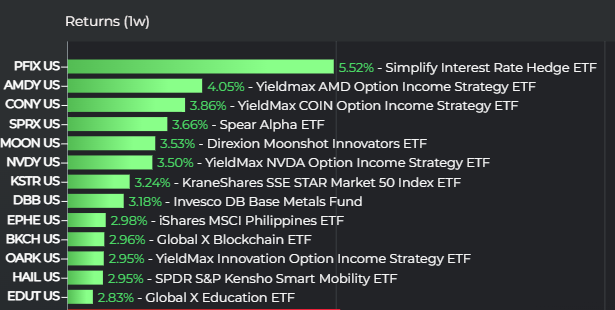

In this week’s edition of the top-performing ETFs, income and Asia ETFs each saw representatives do well. Income especially stood out, which may owe to investors looking to add some current income ballast to portfolios. Asia doesn’t necessarily represent ballast, but it does represent a great source of diversification for U.S. portfolios with a strong domestic tilt.

The Simplify Interest Rate Hedge ETF (PFIX) led the way over the last week, per LOGICLY. The strategy hedges against a sharp jump in long-term rates. With the Fed talking about making one or even two more rate hikes, investors may be looking to the strategy as a source of adaptation. The ETF has returned 5.5% over the last week.

Four different YieldMax strategies focused on income made the top 12 rankings over the last week. All of them focus on a specific stock, with the YieldMax AMD Option Income Strategy ETF (AMDY) leading the way. The fund only launched last month, but did well, returning 4.1%. The ETF relies on a “synthetic covered call strategy,” collateralized by cash and U.S. Treasuries. It looks to generate monthly income by bringing those factors together.

Asia ETFs also did well, with the KraneShares SSE Star Market 50 Index ETF (KSTR) the stand-out. The fund returned 3.2% over the last week, per LOGICLY. The strategy tracks the SSE Science and Technology Innovation Board 50 Index, eyeing Chinese science and technology firms from areas like biomedicine, high-end equipment, and next-gen IT. KSTR’s index weights firms based on market cap and liquidity screens and does apply caps.

Charging 89 basis points (bps), KSTR is set to hit its three-year ETF mark this coming January. Returning 1.5% over the last month, it has turned its performance around and makes for an intriguing China strategy among Asia ETFs.

Income and Asia ETFs did well over the last week per LOGICLY data.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and strategy, visit the China Insights Channel.