 69 basis points to actively invest, managed by subadvisor Nikko Asset Management Americas. In doing so, Nikko uses top-down macro research and bottom-up credit research to build its portfolio. Combining quantitative and qualitative factors, it assesses issuers’ credit profiles as well as their values.

All told, KHYB’s approach presents an intriguing option for investors looking to adapt a fixed income allocation. By diversifying away from the U.S., it can present a nice medium-term option. Returning 5.8% over the last year, consider KHYB should U.S. rate cuts continue to prove elusive.

For more news, information, and analysis, visit the China Insights Channel.